Business finance has a language of its own. If you don’t have an accounting degree, there is a steep learning curve when you begin reviewing your financial reports. Thankfully, developing financial literacy for business owners is easy. On this page, we’ll provide a quick overview of common financial terms for business owners that can help you make sense of your statements or translate messages from your bookkeeper or accountant.

1. Accounting Method

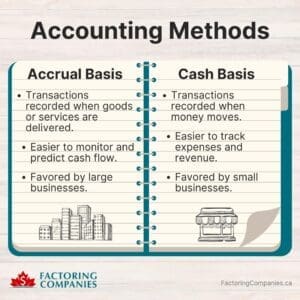

All businesses must keep financial records that clearly show revenue and expenses. However, some record them when money changes hands, and others do it at the time of the transactions. The accounting method a business uses determines when things are logged.

Accrual Basis Accounting

Businesses that use the accrual basis accounting method record revenue and expenses at the time the transaction occurs, not when money changes hands. Large companies favor it because it makes it easier to monitor cash flow and identify potential profitability issues.

Cash Basis Accounting

The alternative to accrual basis accounting is the cash basis accounting method. It involves recording revenue and expenses when the money moves. Smaller businesses favor it because it’s easier to track expenses and revenue.

2. Accounting Period

An accounting period is a range of time in which accounting functions are performed and analyzed. It usually references a 12-month period, such as a calendar or fiscal year. However, it can also be a period of weeks, months, or quarters.

3. Accounts Payable

Accounts payable (AP), also referred to as payables, refer to your business’s financial obligations. This is money your business owes creditors such as suppliers and service providers. AP can be either short-term or long-term, depending on your agreement with the lender, and are listed as a liability on your balance sheet.

4. Accounts Receivable

Accounts receivable (AR), also referred to as receivables, refer to money others owe your business for goods or services delivered. They usually take the form of invoices and are listed as assets on your balance sheet.

5. Accruals

Accruals are expenses that have been incurred but aren’t recorded yet. Payroll taxes and wages often fit into this bracket.

6. Amortization

Amortization refers to a reduction in value over time. For instance, a loan that’s amortized over five years is a loan that’s paid off over five years.

Assets also amortize as their usefulness or benefit declines with age. If, for example, your business purchases a computer that has an expected useful life of five years, it amortizes over five years.

Amortization expenses, also referred to as depreciation expenses, are reflected on your company’s profit and loss statement/ income statement and balance sheet. Most often, it’s calculated as annual amortization, or the depreciation the asset experiences each year. For instance, if the computer is expected to last five years and costs your business $1,000, then the annual amortization is $200. This can be deducted as a capital cost allowance (CCA) at tax time, as Investopedia explains.

7. Assets

Assets are items of value that your business owns. They include tangible goods, such as real estate, vehicles, and computers, as well as intangible goods, such as intellectual property. There are two main types of business assets: current and fixed.

Current Assets

The word “current” often appears in relation to business financials and references the current one-year period. With this in mind, current assets are assets that can be converted to cash within a year. Examples include cash and inventory.

Fixed Assets/Capital Assets

Conversely, the word “fixed” references something that does not change. Ergo, a fixed asset can’t be changed into cash within a year. The business owns them and generates long-term income with them. These are also referred to as property, plant, and equipment (PP&E) or capital assets.

8. Balance Sheet

Your balance sheet summarizes all your assets and liabilities. It’s a common financial report that gives a snapshot of the business’s net worth.

The basic balance sheet formula is: Assets = Liabilities + Owners’ Equity

9. Capital

Capital, sometimes called “fixed capital,” refers to your company’s long-term or overall wealth. It includes assets, cash accounts, and investments.

Capital Gain

A capital gain is an increase in the value of an investment or asset above the price you paid to acquire it.

Capital Loss

A capital loss is a decrease in the value of an investment or asset below the price you paid to acquire it.

Working Capital

Working capital refers to the money your business requires to function and expand. It only includes cash on hand and assets or instruments that you can convert into cash quickly.

10. Cash Flow

Cash flow is the net balance of money moving in and out of your business at a specific time or period.

- Cash Inflows: Money moving into your business.

- Cash Outflows: Money moving out of your business.

Cash flow is often broken into three categories: operating, investing, and financing.

Operating Cash Flow

Operating cash flow is the net cash generated through ordinary business activities.

Financing Cash Flow

Net cash generated financing a business, such as dent and dividend payments, comprises financing cash flow.

Investing Cash Flow

Investing cash flow is the net cash generated through activities such as purchasing and selling assets or securities investments.

11. Cash Flow Statement

A cash flow statement is one of the core financial reports that should be reviewed regularly. It provides a snapshot of cash flow during a selected period and typically breaks it down by operating, financing, and investing activities.

12. EBITDA

EBITDA is short for earnings before interest, taxes, depreciation, and amortization. These are added together to determine your EBITDA. It’s often used as a measure of a company’s ability to generate cash flow.

13. Equity

In business finance terms, equity refers to money that belongs to the business owners after all liabilities are subtracted from the assets. It’s sometimes referred to as shareholders’ equity or owners’ equity on balance sheets.

14. Interest

Interest is one way the cost of borrowing money may be calculated. It’s part of your loan expenses and is paid to you with many investments. It can be calculated as simple interest or compound interest.

Simple Interest

Simple interest is calculated only on the principal or original amount of the loan. For instance, if you pay a simple interest of five percent on a $10,000 loan over three years, you’ll pay $1,500 in interest total or $500 annually.

Compound Interest

Compound interest is often referred to as “interest on interest.” You pay interest on the original amount of the loan and the accumulated interest of previous periods. Using the example earlier of five percent interest on a $10,000 loan over three years, your first year would still have $500 in interest. However, because this interest is calculated in your second year as well, you’ll pay $525 that year. In the third year, you’ll pay $551.25 in interest. That means your total interest paid with compound is $1,576.25, compared to the $1,500 you would have paid with simple interest.

15. Liabilities

Liabilities are the opposite of assets. They’re what you owe to others, including things like your payables and wages.

Current/Short-Term Liabilities

Payments due within the next year are considered current liabilities.

Long-Term Liabilities

Expenses that are paid off over a longer period or are not due within a year are considered long-term liabilities.

16. Liquidity

Liquidity refers to how quickly assets can be converted into cash. That means cash on hand is the most liquid asset. Assets like your receivables are also very liquid. However, an asset like real estate is the least liquid because it can take months to sell.

17. Profit Margin

A profit margin is a measure of business profitability.

Gross Profit Margin

Gross profit margin is usually used to determine the profitability of a specific product.

The formula for gross profit margin is: Gross Profit Margin = (Revenue – Cost of Goods Sold) ÷ Revenue x 100

Net Profit Margin

Net profit margin is usually used to calculate the profitability of a whole company.

The formula for net profit margin is: Net Profit Margin = Net Profit ÷ Total Revenue x 100

Improve Your Cash Flow with Invoice Factoring

Most businesses struggle with cash flow occasionally, but small businesses are especially vulnerable. You’re operating with thin margins, haven’t had time to build a cash cushion yet, and even small shifts in your inflows or outflows can make it impossible to keep up with expenses. If you notice a cash flow gap while reviewing your financial reports or have concerns that your business may face one, invoice factoring can close the gap by turning your invoices into working capital. Because your receivables are liquid assets, the process is quick, and most businesses are approved. Request a complimentary factoring rate quote to learn more or get started.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778