One of the biggest factoring misconceptions is that it’s only for smaller businesses. While it’s true that small businesses often stand to gain the most ground through factoring because of their limited cash reserves and diminished access to traditional financing, there are many situations where large and mid-sized companies benefit, too. Below, we’ll explore the times factoring for large companies is vital and how to get started if you decide it’s the right choice for your business.

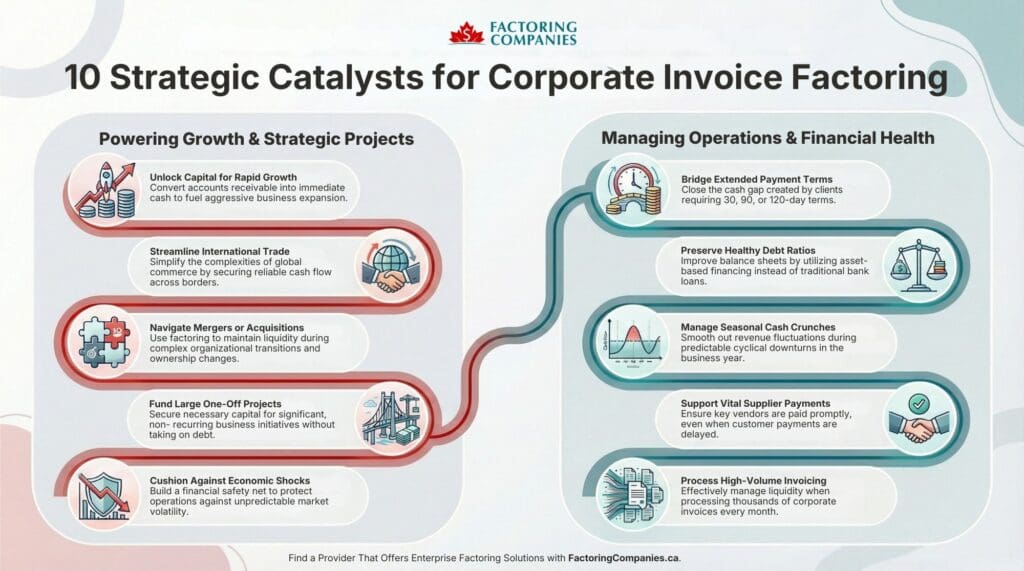

10 Times When Factoring for Large Companies is Vital

Factoring can be helpful anytime your business needs a quick injection of working capital, but because it’s debt-free, factors also take care of collections for you, and it works differently than traditional financing, there are times when it truly shines. We’ll review a few of these situations below.

1. You Need to Unlock Working Capital for Rapid Growth

Nearly one in five businesses say maintaining sufficient cash flow or managing debt is a challenge for them, per Statistics Canada. Rapid expansion is a major contributor here, as it often means expenses arrive weeks before customer payments clear. Factoring lets you convert approved invoices into cash the same day, so you can hire staff, purchase inventory, and more while keeping growth plans on schedule.

2. You Must Bridge Extended Payment Terms

The average B2B payment term in Canada sits at about 45 days, with 44 percent of invoices paid late, according to Atradius. This is lengthy as it is, but enterprise and government buyers often insist on lengthy payment schedules, leaving you waiting 45, 60, or even 90 days for cash to arrive. Factoring advances most of an invoice’s value the day it is issued, so payroll, supplier bills, and tax remittances stay on track while customers take their time.

3. You Need to Preserve a Healthy Debt Ratio

The average debt-to-equity ratio for private non-financial corporations at sits 64 percent, per Statistics Canada. Staying near or below this level keeps lenders comfortable and leaves room for additional borrowing when opportunities arise. Factoring helps maintain that balance because it turns approved invoices into cash without creating new liabilities. The fresh current assets push the ratio in a healthier direction, strengthen covenant compliance, and give your business extra negotiating power when you seek long-term credit or investment.

4. You Face Seasonal or Cyclical Cash Crunches

Companies facing peak-season payrolls or inventory purchases secure predictable cash flow regardless of sales cycles.

Busy periods can drain cash long before customer payments clear. For instance, a construction firm fronts labour costs as soon as the ground thaws, and a manufacturer buys bulk materials to keep assembly lines running at full speed. Each scenario creates a temporary gap between rising expenses and incoming cash. Factoring converts the invoices you issue during these peaks into same-day funding, so supplier bills, payroll, and tax remittances stay current. When the cycle eases, collected payments retire the advance without leaving long-term debt behind, keeping your cash flow smooth year-round.

5. Your Suppliers Can’t Afford to Wait

Reliable, timely payments keep your supply chain strong. When you can settle invoices on or ahead of schedule, suppliers secure their own raw materials, maintain staff, and prioritise your orders during high-demand periods. Factoring releases cash from your receivables the same day, giving you the flexibility to pay suppliers promptly, capture early-payment discounts, and strengthen relationships that safeguard quality, pricing, and on-time deliveries as your business scales.

Reliable, timely payments keep your supply chain strong. When you can settle invoices on or ahead of schedule, suppliers secure their own raw materials, maintain staff, and prioritise your orders during high-demand periods. Factoring releases cash from your receivables the same day, giving you the flexibility to pay suppliers promptly, capture early-payment discounts, and strengthen relationships that safeguard quality, pricing, and on-time deliveries as your business scales.

6. You Want to Streamline International Trade

Cross-border deals often lock up cash while goods travel, and overseas buyers follow lengthy payment schedules. Factoring can advance most of an export invoice’s value as soon as the shipment leaves the dock, giving you funds to cover freight, duties, and the next production run without drawing on credit lines. Many providers also handle foreign collections and assume payment risk, so you enjoy predictable cash flow and smoother expansion into new markets.

7. You Are Navigating a Merger or Acquisition

It’s common for mergers and acquisitions to create a spike in expenses from legal fees, due diligence costs, retention incentives, and system integrations, while incoming cash may slow as teams focus on the deal. Factoring turns current receivables into immediate funding, adding working capital without increasing long-term debt. The extra liquidity keeps payroll, supplier payments, and integration projects on schedule, helping the combined company maintain strong leverage ratios and preserve lender confidence through the transition.

8. You Are Processing Thousands of Invoices Each Month

When you’re engaged in high-volume billing, and customers pay on extended terms, it’s easy to lock up millions of dollars. Enterprise-grade factoring platforms connect directly to your accounting or ERP system, letting you submit invoices in bulk and receive same-day advances on the entire batch. The automated reconciliation eases pressure on your accounts receivable team, while dependable cash inflows keep production, payroll, and growth initiatives moving without delay.

9. You Want to Fund a Large One-Off Project

Major undertakings, such as upgrading a production line, opening a new distribution centre, or launching a national marketing campaign, often demand sizeable outlays before revenue follows. By selling a pool of high-value receivables to a factor, you unlock a lump-sum advance that covers project costs while leaving existing credit lines untouched. Because the advance appears as cash rather than debt, your leverage stays stable, and you retain the flexibility to pursue additional financing if the project scope grows.

10. You Want a Cushion Against Economic Shocks

Wild swings in interest rates, commodity costs, or customer payment schedules can drain cash faster than forecasts predict. Factoring turns outstanding invoices into same-day funding, giving you a built-in reserve that keeps payroll, supplier payments, and growth initiatives moving while your team adapts. Because the advance arrives as cash rather than debt, your leverage stays stable and existing credit lines remain available for strategic opportunities once conditions settle.

Tips for Choosing a Factoring Company for a Larger Business

While general tips for choosing a factoring company still apply, as a larger business, there are a few additional things to look for as you vet factoring companies.

Confirm Syndicated Capacity

Make sure the factor can underwrite and, when needed, syndicate multi-million-dollar facilities so funding grows alongside your receivables.

Validate ERP-Level Integration

Look for direct connectors or robust APIs for SAP, Oracle, Microsoft Dynamics, and similar systems to automate bulk uploads and reconciliation.

Insist on Consolidated Reporting

Require dashboards that roll up activity across subsidiaries, divisions, and currencies, giving the finance team enterprise-wide visibility.

Ask About Multi-Currency Support

Verify the provider can advance and settle in every currency you invoice, easing treasury management and hedging exposure.

Test Covenant Alignment

Ensure the arrangement keeps debt ratios and other loan covenants intact and is acceptable to auditors for off-balance-sheet treatment.

Review Reserve and Concentration Limits

Check that advance rates, customer caps, and reserve requirements reflect the realities of large, enterprise client portfolios.

Examine Service-Level Guarantees

Demand contractual turnaround times for funding and dispute resolution so operations remain smooth when thousands of invoices are involved.

Evaluate Risk-Sharing Terms

For non-recourse deals, confirm the factor’s credit insurance limits fully cover your largest domestic and international customers.

Find a Provider That Offers Enterprise Factoring Solutions

Ready to find a factor that understands how to support businesses at scale? Let us do the heavy lifting and connect you with a provider of enterprise factoring solutions. To get started, share a few details about your business.

FAQs on Factoring for Large Companies

When is factoring versus a bank loan better for a large or mid-sized business?

Choose invoice factoring when you need rapid, scalable liquidity tied to sales growth, want to keep leverage low, or must bridge long payment terms. A traditional loan suits long-term asset purchases, fixed repayment schedules, and situations where you comfortably meet collateral and covenant requirements. Many firms use both at different stages.

Should I be concerned about factoring and business credit impact?

Factoring generally strengthens your credit profile because it adds current assets without new liabilities. Payment history on factored invoices still matters, so be sure customers pay on time. Consistent performance can improve supplier confidence and make future borrowing easier.

How is factoring for mid-sized businesses different than large businesses?

Mid-sized companies often use single-debtor or selective factoring to free cash from specific accounts. Larger enterprises favour full-ledger or syndicated programmes with direct ERP integration, multi-currency support, and higher advance limits. Both models deliver working capital, but service levels, reporting needs, and facility sizes scale with revenue.

What types of large businesses use factoring?

Manufacturers, staffing firms, transportation carriers, oilfield service providers, and exporters commonly factor high-value receivables to smooth cash flow. Enterprises serving government or Fortune 500 buyers also adopt factoring to bridge extended payment terms while keeping debt ratios healthy.

How do I find a provider that understands factoring beyond small businesses?

Start by shortlisting factors with facilities exceeding one million dollars, enterprise resource planning integrations, and experience funding your sector. Then compare advance rates, contract flexibility, and service guarantees. Factoring Companies Canada can match your business with options that fit these criteria.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778