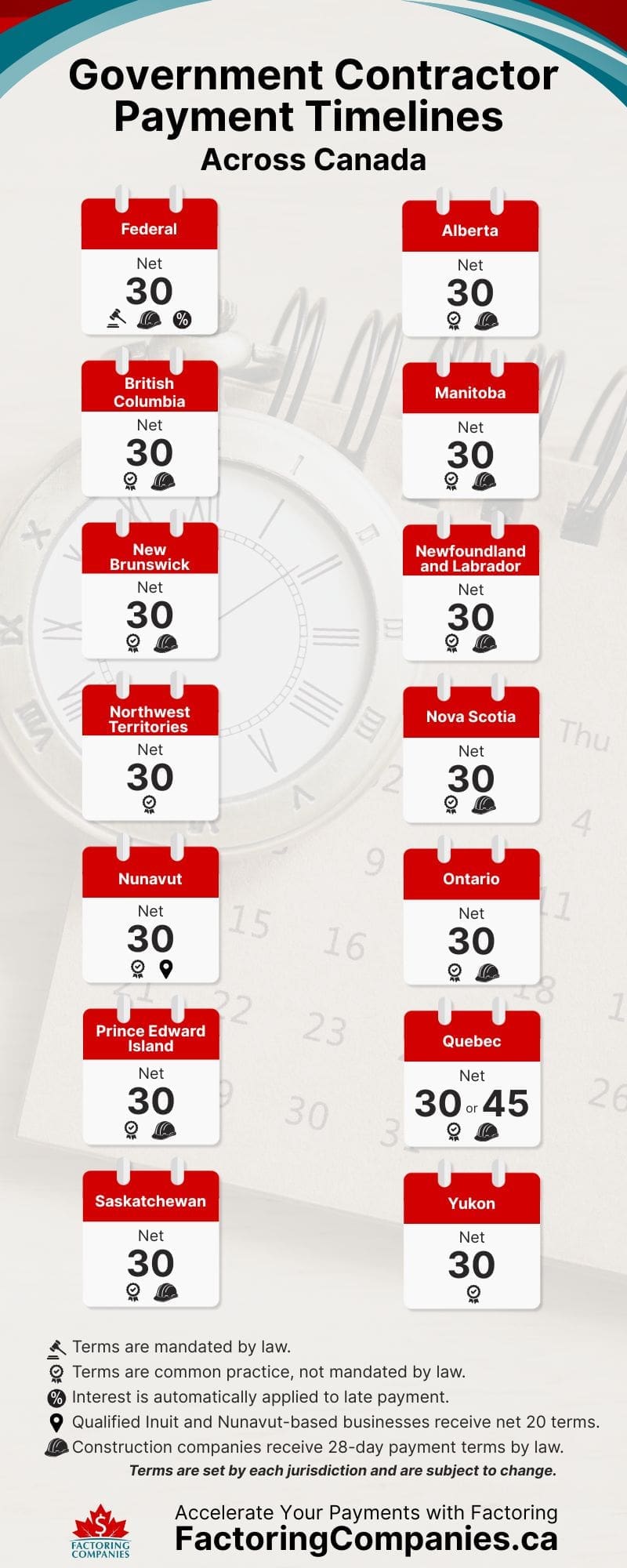

Work in the public sector can be incredibly lucrative. However, one of the most common complaints among government contractors is that payment timelines often stretch beyond expectations. Even though most use net 30 terms, payment delays happen frequently and can create real challenges for businesses across Canada. Below, we’ll review when you can expect payments depending on the jurisdiction and what you can do if you face delays or the timeline is too slow.

When Federal Government Contractors Get Paid

At the federal level, the Payment on Due Date policy is guided by the Directive on Payments issued by the Treasury Board of Canada Secretariat. The standard payment term is 30 calendar days from the date an invoice is received or from when goods or services are accepted, whichever is later. If payment is late, interest is automatically applied under the Interest on Overdue Accounts Act and its regulations.

In short, if you’ve delivered what was agreed upon and submitted your invoice correctly, the government is required to pay you within 30 days. If it does not, it owes you interest, and it must be paid automatically. There’s no follow-up or request needed on your end.

For certain federal construction contracts, the Federal Prompt Payment for Construction Work Act sets a 28-day payment deadline after receipt of a proper invoice, unless a notice of non-payment is issued.

When Provincial and Territorial Government Contractors Get Paid

Each province or territory sets its own procurement rules, and payment terms can vary. Some follow the 30-day standard. Others may have shorter terms for small vendors or longer ones, depending on the funding structure.

For example, Ontario has the Prompt Payment Act that applies to construction projects, and it includes a 28-day payment window once a proper invoice is received. If your contract involves infrastructure or public works at the provincial level, it’s worth reviewing the specific rules of that province’s Construction Act.

Below, we’ll go over some basic payment timeline details across the provinces and territories.

Alberta

In Alberta, net 30 payment terms are common in practice but not required under the Procurement Accountability Framework Manual. The manual outlines general procurement methods but does not set mandatory timelines for payment. Interest on late payments is not applied automatically and must be written into the contract to be enforceable. Vendors with Alberta contracts are encouraged to submit complete and accurate invoices promptly, as delays often occur when goods or services have not been formally accepted. The exception to this is construction payments, as Prompt Payment laws require payments to be made within 28 days.

British Columbia

In British Columbia, net 30 terms are common in practice but not required under the Core Policy and Procedures Manual. The manual outlines procurement standards for ministries and public sector organizations, but does not mandate specific payment timelines. Interest on late payments is not automatically applied and must be written into the contract. The exception to this is construction projects, which are subject to the province’s prompt payment framework that requires payment within 28 days of receiving a proper invoice unless a written notice of dispute is given to the contractor. Vendors are encouraged to ensure invoices are accurate and submitted through the correct channels to avoid delays. It’s also worth noting that British Columbia allows specific service providers to leverage electronic invoicing through its Service Provider Portal, which speeds up processing.

Manitoba

In Manitoba, net 30 payment terms are common in practice, and are referenced in the standard Purchase Order Terms and Conditions, which state that the government will endeavour to pay within 30 days of receiving and accepting a satisfactory invoice. Like many provinces, Manitoba deviates from this with prompt payment laws for construction, which stipulate that payments must be made within 28 days. Interest on late payments for all contracts is payable starting from day 61, but only if your invoice is delayed beyond that point. Vendors working for Manitoba are encouraged to submit complete documentation promptly because incomplete or incorrectly coded invoices can stall approval and push payment beyond 60 days.

New Brunswick

New Brunswick’s government generally operates under net 30 payment terms, as directed in its standard Purchase Order Terms and Conditions. These terms commit the New Brunswick government to pay 100 percent of approved invoices within 30 days of receipt and acceptance, provided the contract terms align. However, broader procurement legislation like the Procurement Act does not mandate firm timelines or interest on late payments. To claim interest, that provision must be clearly stated in the contract. One key exception to this is payments relating to construction, which fall under 28-day payment guidelines. Vendors are encouraged to submit full, accurate documentation and confirm the correct invoicing channel, as payment delays often result from incomplete submissions or required departmental approvals.

Newfoundland and Labrador

In Newfoundland and Labrador, net 30‑day payment terms are commonly used in practice, but the Public Procurement Policy and supporting Public Procurement Regulations do not mandate fixed payment timelines. The policy framework outlines procurement standards but does not compel the government to make payments within 30 days. However, construction projects are covered under the province’s prompt payment framework and require payment within 28 days. Interest on late payments is not automatic and must be explicitly included in the contract to be enforceable. Vendors working for Newfoundland and Labrador are advised to submit invoices via the approved payment process, including clear delivery acknowledgment and referencing the correct purchasing authority, as payment delays often occur when invoicing procedures aren’t followed correctly.

Northwest Territories (NWT)

In the Northwest Territories, net 30 payment terms are commonly used but not guaranteed under the Procurement Guidelines issued by the Department of Finance. The guidelines establish rules for competitive bidding and contract administration but do not legislate fixed payment timelines or automatic interest on late payments. Payment terms are set within each contract. Vendors are advised to submit clear, complete invoices through the designated contact listed in the contract or purchase order, as delays often result from incomplete documentation or mismatched references.

Nova Scotia

In Nova Scotia, net 30 payment terms are commonly used, but they are not mandated under the Procurement Governance Framework Manual. The exception to this is construction contracts, which fall under prompt payment legislation that stipulates payment must be made within 28 days. Interest on late payments is not automatically applied and must be included in the contract to be enforceable. Vendors working for Nova Scotia are advised to follow invoicing procedures carefully, as delays are often caused by incomplete submissions or lack of departmental approvals. The province uses a vendor self-service portal to manage invoicing and payment, which can help you avoid lost invoices.

Nunavut

The Government of Nunavut follows a standard payment timeline of 30 calendar days, calculated from the later of the date of service or goods delivery, or the date the invoice is received. However, in recognition of the higher cost of doing business in the North, the GN offers 20-day payment terms to qualified Inuit and Nunavut-based businesses. This policy is outlined in the Doing Business with the GN – How To Guide. Interest on late payments is not applied automatically and must be included in the contract to be enforceable. To avoid delays, vendors are advised to include the correct contract or purchase order number on each invoice and ensure all required documentation is submitted.

Ontario

In Ontario, net 30 payment terms are standard practice for most government contracts. For construction-related contracts, the Construction Act includes legislated prompt payment rules, requiring payment within 28 days of receiving a proper invoice. For other sectors, the Procurement Directive provides general procurement guidelines but does not enforce specific payment timelines. Interest on late payments is not applied automatically outside of construction contracts and must be specified in the agreement. Vendors with Ontario contracts are encouraged to follow submission guidelines closely, particularly regarding proper invoice formatting and delivery confirmation, to avoid payment delays.

Prince Edward Island

Net 30-day payment terms are commonly used in practice in Prince Edward Island, but the province’s official Procurement of Goods Act and Regulations and the Supplier’s Guide to Goods Procurement in the Government of Prince Edward Island do not mandate fixed timelines for payment. These documents set the framework for fair and open purchasing, but they do not guarantee payment within 30 days. The exception is construction payments, which had a 28-day window. Interest on late payments is not applied automatically and must be included in the contract to be enforceable. Vendors are encouraged to submit complete invoices and delivery confirmations through the proper channels, since delays often result from missing documentation or routing errors.

Quebéc

In Quebéc, net 30 or net 45 payment terms are common in practice but not mandated under provincial procurement law, outside of a few exceptions. The Act Respecting Contracting by Public Bodies (CQLR c C‑65.1) and its related regulations outline procurement standards but do not enforce fixed payment timelines or automatic interest on late payments. Interest is only payable if it is clearly spelled out in the contract. Construction projects are handled differently, with a 28-day window stipulated. Vendors working for Québec are advised to submit accurate invoices with documented delivery acceptance and to follow the specified invoicing route carefully, as delay often results from missing documentation or misrouted submissions.

Saskatchewan

In Saskatchewan, net 30 payment terms are commonly used in practice, and the government’s central financial system is set to pay suppliers within 30 days of receipt of goods or services, according to internal Finance procedures (Section 3150: Timing of Supplier Payments). However, the Builders’ Lien Act applies to construction projects and requires payment within 28 days of receiving a proper invoice. Interest on late payments is not applied unless you include it explicitly in your contract. Vendors working for Saskatchewan should ensure that invoices are correctly submitted, reference valid purchase orders, and include documentation of delivery or acceptance, because delays are often caused by incomplete or misrouted invoices.

Yukon

In Yukon, net 30 payment terms are commonly used but not mandated under the Government of Yukon Procurement Policy. The policy outlines procurement principles, thresholds, and supplier engagement standards, but does not impose specific payment timelines or automatic interest for late payments. Payment terms are established through individual contract agreements. Vendors are encouraged to ensure invoices are properly itemized, submitted through the approved channels, and matched to corresponding purchase orders, as administrative delays are often the result of incomplete documentation or pending internal approvals.

When Municipal Government Contractors Get Paid

Municipalities are not always subject to the same legislative oversight, but many adopt net 30 payment practices as part of their vendor policies. However, actual disbursement can stretch depending on the city’s size, budget cycles, or internal approvals.

Some small-town governments still rely on batch payment processing, cutting cheques once or twice a month, so even when payment is technically due, it can lag in practice.

Why Government Contractor Payments Often Come Slow

Even though most areas try to pay their contractors within 30 or 45 days, that timeline can feel like it’s dragging on for many reasons.

You Have to Invest in the Project

Oftentimes, contractors invest heavily in materials, supplies, labor, and equipment. These costs can leave your pocket on day one, even if the project goes on for months before you can even generate an invoice.

Approval Requires Vetting

Sometimes, multiple people have to sign off on an invoice before it can be paid, or your client needs to see something in action for a period of time before it can be approved.

You Operate a Small Business

Smaller businesses tend to have limited working capital to begin with and fewer funding options available to bridge the gap. This means payment delays hit a little harder.

You Hit Roadblocks Along the Way

Government payables departments are very particular about the invoices they receive. If your invoice goes to the wrong department, has discrepancies, or is disputed, payment will be delayed.

Invoice Factoring Accelerates Government Contractor Payments

Through invoice factoring, you can sell your unpaid invoices at a discount to a third party, known as a factor or factoring company. In exchange, you get immediate payment for most of the invoice’s value and are freed from the collections process.

Easy Approval

Unlike other funding solutions, approval is not based on your credit score. Factors care more about the creditworthiness of your client. Because government agencies tend to be excellent payers, most government contractors are approved quickly.

Fast Payment

In a typical timeline, you’ll receive payment in around 24 to 48 hours. Some factoring companies even offer same-day payments.

No Debt

Your invoices are business assets because they represent money you’ve already earned. Moreover, the balance is cleared when the government agency pays the balance. That means there’s no debt or interest to pay back.

Flexibility

There are many ways to tailor your factoring agreement. For instance, you can opt to factor a single invoice in a process known as spot factoring or factor in bulk, which may qualify you for discounts.

Kickstart Your Factoring Approval

If you’re a government contractor or considering bidding on projects, invoice factoring can help reduce the strain of long payment cycles and provide you with the working capital you need to maintain smooth operations. To kickstart the process, request a complimentary factoring quote.

Editor’s Note: Please note that every effort has been made to ensure the accuracy of the information provided, and links to policies are included for your reference. However, contract terms are set by individual jurisdictions and are subject to change. Be sure to check with relevant regulatory bodies and your contract as needed.

FAQs on Government Contractor Payment Timelines

What are the standard payment terms for provincial government contracts?

Most provinces use net 30 payment terms as a standard, but these are not always legally mandated. Some provinces, like Ontario, have specific rules for certain sectors such as construction. Contractors should always review the terms outlined in their agreements and confirm invoicing requirements.

Do municipalities in Canada follow net 30 payment terms for contractors?

Many municipalities adopt net 30 as a best practice, but they’re not always required to follow it. Payment timing can be affected by city size, budget cycles, and administrative procedures. Smaller towns may issue payments in batches, which can delay disbursements even if the invoice is approved.

Why do government contract payments take so long in Canada?

Delays can occur due to multi-step approval processes, invoice disputes, or incomplete documentation. Some agencies also process payments on fixed schedules. Even when net 30 terms apply, these factors often extend payment timelines to 45 days or more, especially for new vendors or complex contracts.

What happens if a government agency in Canada pays a contractor late?

At the federal level, late payments typically trigger automatic interest under the Interest on Overdue Accounts Act. In other jurisdictions, interest must usually be written into the contract to be enforceable. Without it, contractors may have limited recourse for delayed payments beyond following up.

Are payment timelines legally enforced for Canadian government contracts?

In most cases, no. While the federal government enforces 30-day payment terms by policy, provincial and municipal governments are not always legally bound to specific timelines unless stated in legislation or the contract itself. Enforcement depends heavily on the contract language.

How do payment timelines differ between federal and provincial contracts?

Federal contracts are governed by the Directive on Payments, which mandates 30-day payment terms and automatic interest on late payments. Provinces often follow similar practices, but timelines are not always enforced. Payment terms may vary widely depending on department, sector, or project type.

What can contractors do to avoid payment delays from government clients?

Contractors should submit accurate, complete invoices with proper documentation and follow invoicing procedures closely. It’s also wise to confirm who is responsible for approvals and to follow up regularly. Including clear payment terms and interest clauses in the contract can help protect your timeline. You can also bypass this and leverage invoice factoring to receive payment right away.

What are typical payment terms at government level for contractors?

Payment terms for government contracts in Canada vary. However, the federal government and most provinces follow net 30 terms, either by law or as a common practice.

How long does the government take to pay contractors?

The federal government and most provinces and territories have net 30 payment terms, meaning payment should be issued within 30 days of invoice approval. However, approval delays, invoice errors, and other issues can push out the timeline. Businesses can sometimes wait months for payment. Invoice factoring can help accelerate payment for those who need more rapid cash flow.

How can I find a factoring company that serves Canadian government contractors?

Factoring Companies Canada can match you with a factoring company that works with government contractors across the country. Tell us a little about your business to get started.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778