Running a business means keeping an eye on how money comes in and goes out. But sometimes, waiting for payments can slow things down. That’s where invoice factoring comes into play, offering a quicker way to access your money. At the center of this process is something called the factoring notice of assignment (NOA). It’s not much more than a slip of paper, but it plays a significant role in making factoring work smoothly. We’ll explore what an NOA is and why it’s a key piece for businesses looking into factoring below.

How Factoring Works

NOAs are a stepping stone on your path to invoice factoring, so let’s start with the basics of how factoring works.

It can be difficult for small and mid-sized businesses to maintain a healthy cash flow. This critical issue contributes to the closure of eight in ten small businesses, Forbes reports. Invoice factoring addresses this issue head-on by allowing you to sell your invoices to a factoring company, also called a factor, at a slight discount in exchange for instant payment. The typical factoring process is outlined below.

- Step 1: Work. Complete work or deliver goods as usual.

- Step 2: Invoice. Send an invoice to your client via your everyday process and send a copy to your factoring company.

- Step 3: Get paid instantly. The factoring company quickly confirms the invoice is valid, and you receive most of the invoice’s value right away. Payments are typically made via ACH, so funds hit your bank account within a couple of business days. Some offer accelerated solutions, including same-day payments.

- Step 4: Move forward. Your factoring company waits on payment and takes care of collecting the balance for you, saving you the time and trouble of chasing invoices. Meanwhile, you can focus on the core areas of your business and keep serving your clients.

- Step 5: Receive the remaining balance. Once your client pays, your factoring company sends you the remaining balance minus a small factoring fee. It’s not a loan, so there’s nothing for you to pay back.

What is a Notice of Assignment in Factoring?

With factoring, your customers send their payments to the factoring company rather than to you. That means they need to be notified of this change so they can start sending payments to the correct location. Your factoring notice of assignment serves this purpose. It’s a short note to your client that explains what’s happening and why. It generally includes the following details:

- Who: NOAs express the new partnership between your business and the factoring company.

- What: Clients learn that their unpaid balances are being assigned to the factoring company and that they need to send payment to them.

- Where: NOAs explain how to remit payment and provide a physical address for the factoring company.

- When: Most NOAs are open-ended, meaning they tell clients they should remit all future payments to the factor unless otherwise instructed. However, some factoring companies will provide service for a single invoice, so the language will reflect that if it’s part of your factoring agreement.

- Why: NOAs often explain the need for factoring in a client-friendly way, such as “In order to serve you better…” or “To continue providing you with extended payment terms…”

NOAs are common in business and are used in many different situations. Because most businesses have had some exposure to third-party billing companies or factoring, they’re already accustomed to NOAs and adjust accordingly.

Integrating a factoring notice of assignment into your invoicing process brings numerous benefits that can significantly enhance your business’s financial health. Invoice factoring allows you to receive high advances at competitive rates, helping maintain steady cash flow. By issuing an NOA, you inform your customer about the change in payment instructions, ensuring that all payments are directed to the factoring company, which prevents misdirected or delayed payments.

This clear communication highlights your right to collect payments through the factor while offering extended payment terms to your clients. NOA is a straightforward document that notifies customers without complicating the billing process. It plays a critical role in efficient accounts receivable management by reducing the risk of payment errors. Factoring companies understand the significance of maintaining a strong factoring relationship with both your business and your customers, ensuring seamless payment processing.

Whether using traditional factoring or other options, partnering with a reputable factoring company ensures smooth transactions and allows your business to thrive by leveraging these financial advantages. Factoring your invoices strengthens trust with clients and reinforces the importance of a well-executed NOA in successful factoring.

Purpose of NOAs in Factoring

NOAs serve several purposes in the factoring process.

- Ensures Transparency: NOAs clearly communicate to your customers that a factoring company is now handling the invoices. This open communication prevents confusion and maintains the trust your customers have in your business.

- Provides Legal Clarity: By formally notifying your customers about the assignment of invoices to the factoring company, the NOA provides a legal basis for the redirection of payments. This clarity is crucial for avoiding disputes over who should receive payments.

- Facilitates Smooth Operations: With the NOA in place, both your business and the factoring company can expect a smoother operation. Payments go directly to the factoring company, aligning with the agreement’s terms, ensuring that your business receives its funds promptly and without unnecessary complications.

Maintaining Positive Customer Relationships with Factoring and NOAs

Invoice factoring, and thereby NOAs, can be a helpful tool that supports and enhances your customer relationships.

- Transparent Communication: The issuance of an NOA is a prime opportunity for clear communication. By informing customers about the factoring arrangement and what it means for them, you’re prioritizing transparency. This openness can strengthen trust, as customers appreciate being kept in the loop about changes that might affect their payment processes.

- Simplifying Customer Payments: Factoring, facilitated by the NOA, simplifies the payment process for customers. By directing them to send payments to the factoring company, you’re streamlining their accounts payable process. This can be particularly beneficial if the factoring company offers multiple payment methods, making it easier for your customers to fulfill their invoices.

- Reassuring Your Clients: A well-crafted NOA can highlight your decision to factor as part of your business’s strategy to ensure stability and continuous improvement in service delivery. This reassures customers that your business is financially proactive, focusing on long-term partnerships and reliability.

- Focus on Core Business Values: With the administrative aspect of invoice processing handed over to the factoring company, your business can devote more attention to its core offerings. This can lead to improved services or products for your customers, reinforcing the value of your business relationship with them.

Alternatives to NOAs

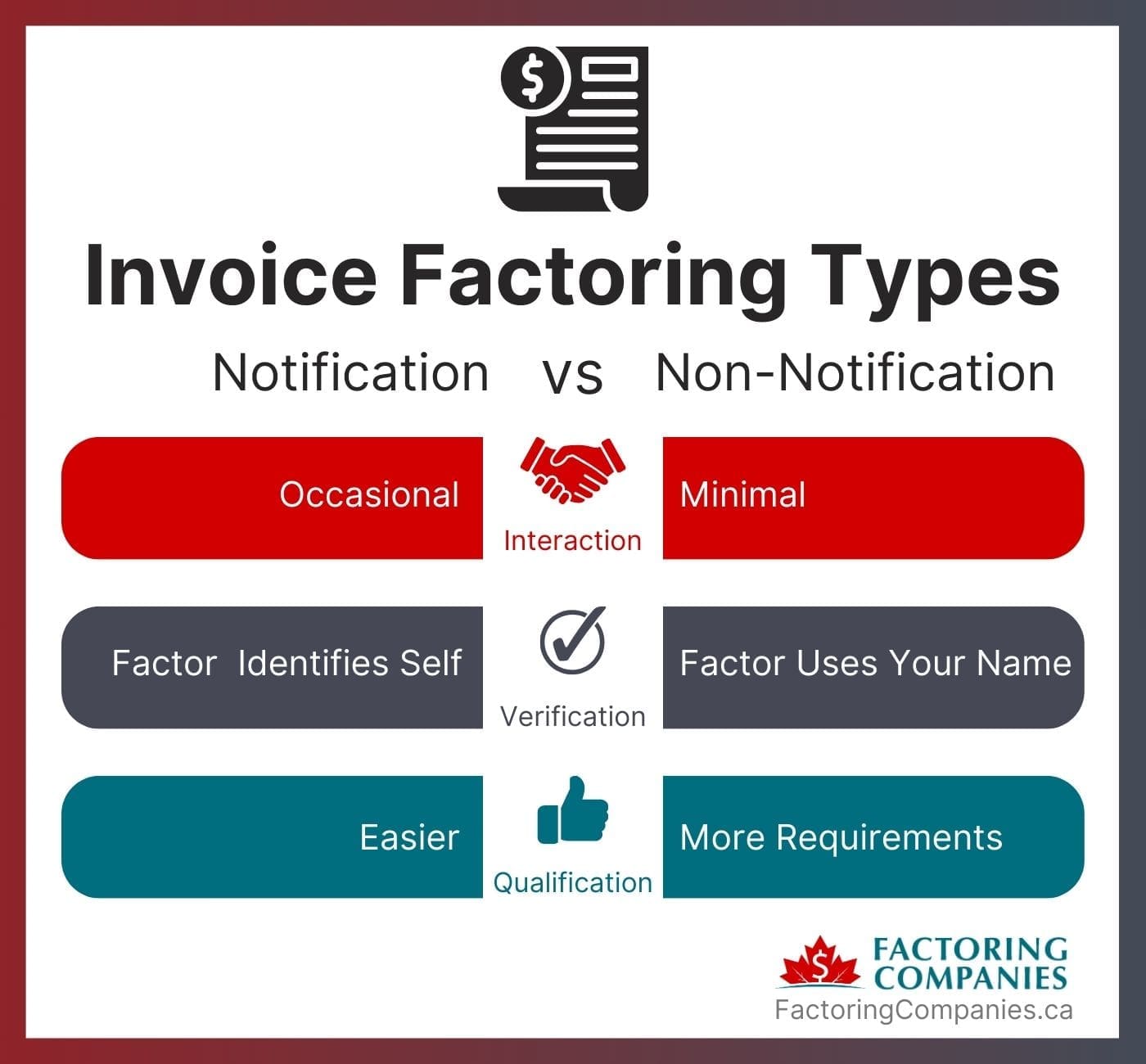

While NOAs are common in business, sometimes businesses still ask whether NOAs are mandatory in invoice factoring. Traditional invoice factoring, sometimes referred to as “notification factoring” or “full notification factoring,” always requires NOAs. However, there is a newer form of invoice factoring called “non-notification factoring” offered by some factoring companies. In these cases, the factoring company doesn’t make a point of announcing its presence. It changes the nature of your agreement a bit, and there are additional requirements.

Full Notification vs Non-Notification Factoring

- Interaction: Factors limit their interactions with your clients more when you choose non-notification factoring.

- Verification: Your clients know that your factoring company is the one verifying invoices under a traditional factoring agreement. With non-notification factoring, they use your company name while doing it instead.

- Qualification: It’s easy to qualify for traditional factoring because your client’s creditworthiness is evaluated, not yours. With non-notification factoring, you’ll also need to meet specific eligibility requirements.

Unlock Your Business’s Potential with Factoring

Factoring and the use of notices of assignment streamline cash flow and foster transparent, trusting relationships with customers. By embracing this financial strategy, you can also access funds faster, ensure smooth operations, and focus on growth without the wait. However, it’s important to work with an experienced factoring company that is committed to providing your clients with top-notch service and understands your business. We’re happy to match you with a provider that meets your needs. If you’re ready to explore how invoice factoring can transform your business cash flow, request a complimentary factoring rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778