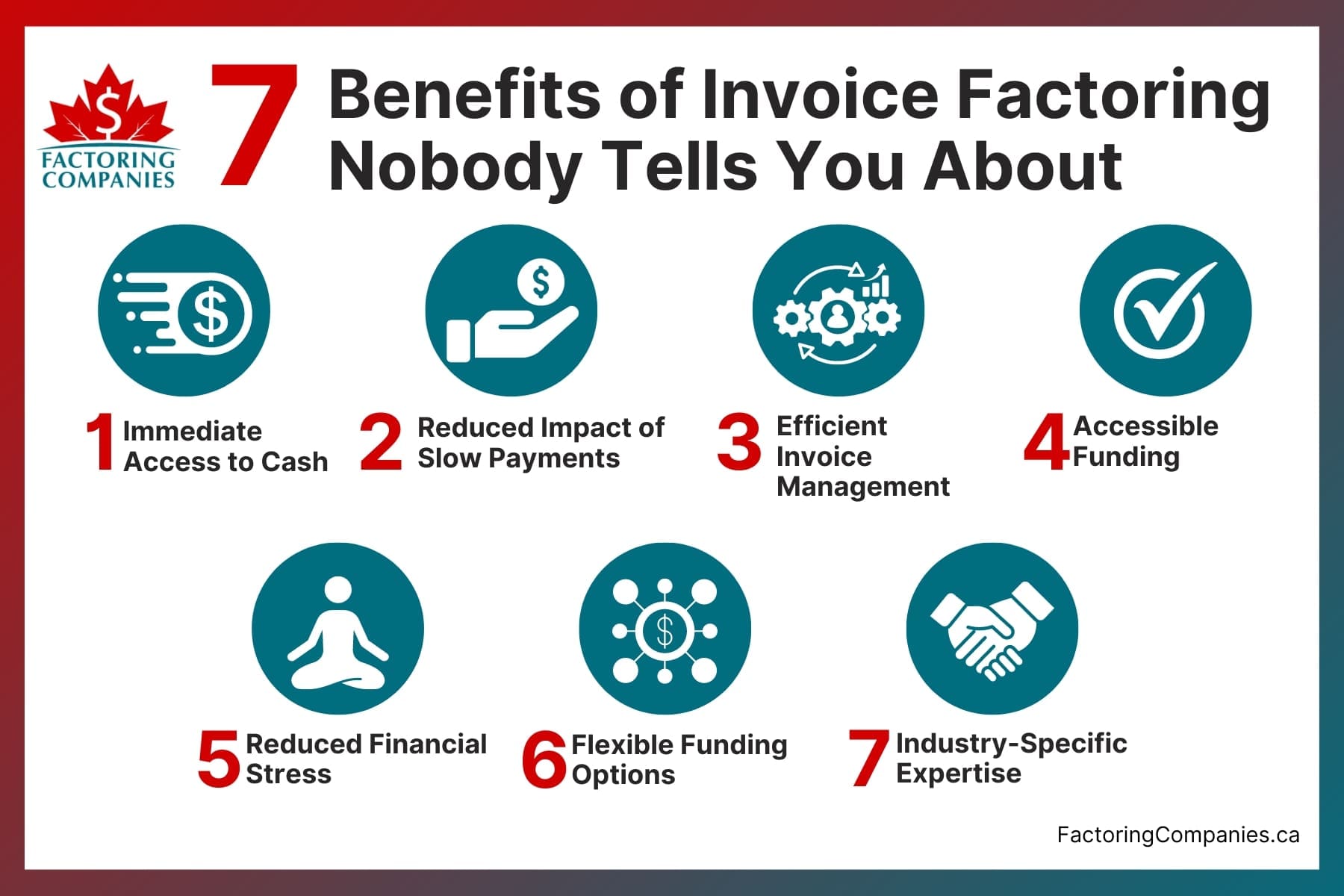

You’ve probably heard of the basic factoring advantages, like its ability to accelerate your cash flow and help your business make ends meet. But, there are many hidden benefits of invoice factoring in business that aren’t often discussed. It’s typically these aspects that set it apart from other funding solutions and result in the strong partnerships that are often formed between a business and its factoring company.

On this page, we’ll walk you through some of the benefits of factoring that people don’t often discuss, so you can ensure you receive maximum benefit from your invoice financing arrangement.

1. You Get Immediate Access to Cash

One of the most significant benefits of invoice factoring is that you’ll usually get paid within two business days for your outstanding invoice. Some factoring companies can even provide same-day payouts. This can make all the difference when dealing with something time-sensitive, such as making payroll, addressing an emergency, or seizing a business opportunity.

2. You Can Reduce the Impact of Customer Payment Delays

Canadian businesses wait an average of 53 days for B2B payments, per Atradius research. Considering that many businesses are in the habit of invoicing monthly, it can easily take two or three months after completing work or delivering goods to receive payment. These slow payments create issues for businesses. They make it harder for you to pay your own bills and can stunt your business growth. Because invoice factoring eliminates these lengthy waits, all the challenges you face because of them disappear, too.

3. Efficient Invoice Management and Outsourced Credit Control

Nearly half of all B2B payments that come in late are due to the customer having insufficient funds, according to Atradius. Canada ranks the highest of any country in the Americas in this respect. Mexico, the second-highest country, barely hits 40 percent. This means that Canadian businesses must be more selective about extending trade credit and following up as deadlines approach and are missed. Unfortunately, many small businesses don’t have the resources to pour into these processes.

However, invoice factoring companies check the credit of your clients for you. That way, it’s easier to know which companies generally pay their invoices on time and which ones you may want to pass on or require upfront payment from. Your factor is also responsible for collecting payments. Because this is something they do every day and is a core area of their business, they use methods that keep clients happy but accelerate payment, such as by providing reminders and convenient digital payment options.

4. Factoring is More Accessible Than Bank Loans and Very Affordable

Invoice factoring for small businesses tops traditional loans in a multitude of ways. Unlike bank loans, which often involve a lengthy application process and require stringent credit checks, invoice factoring provides a more streamlined and accessible solution for businesses looking to manage their accounts receivable more effectively. One significant advantage is that factoring is not a loan; it’s an advance on your invoices. This means that businesses can avoid the high interest rates and rigid payment schedules associated with traditional bank loans. Using invoice factoring, companies receive immediate cash based on their total invoice value, not on their credit score. This is particularly beneficial for small business owners who may face challenges securing bank loans due to less-than-perfect credit or lack of collateral. Invoice factoring offers recourse and non-recourse factoring options, providing businesses with flexibility depending on their risk preferences and factoring needs.

Recourse factoring tends to be more cost-effective, while non-recourse factoring provides additional security, protecting businesses if a client fails to pay an invoice. Factoring costs are also more transparent and predictable compared to the hidden fees and variable interest rates associated with bank loans. Businesses can benefit from using invoice factoring because the fees are straightforward and agreed upon upfront, usually a percentage of the total invoice amount. This makes budgeting easier and helps businesses plan their finances more effectively.

Easy Qualification

Most businesses qualify for invoice factoring because the creditworthiness of your clients matters more than yours.

Low Cost

A typical factoring fee is somewhere between one and five percent of an invoice’s value. Meanwhile, most business credit cards hover around 20 percent, with some climbing even higher. Other funding methods, such as merchant cash advances, have an APR of 200 percent. When you compare your options, factoring is much more affordable than other business funding solutions.

Debt-Free and Interest-Free Financing

Most funding solutions create debt that you must pay back with interest. That can be problematic because cash flow is often inconsistent for growing businesses. It’s difficult to know how much you can put toward paying off debt from one month to the next. Feeling optimistic, many business owners agree to lengthy terms and end up buried in debt they can’t repay.

Most funding solutions create debt that you must pay back with interest. That can be problematic because cash flow is often inconsistent for growing businesses. It’s difficult to know how much you can put toward paying off debt from one month to the next. Feeling optimistic, many business owners agree to lengthy terms and end up buried in debt they can’t repay.

Factoring doesn’t work this way. Instead, the factor retains a small portion of the invoice’s value when you receive your final payment. There’s no debt or interest accrued.

No Collateral Required

Oftentimes, lenders expect businesses to use their assets as collateral. The owner’s personal assets are sometimes leveraged as collateral, too. With invoice factoring, you’re selling your invoice to the factor. Your receivables essentially become collateral in this situation, so no other collateral is usually required.

5. Risk and Financial Stress Reduces

In all, 44 percent of business owners say they experience financial stress, according to FreshBooks polls. While everyone copes with it differently, lost sleep and feelings of anxiety or irritability are quite common. One of the overlooked benefits of factoring is that the very things likely to trigger financial stress are taken care of or diminished.

Receive Protection from Unpaid or Late Invoices

Again, factoring companies perform credit checks for you, so the likelihood of nonpayment is incredibly low. Furthermore, late payments from your clients are not a problem. You receive most of the invoice’s value immediately.

Pay Your Suppliers Earlier

It may go without saying, but one of the best ways to maintain good relationships with your suppliers is to ensure they’re paid on time. You can do this with greater ease when you factor. Plus, many vendors offer prepayment or early payment discounts, which you can take advantage of when you have working capital on hand by factoring.

Eliminate Debt Collection Hassles

Money can complicate client relationships. However, your factor collects for you and does so with the utmost concern and respect for your hard-earned relationships. You don’t have to feel like the “bad guy” always asking for money. You get to be the “good guy,” delivering excellent service, while your factor follows up on payments.

Improve Your Credit Score

One of the lesser-known perks of invoice factoring is its ability to boost your credit score. Business credit scores work similarly to personal scores in that things like your payment behaviours, missed payments, and debt level all contribute to a strong rating. Factoring influences all these areas. For instance, it’s debt-free, so your debt ratio stays lower. It also ensures you have working capital on hand to keep up with existing debt payments and pay vendors in a timely manner.

One of the lesser-known perks of invoice factoring is its ability to boost your credit score. Business credit scores work similarly to personal scores in that things like your payment behaviours, missed payments, and debt level all contribute to a strong rating. Factoring influences all these areas. For instance, it’s debt-free, so your debt ratio stays lower. It also ensures you have working capital on hand to keep up with existing debt payments and pay vendors in a timely manner.

Because anyone, from prospective landlords to insurance companies, lenders, and suppliers, may use your credit score to decide whether to work with you and what terms to offer, building your credit rating through invoice factoring can have massive and lasting implications for your company.

Offer Better Payment Terms to Your Customers

As you probably know from paying your own bills, the businesses that give you longer to pay are likely your favourites to work with. You stress less about affordability and probably have better relationships with them. If you have to choose between them and a similar business that doesn’t give you extra time to pay, you’re going with the one that gives you longer. The same is true for your clients and prospective clients. Offering extended payment windows is good for relationships and can help you close more sales. You can provide this when you factor without worrying about what waiting for payment means to your business.

6. Factoring Companies Offer Flexible Financing Options

One of the big advantages of factoring that nobody talks about is how flexible it is. Businesses that haven’t leveraged it often expect to be tied into lengthy contracts, required to factor all their invoices, or forced to meet monthly minimums. While some factoring companies have these requirements, not all do. Moreover, even when a factor includes these stipulations, they’ll usually offer programs that don’t have them. If these are sticking points for you, ask about them during your initial consultation and see their options to alleviate your concerns.

For businesses that need flexibility, single invoice finance provides an excellent option, allowing you to factor individual invoices on an as-needed basis without the burden of long-term commitments. This tailored approach ensures you can manage cash flow effectively while maintaining financial agility.

7. You Can Tap into Industry-Specific Expertise

Some factoring companies specialize in specific industries. Those who do typically understand the challenges their selected industries face and have greater familiarity with how successful businesses overcome them. Some also offer unique perks for their clients. For instance, a company that offers freight factoring may also provide fuel cards or a load board. Conversely, a company that caters to the construction industry may offer novel ways to pay subcontractors. Similarly, a business in the commercial cleaning sector may benefit from partnering with a janitorial factoring company, which can offer tailored support, fast funding, and expertise specific to the industry’s billing cycles and client terms. Because of this, it’s always a good idea to look for factoring companies with experience in your industry before going with a generalist.

Unlocking the Full Potential of Invoice Factoring

Invoice factoring offers multiple benefits that can transform how small business owners manage their finances. Beyond the immediate access to cash and efficient invoice management, this financial tool helps reduce financial stress and enhances the ability to make strategic business decisions. By utilizing invoice factoring services, businesses can enjoy the benefits of invoice factoring, such as improved relationships with suppliers, risk reduction, and the flexibility to use factoring according to their unique needs.

Factoring companies provide more than just funding; they offer a partnership that helps businesses navigate the complex world of invoice factoring. Whether you’re looking to factor your invoices to avoid the hassle of unpaid invoices or seeking a factoring service that aligns with your industry-specific challenges, invoice factoring is a solution that supports small business owners in their quest to take their business to the next level.

Get a Free Factoring Rate Quote

As you can see, the hidden benefits of invoice factoring are what truly set it apart from other funding solutions. If it sounds like the ideal solution for your business, request a complimentary rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778