What would it mean for your business if you could get 30 percent of your working hours back? That’s time you could reallocate for strategic tasks, and money you could reinvest back in your company. This is a real possibility. Within the next few years, approximately 30 percent of all hours worked could be automated, according to McKinsey. Your factoring processes are not immune. In fact, you can automate many tasks already. Give us a few minutes, and we’ll walk you through some examples and how to automate factoring-related tasks, so you can start saving time and resources right away.

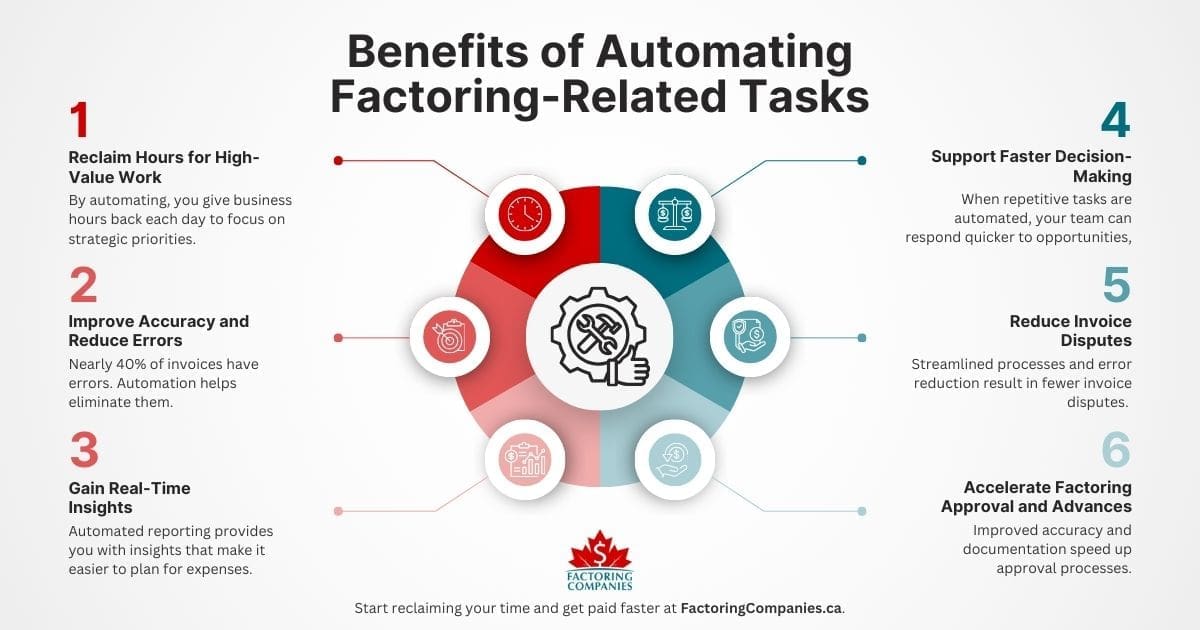

Benefits of Automating Factoring-Related Tasks

Automating your finance operations frees up time, improves accuracy, and creates consistency across your processes. Even when you work with a factoring company that handles collections, there are still parts of your invoicing and cash flow management you control. Automating these can give your business measurable advantages.

Reclaim Hours for High-Value Work

Small and medium-sized businesses spend an average of 120 working days on administrative tasks, according to Sage. Inefficient processes result in nearly $18 billion in lost productivity across the country. By automating tasks tied to factoring, you give yourself and your team hours back each day to focus on strategic priorities.

Improve Accuracy and Reduce Errors

Nearly 40 percent of invoices have errors, Ascend reports. Automating processes that would normally involve manual data entry allows you to avoid errors from mis-keyed information, missed fields, and more. Simply put, the fewer human touchpoints, the fewer chances for costly errors.

Gain Real-Time Insights

Automated reporting provides you with insights that make it easier to plan purchases, payroll, and other expenses without relying on manual updates.

Support Faster Decision-Making

When repetitive tasks are handled automatically, your finance team can respond more quickly to opportunities, whether that means taking on a new client, accepting a larger order, or adjusting terms with a supplier.

Reduce Invoice Disputes

When processes follow the same patterns each time, errors reduce, and documentation is always ready, the number of disputes drops.

Accelerate Factoring Approval and Advances

When you’re just getting started or onboarding a new client, your factoring company will request certain documents. Being able to provide these quickly and with the certainty of accuracy speeds up approvals.

The same is true of your factoring advances. The faster your factoring company receives documentation, the quicker you receive your advance. Because invoices are verified before approval as well, accuracy and the absence of disputes keep your funding on track.

Factoring-Related Tasks You Can Automate

Factoring companies take care of collections, but that does not mean every related task is out of your hands. Many steps that happen before and after funding can be streamlined with automation. The more you integrate these into your workflow, the more consistent and efficient your cash flow cycle becomes.

Invoice Creation and Data Entry

Use your accounting or enterprise resource planning (ERP) software to generate invoices automatically from sales orders, purchase orders, or time-tracking data. This ensures formatting, required details, and accuracy are consistent every time.

Batch Submission to Your Factor

Some factoring companies offer online portals or APIs. You can set up your system to send multiple invoices at once and eliminate the need for manual uploads.

Payment Matching and Reconciliation

Automate the matching of payments from the factor to the corresponding invoices in your accounting system. This reduces the time spent tracking down mismatches or missing payments.

Reporting and Dashboards

Create automated reports that show funded versus non-funded invoices, reserve releases, and outstanding approvals. You can have these emailed to you or updated in a live dashboard.

Credit Checks for New Customers

If your factoring company requires credit approval for each customer, you may be able to integrate their system with your customer relationship management (CRM) software or accounting platform to run checks automatically.

Notifications and Reminders

Set up alerts for important milestones, such as when reserves are due for release or when an invoice has been sitting in pending status for too long.

Maximise Impact by Working with a Factor That Automates

Your own automation strategy is only part of the equation. The factoring company you choose can either support or slow down your progress, depending on how advanced their systems are. Working with a factor that invests in automation means faster funding, fewer errors, and more transparency.

Automated Invoice Verification

The factor’s system compares invoice details against purchase orders, proof of delivery, or contracts. This speeds up approvals and reduces manual back-and-forth.

Customer Payment Reminders

Timed, professional reminders are sent to customers automatically, which helps reduce late payments without extra effort from your team.

Real-Time Client Portals

Secure online dashboards show invoice status, funding timelines, and reserve releases. You can check the latest information at any time without contacting your account manager.

Automated Credit Checks

Customer credit assessments run instantly, so you know right away if a new or existing account is eligible for factoring.

Integrated Reporting Tools

Built-in analytics help you track trends, see average payment times, and download funding history in a few clicks.

How to Integrate Automation into Your Factoring Strategy

Automation works best when it is introduced in a structured way. These steps will help you get started and keep the process moving smoothly.

1. Understand the Factoring Process

Map out each step from invoice creation to final payment release. Include the requirements and systems used by your factoring company, as these will shape what you can automate.

2. Assess Your Technology and Capabilities

Review your accounting software, ERP, CRM, and any integration tools you already have. Knowing your starting point will help you avoid buying tools you do not need.

3. Identify and Prioritise Opportunities

List the tasks you could automate and rank them by ease of implementation, potential time savings, and impact on cash flow.

4. Allocate Resources

Confirm you have the right budget, tools, and internal expertise to implement the chosen solutions. This may involve hiring outside help or upgrading your systems.

5. Implement in Phases

Start with one or two high-impact automations before expanding. This makes the rollout easier to manage and helps you refine your approach.

6. Train Your Team

Show everyone involved how to use the new systems. Include practical examples tied to your factoring workflow so adoption is faster.

7. Measure Results and Optimise

Track the time and costs saved after implementation. Use these insights to refine your automation strategy and guide future investments.

Streamline Your Processes with the Right Factoring Company

Automation is valuable for freeing up time and money, but it’s not everything. For instance, if a factor automates all its customer service channels and you can’t get someone on the phone, it’s not going to serve you well in the long run. The key is to find a partner that provides a blend of automation with personal touches as needed, so you feel supported, get paid quickly, and everyone has a positive experience. If you’d like to explore your options more, connect with a factoring specialist.

FAQs on Factoring Automation

What are the best tools to integrate accounting with my factoring company?

Look for accounting platforms like QuickBooks Online, Sage, or Xero that support API integrations or partner apps. Many factors offer portals or direct API connections, allowing you to submit invoices, track approvals, and reconcile payments without switching between systems or re-entering data.

How do I reduce manual data entry in my finance department?

Use automation tools that connect your CRM, ERP, and accounting systems. Data entered once flows through all connected platforms, eliminating duplicate entry. Optical character recognition (OCR) software can also capture invoice data from scanned documents, further reducing manual input and improving accuracy.

What tasks can I automate to speed up funding from my factor?

Automate invoice creation, batch submission to your factor’s portal, credit checks for new customers, and payment reconciliation. These steps ensure accurate, complete information reaches the factor faster, which can shorten approval times and help you receive funding more quickly.

How can automation improve my cash flow management?

Automation can provide real-time insights into invoice status, funding timelines, and reserve releases. With accurate, up-to-date data, you can plan expenses, schedule payments, and make growth decisions confidently, without waiting for manual reports or updates from your team or factoring company.

What software automates payment matching and reconciliation?

Many accounting systems, including Sage, QuickBooks Online, and Xero, have built-in payment matching tools. They automatically link incoming payments from your factoring company to the correct invoices, flag mismatches, and update your ledger, reducing manual effort and errors.

How do I choose a factoring company with strong automation tools?

Ask potential factors about their client portal, reporting features, invoice submission process, and system integrations. Request a demo to see how tasks like invoice verification, payment tracking, and reporting are automated, ensuring you save time and gain transparency.

Can automation help track invoice status in real time?

Yes. Many factoring companies offer online portals or API integrations that update invoice status instantly. You can see approvals, funding dates, and reserve releases in one place, without calling or emailing your account manager for updates.

How do I set up automated reporting for my factored invoices?

Most accounting platforms and factoring portals allow you to schedule recurring reports. You can choose metrics like funded versus pending invoices, reserve balances, and average payment times, then have the reports emailed to you or updated in a live dashboard.

What is the ROI of automating financial and factoring-related tasks?

ROI depends on your current manual workload and the tools you adopt. Savings often come from reduced labour hours, faster funding cycles, fewer errors, and better cash flow planning. Tracking these metrics before and after automation will show the true financial impact.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778