Wondering what your options are for accounting and accounting software integration? Syncing the two can open doors for automation and streamlining processes, but bringing it all together can sometimes be complicated. In this guide, we’ll walk you through the basics of integration, how to set things up, and what to do if a true integration isn’t possible.

Integrating Factoring and Accounting Software Can Streamline Financial Processes

When you connect factoring with your accounting platform, you streamline financial management and open up opportunities to run your business more efficiently.

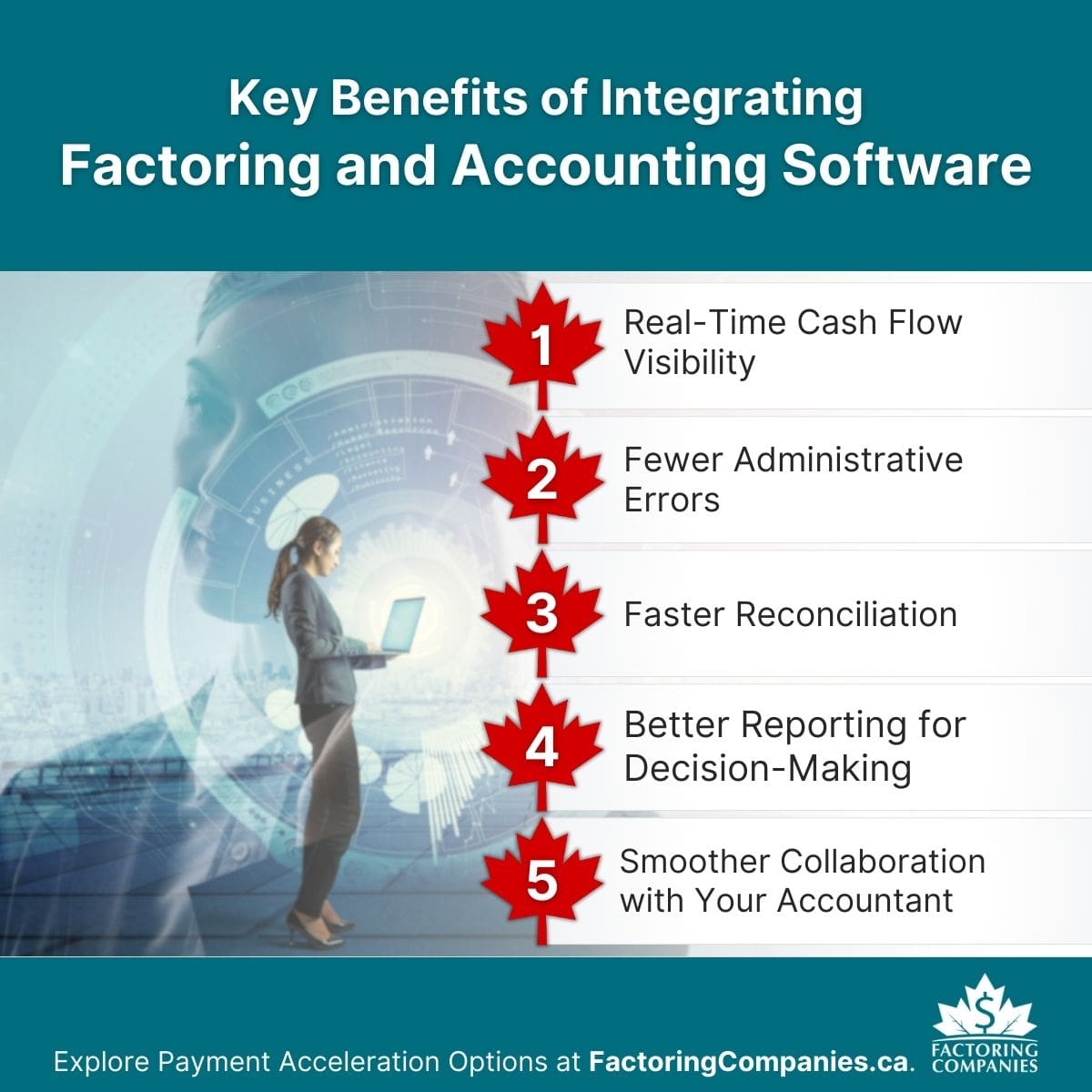

Key Benefits of Integrating Factoring and Accounting Software

By integrating factoring with your accounting software, you unlock many benefits.

- Real-Time Cash Flow Visibility: With factoring transactions automatically syncing into your accounting software, you see current balances, advances, and reserves without manual entry. That means you can plan purchases and payroll with confidence.

- Fewer Administrative Errors: Double data entry is one of the biggest causes of mistakes. Automated syncing reduces the risk of missed invoices, duplicate entries, or incorrect payment tracking.

- Faster Reconciliation: When factoring advances and customer payments flow into your books directly, reconciliation becomes a matter of checking entries rather than manually entering and matching them.

- Better Reporting for Decision-Making: Integration means your financial statements include both factored and unfactored invoices. This creates a full picture of revenue and outstanding receivables, which helps when you are seeking loans, managing budgets, or forecasting growth.

- Smoother Collaboration with Your Accountant: Your accountant or bookkeeper can access clean, up-to-date records without waiting for you to send files or explanations.

Additional Capabilities You Gain with Integration

After integration is in place, you can put it to work in several ways.

- Automate Invoice Submission: Some factoring companies offer tools that let you send invoices directly from your accounting software into their system, saving time and reducing turnaround delays.

- Track Customer Payments: Integration allows you to see when your customers have paid the factoring company, which helps you stay on top of collections and customer relationships.

- Simplify Tax Preparation: Because factoring activity flows directly into your books, year-end reports are easier to prepare and more accurate.

- Monitor Key Metrics: Set up dashboards in your accounting platform to track days sales outstanding (DSO), average advance rates, and fees. This makes it easier to measure the true impact of factoring on your bottom line.

- Strengthen Cash Flow Forecasting: By linking factoring data with your expenses and accounts payable, you can build more accurate cash flow projections and spot funding gaps early.

How to Integrate Factoring and Accounting Software

Now that we’ve covered the basics, let’s take a look at how integrations work and the steps involved in joining your systems.

Types of Integrations Available for Factoring and Accounting Software

Most factoring companies and accounting platforms give you a few ways to connect the two.

- Direct Integrations: Some factoring companies have built-in connections with popular platforms like QuickBooks Online or Xero. You link accounts, and invoices flow automatically.

- Third-Party Connectors: Tools like Zapier or specialized middleware bridge the gap between systems that do not natively connect. This option is useful if your factoring company does not directly integrate with your accounting software.

- Custom APIs: Larger companies sometimes build their own connections using application programming interfaces (APIs). This is more advanced but gives you full control over how data moves between systems.

Steps to Set Up the Integration

How you’ll approach integration often depends on the type of integration you select. A basic overview of the process is detailed below.

- Confirm Compatibility: Check with your factoring provider and your accounting platform to see what direct integrations are available. Many factoring firms now publish compatibility lists on their websites.

- Decide What to Sync: Determine if you want to sync invoices only, or if you also want payments, reserves, and fees to feed into your accounting system.

- Establish User Permissions: Protect sensitive financial information by ensuring only authorized team members can set up or manage the connection.

- Test with a Few Invoices: Start small to confirm invoices are flowing correctly and that payments are being matched to the right accounts.

- Review Reporting Settings: Adjust your accounting dashboard or reports so that factoring transactions appear in a way that makes sense for your business.

Tips for a Smooth Transition

As you plan your integration, keep the tips below in mind.

- Keep Your Records Clean: Before connecting, tidy up your accounting system by clearing duplicates and updating customer details. Clean data makes for a cleaner integration.

- Ask About Support: Some factoring companies provide technical help during integration. Taking advantage of that support can save you headaches down the road.

- Plan for Training: Make sure your accounting staff understands how factored invoices will look in the system. That way, they will not misinterpret balances or double-record payments.

- Schedule Regular Reviews: Even with automation, it is good practice to review transactions monthly to ensure accuracy.

Alternatives When Your Factoring and Accounting Software Are Incompatible

Only a handful of factoring software providers offer integrations, and direct links to accounting platforms are even rarer. However, most businesses can still connect their systems through tools like Zapier or APIs.

However, if this is not an option for you due to gaps in your company’s expertise or the software involved, you can still keep things in sync. At the end of the day, what matters most is that your records stay consistent, clean, and easy to interpret for decision-making, tax filings, and any financing applications you might pursue.

What to Do if Your Software is Incompatible

Even without a direct connection, you can still keep systems aligned. The key is building routines that reduce manual effort and limit errors.

- Export and Import Data: Many accounting platforms let you export invoices and payment data as CSV or Excel files. You can upload those into your factoring portal or vice versa. It adds a step but helps maintain consistency.

- Use Batch Entries: Instead of entering transactions one by one, group them. For example, record all factoring advances for the week as a single batch in your accounting software. This saves time while still keeping records accurate.

- Rely on Reports: Run weekly or monthly reports from your factoring company and cross-check them against your accounting system. It is less seamless than automation, but it ensures both systems line up.

Tips for Staying in Sync without a Factoring Software Integration

Even without a built-in connection, you can keep your books aligned with your factoring activity. The key is consistency. Simple habits go a long way in keeping everything accurate.

- Set a Regular Schedule: Create a weekly or bi-weekly routine to update factoring activity in your accounting software. Consistency is what prevents mismatches.

- Standardize Categories: Use the same account codes in your books for factoring advances, fees, and reserves. Clear labelling makes reconciliation much easier.

- Leverage Spreadsheets as a Bridge: A shared spreadsheet can serve as a middle ground between factoring data and your accounting system. It is a manual workaround, but it helps track invoices and payments in real time.

- Delegate Responsibilities Clearly: Assign one person to update records and another to review. That second set of eyes can catch errors before they snowball.

- Ask Your Provider About Alternatives: Even if your factoring company does not have an official integration, some will provide custom file formats or work with you to develop a process that reduces friction.

Find a Factor That Works the Way You Do

Integrations can be helpful, but they’re not as important as finding a factoring company that offers fast, reliable service and can tailor a contract to your needs. If you’re looking for the best fit, we’ll help find a factoring company for you at no cost to your business. Request a complimentary quote to get started.

FAQs on Factoring and Accounting Software Integration

What is the best accounting software for factoring if I want to connect it with QuickBooks or Xero?

QuickBooks Online and Xero are the most common platforms used with factoring, especially for small and mid-sized companies. They are flexible, widely supported, and many factoring providers build processes around them. Sage is also a popular option for larger firms with more complex reporting and reconciliation needs. However, it’s essential to confirm which applications work with your factoring company’s software before proceeding.

How do I handle factoring payment reconciliation in my books when customer payments go directly to the factoring company?

You record the factoring advance when funds are received, then apply customer payments against the invoices once your factoring company settles them. Many businesses create separate accounts for advances, fees, and reserves to keep transactions organized. Consistency in categorization makes reconciliation faster and reporting clearer.

What is the best way to set up cash flow tracking in factoring so I can see the impact on my business finances?

Link factoring advances, reserves, and fees to specific accounts in your accounting software. This allows you to run reports that separate operating income from factoring-related transactions. With dashboards or cash flow forecasts, you can see how factoring directly supports working capital and plan ahead more effectively.

How secure is my financial information when using factoring portals, and what should I look for in factoring data security?

Look for secure login protocols, encrypted file transfers, and clear policies around data use. Factoring providers often use bank-level security, but it is worth confirming. Ask whether they meet standards like service organization control (SOC) audits, and whether they limit access to sensitive client records internally to safeguard your business information.

What steps are involved in factoring and accounting system setup to make sure integration runs smoothly?

Start by checking compatibility, then map out which data will flow between systems. Clean up existing records before connecting. Test with a few invoices, confirm payments post correctly, and train your staff on how factored transactions will appear. Ongoing reviews keep the integration reliable as your business scales.

How can I check factoring software compatibility with my current accounting tools?

Ask your factoring provider directly which systems they support. Many publish compatibility lists. If there is no direct integration, see if they allow CSV exports, API access, or use third-party connectors. Testing a small batch of invoices is the fastest way to confirm whether syncing will be reliable.

What factoring provider requirements should I know about before connecting my accounting software?

Factoring providers may require specific invoice formats, proof of delivery, or customer credit checks before funding. On the technology side, some mandate the use of their portal or reporting templates. Clarifying requirements early helps you choose an accounting system setup that avoids extra manual work and fits their process.

What kind of factoring reporting and analytics can I expect if I integrate with my accounting platform?

You can generate reports that show days' sales outstanding, factoring fees, reserve balances, and advance timelines. With integration, these figures flow directly into financial dashboards, so you see how factoring affects cash flow, profitability, and customer payment patterns. This makes it easier to plan strategically and manage growth.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778