Nearly 40 percent of all B2B invoices are not paid on time, Atradius research shows. While many see this as a simple annoyance or the cost of doing business, the reality is that late payments and cash flow issues go hand in hand. If you’re struggling with payment delays, it’s likely showing up in many areas of your business and could be costing you more than you realize. In this guide, we’ll walk through what’s happening in the background when late payments occur and how to shore up your processes to reduce late payments and minimize their impact.

Late Payments Impact Cash Flow and Come with Hidden Costs

Late payments are one of those issues that creep up quietly but can leave a lasting mark on your business. On the surface, it may seem like you are simply waiting a few extra weeks to get paid, but the financial and operational strain runs much deeper.

Payment Delays Disrupt Business Operations

When customers or clients take longer than agreed to pay their invoices, the entire rhythm of your business shifts. You might still be fulfilling orders, covering payroll, or paying suppliers, but the money to support those activities is stuck in limbo.

- Cash Flow Interruptions: When your receivables are delayed, you have less working capital on hand to handle everyday expenses. This makes it harder to manage inventory, pay staff, or invest in growth.

- Operational Slowdowns: A shortage of cash can force you to delay new projects, hold off on equipment upgrades, or reduce marketing spend. These choices often have a compounding effect, reducing efficiency and growth potential.

- Strained Supplier Relationships: If your own payments start running late because clients have not paid you, suppliers may shorten payment terms, increase prices, or limit credit. That can further squeeze your cash position.

Borrowing Costs Increase Due to Cash Flow Gaps

When payments arrive late, you may find yourself relying on external funding to keep things running smoothly. While short-term financing can be a safety net, it comes at a cost.

- Higher Interest Expenses: Bridging cash flow gaps often means using credit cards, overdrafts, or short-term loans. These options carry higher interest rates, increasing your overall operating costs.

- Reduced Financial Flexibility: The more debt you take on to fill temporary gaps, the less flexibility you have to pursue new opportunities or handle unexpected challenges later.

- Credit Risk Implications: Frequent borrowing to manage late payments can make your business appear riskier to lenders, potentially leading to higher rates or limited access to credit in the future.

Common Causes of Late Invoice Payments Centre on Key Themes

Late payments usually stem from a mix of financial pressures, administrative errors, and even habits that have developed across industries. Understanding why clients pay late is the first step toward reducing the problem and improving your cash flow.

Administrative or Process-Related Delays

Even the most well-intentioned clients can fall behind due to simple oversights or inefficient systems.

- Disorganized Accounts Payable Processes: If a client’s accounting team is understaffed or uses outdated systems, invoices can sit unapproved or misplaced for weeks.

- Invoice Errors or Missing Information: Nearly 40 percent of invoices have errors, according to Ascend. A missing purchase order number, incorrect total, or unapproved rate can trigger a delay in processing. Every correction adds more time before payment is released.

- Irregular Billing Cycles: Some companies have fixed internal payment dates. If your invoice misses their cycle cutoff, it may not be reviewed again until the next period.

Financial Strain on the Client’s Side

Cash flow issues often trickle down. If your client is facing financial challenges, they may use payment delays as a buffer.

- Temporary Cash Shortages: When clients are waiting on their own receivables, they may hold onto cash longer to cover immediate expenses.

- Seasonal Revenue Fluctuations: Businesses with cyclical sales, such as construction or retail, sometimes stretch payment terms during slow periods.

- Overextension or Poor Planning: Rapid expansion or excessive overhead can cause clients to prioritize who gets paid first, and smaller suppliers often end up at the back of the line.

Cultural and Industry Norms

Late payments have become normalized in some industries, particularly where large corporations set the tone.

- Extended Payment Terms as Standard Practice: In sectors such as manufacturing and transportation, 60 or 90-day terms are common. Unfortunately, some clients treat those as minimums rather than maximums.

- Power Imbalance Between Large and Small Firms: Smaller businesses may hesitate to chase overdue invoices aggressively for fear of losing a major client. This tolerance can unintentionally reinforce slow payment habits.

Lack of Clear Communication

Sometimes, clients delay payments because expectations were never clearly set or reinforced.

- Unclear Payment Terms: If your contract or invoice does not specify when payment is due or what happens if it is late, clients may assume flexibility.

- Limited Follow-Up: When invoices go unacknowledged, it is easy for clients to assume there is no urgency. Consistent, polite reminders help create accountability.

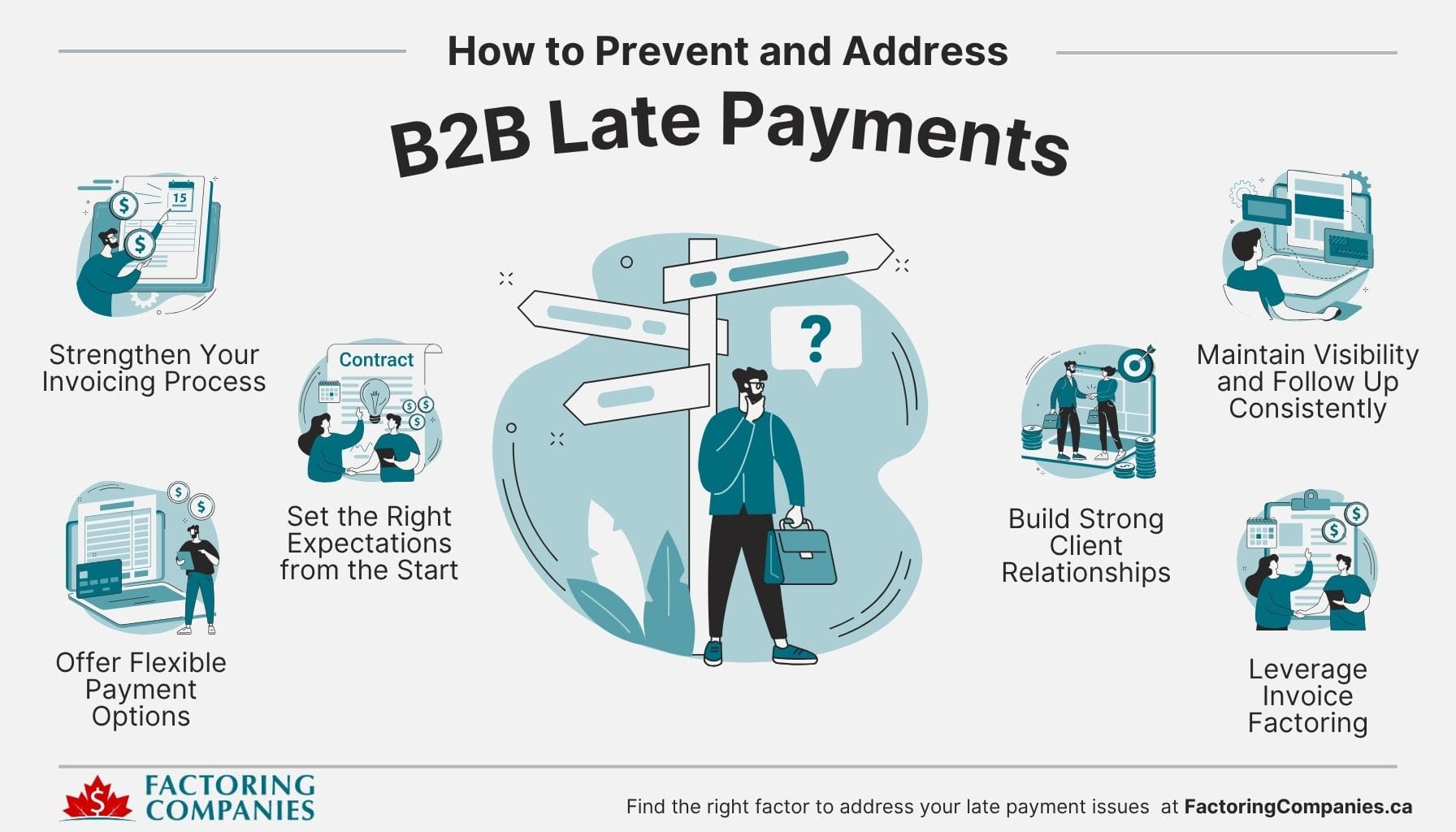

Apply Late Payment Prevention Strategies as a First Line of Defense

You cannot always control when a client pays, but you can build processes that make on-time payments far more likely. By following invoicing best practices for faster payments and reinforcing expectations early, you can protect your business from the ripple effects of payment delays.

Strengthen Your Invoicing Process

Think of your invoice as a communication tool that sets expectations. Clarity and consistency are key.

- Clear Payment Terms: Specify exact due dates, accepted payment methods, and any late fees or interest charges. Avoid vague language like “due upon receipt.”

- Accurate and Complete Information: Include purchase order numbers, line-item details, and your business contact information. Errors or omissions can push your payment into the next billing cycle.

- Automated Invoicing Tools: Cloud-based invoicing platforms help you issue invoices promptly, track their status, and send automated reminders before and after the due date.

Set the Right Expectations from the Start

The tone you set early in a relationship often determines how seriously clients take your payment terms.

- Contractual Clarity: Include payment terms and late fee policies in every contract. Review these details with clients before beginning work.

- Professional Consistency: Send invoices on time, every time. Reliability on your end encourages reliability on theirs.

- Personalized Follow-Ups: If a client’s payment is overdue, a brief but courteous message reminding them of the outstanding balance often resolves the issue faster than formal notices alone.

Offer Flexible Payment Options

Making it easy for clients to pay removes friction and speeds up collections.

- Multiple Payment Methods: Offer credit card, e-transfer, or electronic funds transfer (EFT) options. This flexibility can shorten turnaround times dramatically.

- Early Payment Incentives: Consider small discounts for payments made ahead of schedule. Even a two percent incentive can motivate faster remittance.

- Structured Payment Plans: For larger projects or long-term contracts, divide payments into milestones to keep cash flowing throughout the engagement.

Maintain Visibility and Follow Up Consistently

The more visibility you have into your receivables, the faster you can respond when payments lag.

- Accounts Receivable Monitoring: Review your outstanding invoices weekly. Tracking days sales outstanding (DSO) helps identify patterns or repeat offenders.

- Gentle Reminders: Send a friendly reminder a few days before an invoice is due. If it passes the due date, follow up immediately with a professional message.

- Escalation Process: Have a clear internal policy for when and how overdue accounts are handled, from reminders to final notices or collection steps.

Build Strong Client Relationships

Healthy communication often prevents late payments before they start.

- Regular Check-Ins: Stay in touch with clients throughout projects rather than only when sending invoices. This reinforces goodwill and keeps financial communication open.

- Empathy and Flexibility When Appropriate: If a trusted client faces short-term challenges, a structured plan or temporary extension can preserve the relationship while ensuring payment.

- Professional Boundaries: Being understanding is helpful, but it is equally important to reinforce payment policies consistently so delays do not become routine.

Factoring Helps Businesses Manage Late Payments, Too

Even with strong invoicing systems and reliable clients, cash flow gaps can still appear. When payments are delayed, invoice factoring can stabilize your finances without taking on new debt or waiting weeks for your receivables to clear.

Turn Unpaid Invoices into Cash

Factoring, often called invoice factoring, is a funding solution that allows your business to exchange unpaid invoices for immediate working capital. Instead of waiting weeks or months for clients to pay, you receive most of the invoice value upfront from a factoring company. When your client pays the invoice later, the remaining balance is released to you, minus a small fee.

- Immediate Access to Funds: You get working capital quickly, usually within 24 hours of submitting invoices.

- No Additional Debt: Unlike other cash flow solutions for late payments, such as bank loans or lines of credit, factoring does not create a repayment obligation. You are simply converting your receivables into usable cash.

- Flexible Use of Funds: The advance can be used to pay suppliers, cover payroll, or invest in new opportunities, whatever keeps your business moving.

Address Many Late Payment Challenges

Factoring tackles the root cause of cash flow issues: delayed customer payments.

- Bridging Cash Flow Gaps: Instead of waiting on clients to pay, you receive most of the invoice value right away, giving you predictable cash flow even when payments run late.

- Reducing Borrowing Costs: Because you are not relying on high-interest credit cards or short-term loans to cover expenses, you avoid accumulating additional debt or interest charges.

- Stabilising Growth Plans: Consistent cash flow makes it easier to plan ahead, whether that means taking on new contracts, upgrading equipment, or hiring staff with confidence.

- Improving Collections Efficiency: Most factoring companies manage collections on factored invoices. This means your team spends less time chasing payments and more time focusing on revenue-generating work.

Leverage a Sustainable Approach to Cash Flow Management

Factoring is a strategic tool. By unlocking the value of your receivables, you can keep operations running smoothly while continuing to offer fair payment terms to clients. This balance supports both stability and growth, turning what once felt like a cash flow setback into an opportunity for greater control and confidence in your business.

Follow Best Practices for Long-Term Cash Flow Stability

Managing late payments is an important start, but sustainable success depends on building systems that keep your cash flow stable year after year. Long-term financial health comes from foresight, structure, and steady monitoring.

Forecast and Plan Ahead

Strong cash flow management begins with visibility. When you understand your financial patterns, you can plan for both lean periods and opportunities.

- Regular Cash Flow Forecasting: Track expected inflows and outflows monthly or quarterly. This helps you anticipate shortfalls before they happen.

- Scenario Planning: Build multiple versions of your forecast, including best case, average, and conservative, so you know how to adjust spending when payments slow.

- Budget Alignment: Review your budget against your forecast often to identify areas where costs can be controlled or postponed.

Build a Cash Reserve

A safety buffer allows your business to operate confidently, even when receivables are delayed.

- Emergency Fund Strategy: Aim to keep at least one to three months of operating expenses in reserve to cushion against disruptions.

- Automatic Transfers: Schedule recurring transfers into a savings or reserve account whenever cash flow is strong. Treat it as a non-negotiable business expense.

- Use Wisely: Only dip into reserves for genuine shortfalls or strategic investments that will generate future returns.

Strengthen Client Vetting and Credit Practices

Preventing late payments begins long before an invoice is sent.

- Credit Screening for Invoicing Terms: Assess financial reliability before extending credit terms. Trade references and credit reports are valuable indicators.

- Set Reasonable Terms: Tailor payment terms to the client’s reliability and payment history. Long-standing clients with strong records may earn extended terms, while newer accounts might start shorter.

- Periodic Reviews: Reassess client payment patterns regularly and adjust terms if their reliability changes.

Use Data and Technology for Better Control

Digital tools simplify cash flow tracking and help identify trends before they become problems.

- Integrated Accounting Software: Connect invoicing, expense management, and payment tracking systems to gain real-time visibility.

- Analytics Dashboards: Monitor key metrics like days sales outstanding (DSO) and average payment timelines to spot red flags early.

- Automated Reminders and Alerts: Use automation to keep payments on schedule and minimize manual follow-up.

Diversify Revenue Streams

Relying too heavily on a few clients or seasonal contracts increases your vulnerability to delayed payments.

- Expand Your Client Base: A broader customer mix reduces the impact if one client pays late or cuts back on spending.

- Explore Recurring Revenue Models: Retainers, maintenance contracts, or subscription-style services create steady income between larger projects.

- Balance High and Low-Margin Work: Blending fast-turn, lower-margin jobs with slower, higher-value contracts helps maintain consistent cash flow.

Review and Adjust Regularly

Cash flow management is not static. Your business will evolve, and your systems should too.

- Quarterly Financial Reviews: Sit down with your accountant or financial advisor to review results and identify trends.

- Refine Payment Policies: Revisit your payment terms, reminders, and collection procedures annually to ensure they reflect your current business reality.

- Invest in Financial Literacy: Keep yourself and your team informed. Workshops, webinars, or even short courses on financial management can improve long-term performance.

Address Cash Flow and Late Payments with Factoring

If you’ve applied best practices and are still struggling with cash flow challenges from delayed payments, factoring can help. To explore the fit more, talk to a factoring specialist.

FAQs on Factoring, Late Payments, and Cash Flow

How can businesses handle cash flow problems from unpaid invoices?

Businesses can manage cash flow issues by tightening invoicing practices, setting clear payment terms, and following up consistently. Offering multiple payment methods, monitoring accounts receivable regularly, and maintaining a cash reserve also help. For persistent delays, short-term funding options like factoring can provide immediate access to working capital.

How does using factoring for unpaid invoices work?

Factoring allows a business to sell its unpaid invoices to a factoring company in exchange for quick cash. The company advances most of the invoice value upfront and releases the remainder, minus a small fee, once the customer pays. This process helps businesses maintain steady cash flow without taking on new debt.

How does factoring fit into a cash flow risk management strategy?

Factoring adds stability to a cash flow management plan by reducing dependence on client payment timelines. It transforms receivables into reliable cash, allowing businesses to cover expenses and pursue growth opportunities. By smoothing out cash flow fluctuations, factoring complements budgeting, forecasting, and credit control efforts for stronger long-term financial resilience.

How does late payment affect cash flow?

Late payments delay the inflow of cash needed to cover operating expenses, such as payroll, rent, and supplier costs. This disruption can create short-term funding gaps, forcing businesses to use credit or delay their own payments. Over time, repeated late payments reduce financial flexibility and weaken overall business stability.

What are the five main causes of cash flow problems?

Common causes include slow or late customer payments, poor cash flow forecasting, high operating expenses, rapid business growth without sufficient funding, and holding excess inventory. Each of these factors restricts available working capital, making it harder to manage day-to-day operations or reinvest in the business effectively.

How do late payments affect a business?

Late payments increase financial stress, reduce liquidity, and limit a business’s ability to pay suppliers or staff on time. They can strain relationships, raise borrowing costs, and disrupt growth plans. When left unchecked, consistent payment delays can even threaten long-term profitability and damage a company’s reputation for reliability.

What is the impact of late payments on business loans?

Businesses with late payments often struggle with cash flow issues, which can increase reliance on loans and other forms of financing. At the same time, cash flow uncertainty has a negative effect on creditworthiness, so it can be more challenging to secure financing and results in less favourable terms when it can be secured, research shows. However, invoice factoring provides an alternate path. Instead of waiting for late payments to clear, the business sells its unpaid B2B invoices at a slight discount to a factor. This provides an instant injection of working capital and decreases reliance on financing, plus it does not create debt or come with interest charges.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778