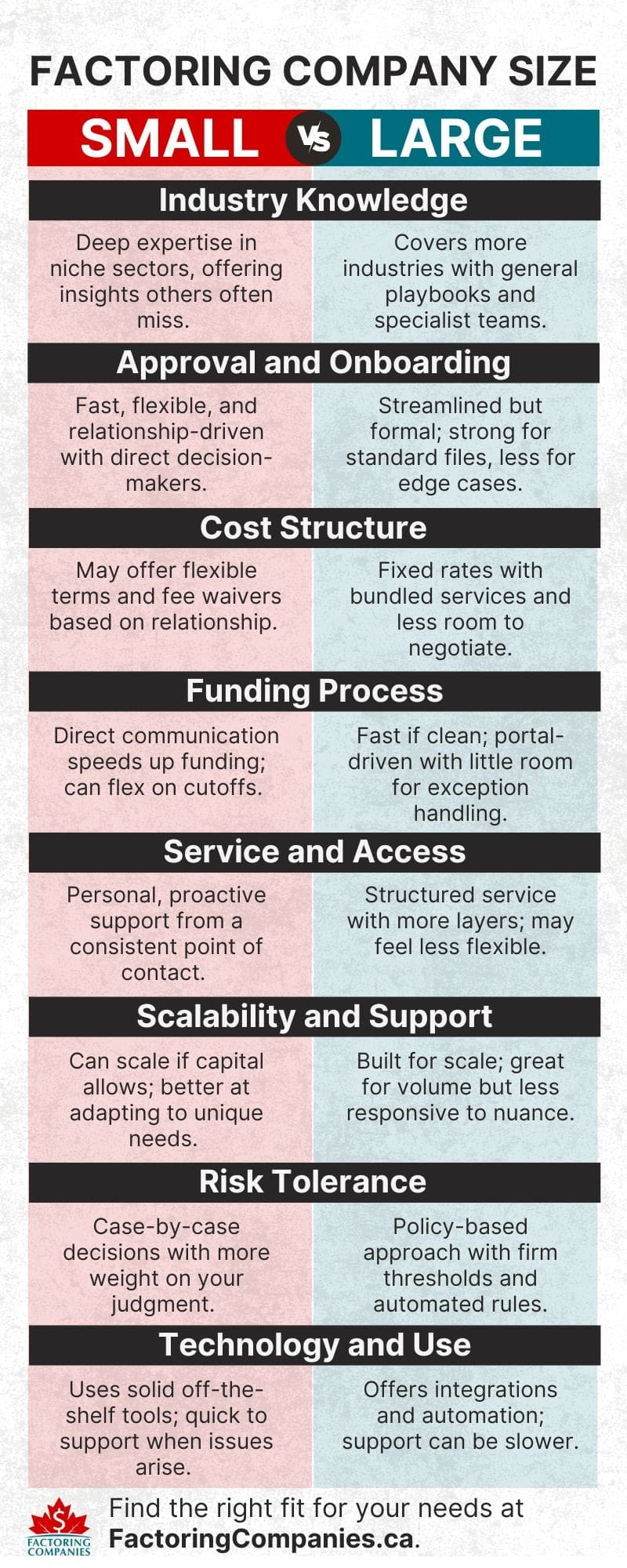

The small vs. large factoring companies debate isn’t what it used to be. While there were once some large gaps between the two due to the additional infrastructure that larger factors have, modern technology has done a fantastic job of closing that gap.

Even still, you may pick up on a few differences between small and large factoring companies as you explore your options. We’ll walk you through some of the areas that can impact your factoring agreement the most below and share some general insights about what to expect from each.

Industry Knowledge

Think of factoring as a working relationship built around your receivables. Like any relationship, it functions best when both sides understand the world you’re operating in.

Industry knowledge plays a big role here. When a factoring company understands your business model, your clients, and the common risks in your sector, approvals tend to move faster. The terms make more sense. The guidance they give actually helps. And when things go sideways, as they sometimes do in business, they’re more likely to respond with insight instead of red tape.

This is true whether you’re in trucking, staffing, manufacturing, oil and gas, or another B2B sector. The question is: how much does your factor know about your industry?

Level of Industry Knowledge in Small Factoring Companies

One of the main benefits of small factoring companies is that they often focus on one or two sectors where they’ve developed deep expertise. For example, you might come across a small team that works almost exclusively with trucking businesses or staffing firms. Because they live and breathe that industry every day, they tend to pick up on the nuances others miss.

- Faster, More Flexible Approvals: If your customer terms or invoice structure look unusual to someone outside your field, it could trigger delays or denials. But when your factor understands the norms in your industry, they’re more likely to approve you quickly and work with you on the edge cases.

- Stronger Day-to-Day Support: When a factor understands your industry, they can offer more relevant advice, like how to avoid problematic customers, how to handle customer disputes, or what documentation tends to raise flags during verification.

- Relationship-Driven Guidance: In many cases, small firms act more like partners than providers. They may even introduce you to other businesses, back-office tools, or legal experts that work in your space.

Large Factoring Companies

Larger factoring companies tend to serve a wider range of industries. While they may not go as deep in any one sector, they usually have internal specialists or teams who work with certain verticals.

- Broader Coverage, Less Specialization: You’re more likely to find a receivables factoring company that can work with your industry, but they may be drawing from a general playbook rather than hands-on experience.

- Stronger in Regulated or Complex Spaces: In industries like oil and gas, aerospace, or enterprise-level manufacturing, larger firms sometimes have more robust compliance teams and processes in place to manage high-risk receivables.

- Inconsistent Expertise Across Reps: One account manager may have deep sector knowledge. Another may not. It can vary based on who’s assigned to your file and whether they have time to learn the specifics of your operation.

Questions to Ask About Industry Knowledge Before You Sign an Agreement

A factoring company doesn’t need to know your business better than you do. But they do need to know enough to respond quickly, make informed decisions, and offer support that’s relevant. Asking the questions below can help you assess their ability to do just that.

“How many clients do you currently work with in my industry?”

This gives you a sense of their comfort level and real-world exposure.

“What challenges have you helped similar clients navigate?”

A good factoring partner should be able to speak beyond funding and understand your risks, customer behaviours, and industry timing.

“Do you have staff who specialise in my sector?”

Whether it’s an account manager, credit analyst, or onboarding rep, you want someone who gets the rhythm of your business.

“Can you walk me through how you’d handle a delayed payment or dispute in my industry?”

This one reveals how much hands-on experience they really have.

Approval Process and Onboarding

For most businesses exploring factoring, the first question is usually: “How fast can I get approved and funded?” But the speed of approval is only part of the story. How your factor evaluates your business, how flexible they are during onboarding, and whether the agreement you’re signing actually reflects how you operate matter just as much.

The approval process is where your working relationship really starts to take shape, and in many cases, how you’re treated during onboarding will mirror how you’re treated once you’re a client.

How Small Factoring Companies Handle Approvals and Onboarding

Smaller factoring companies tend to have leaner teams, and that often works in your favour.

- Faster Response Times: You’re usually dealing directly with the decision-makers, so approvals don’t get stuck in layers of internal review. In many cases, you’ll have an answer within twenty-four hours, and funds can be released the same day.

- More Flexibility with Requirements: If your paperwork isn’t perfect, or your customer base is a bit non-traditional, a small factor is more likely to look at the full picture. Their approval process is often driven more by real conversations than rigid checklists.

- Personalised Solutions in Small Factoring Companies: Smaller firms are more inclined to shape the structure of your agreement around your business model, whether that means adjusting reserve amounts, offering non-recourse terms, or accommodating a seasonal cycle.

- A More Collaborative Experience: Onboarding often feels less like a transaction and more like a partnership kickoff. They’ll take time to explain the agreement, talk through how to submit invoices, and walk you through client verification if needed.

What the Approval and Onboarding Process Looks Like with Larger Firms

Larger factoring companies are built for volume, and that shows in how they process new accounts.

- High-Speed, High-Standard Processes: If you fit their ideal profile, approval is fast and efficient. In fact, the speed of approval is often one of their strongest selling points. But if your business has unique needs, it may be harder to get the kind of flexibility you’re looking for.

- Flexibility vs Standardization in Factoring: Larger firms often rely on standard procedures and fixed contract templates. This streamlines operations, but it also means there’s less room to adapt the agreement to suit your workflow or customer terms.

- More Formal Onboarding Experience: You may be handed off to an account setup team or asked to complete steps through a portal. The process is generally smooth, but less personal. And if questions or concerns come up, it may take longer to get answers.

- Customisation Can Be Limited: Agreement customisation or flexibility may be available, especially if you’re a high-volume client, but it’s often subject to multiple layers of approval or internal policy constraints.

Questions to Ask About Approvals Before You Apply

Before you submit an application or sign a contract, it helps to clarify a few key points relating to approval and onboarding.

“How long does your approval process typically take?”

If they hesitate to give a clear answer, that may be a red flag.

“What documents do you need to approve my account?”

Some firms want detailed financials. Others are happy with basic invoice history and customer details.

“Do you offer any flexibility in how the agreement is structured?”

This will tell you whether you’re getting a one-size-fits-all contract or something that actually works for your business.

“Who will be managing my onboarding?”

A named contact is always better than a generic email address.

Cost Structure

One of the most common questions business owners ask when considering factoring is, “What will this actually cost me?” But it’s not always easy to gauge because the advertised percentage is only part of the equation. The total cost depends on how the agreement is structured, what services are included, and how your business uses the facility.

Let’s take a look at how small and large factoring companies typically approach pricing and what you should ask before signing.

How Pricing Typically Works with Small Factoring Companies

Small factoring companies tend to be more hands-on with pricing and more open to tailoring the agreement around your needs.

- Custom Terms Based on the Relationship: Many smaller firms will adjust rates based on your volume, customer quality, or payment history. If they like your business and see long-term potential, they’re often willing to sharpen the pencil.

- Room for Negotiation: Instead of fixed fee schedules, small firms are more likely to offer bundled pricing or waive certain charges, such as credit pulls or bank wire fees, especially if you’re easy to work with or refer others.

- Fewer Layers, Faster Decisions: There’s often no “pricing committee” to review your file. You’re speaking with the person who can make the call, which keeps things simple.

- Transparency Can Vary: While many small factors are clear and upfront, a few may rely on verbal agreements or avoid spelling out every scenario in writing. Be sure to ask for documentation that reflects what’s been promised.

What to Know About Cost Structures in Larger Firms

Larger factoring companies typically offer more structured pricing, and they tend to operate on volume-based models.

- Fixed Fee Structures: Rates are usually tied to how much you factor per month and how quickly your customers pay. For example, a 30-day invoice might cost a fixed percentage, with higher rates for slower payers.

- More Line Items in the Agreement: Expect to see details on things like minimum fees, credit check charges, client onboarding fees, and early termination clauses. The terms are usually spelled out, but you may need to read closely.

- Less Wiggle Room: Agreement terms are often standardised, especially for small and mid-sized clients. You might be able to negotiate if you’re factoring large volumes, but if not, there may be little flexibility.

- Bundled Services Can Add Value: Larger firms sometimes include perks like automated credit monitoring, integrations with accounting software, or dedicated customer portals. These can make life easier and offset some of the cost.

Questions to Ask About Pricing and Fees Before You Commit

The following questions will help you understand the total cost of factoring with any given prospective partner.

“What fees should I expect beyond the factoring rate?”

Ask about wire transfers, credit checks, minimum volume charges, and termination fees.

“Is the rate the same for all my customers or does it vary?”

Some customers may be priced differently based on credit risk or geography.

“Can the agreement be customised based on my business needs?”

This gives you a sense of how much flexibility you’re working with.

“How is the rate calculated, and when does the clock start?”

Clarify if the fee is based on invoice date, payment date, or funding date. That small detail can change the cost significantly.

Funding Process

Once you’re approved, the real test begins: how quickly and consistently can your factoring company get you paid?

What the Funding Process Looks Like with a Small Factor

Smaller factoring companies often stand out when it comes to responsiveness and personal oversight. You’re usually working with someone who knows your file, your customers, and your funding habits.

- Hands-On Attention: If an invoice kicks back during verification, a small team is more likely to pick up the phone, troubleshoot quickly, and keep your funding on track.

- Direct Communication Speeds Things Up: No need to submit a ticket or wait for a queue. You can just email your contact or call them directly. That human element can make a big difference when timing matters.

- Flexibility with Cutoff Times: If you miss a standard cutoff by a few minutes, they might still push it through. That kind of flexibility is harder to find in larger organizations.

How Larger Firms Handle Funding and Payment Timing

Larger factoring companies tend to rely on highly systematised processes, and that comes with trade-offs.

- Streamlined Systems Designed for Speed: These companies have built infrastructure to process high volumes efficiently. If you submit invoices through their portal and your customers verify cleanly, funding tends to happen on schedule, usually same day or next morning. The efficiency of funding in large factoring companies is a major draw for businesses with predictable workflows.

- Less Room for Exceptions: If something falls outside the process, like an unusual invoice format or a customer verification delay, it may get held until the next cycle. That’s not always a dealbreaker, but it’s worth preparing for.

- Clearer Cutoffs, Faster Batch Processing: Larger firms often have defined funding windows, and if you hit those on time, funds may hit your account same day or next morning. The turnaround time in small vs large factoring can be nearly identical if the conditions are clean.

- Automated Systems Reduce Friction: Many large firms offer portals that integrate with your accounting software or allow you to submit invoices in bulk, which speeds up processing. But if you need to explain something, getting a real person on the line may take longer.

Questions to Ask About How and When You’ll Be Funded

Before you commit to a factoring relationship, ask questions to ensure the funding process lines up with how your business operates.

“What is your standard turnaround time for funding once an invoice is submitted?”

This is a good time to consider funding speed; small vs. large factoring companies often handle it differently depending on their processes and systems.

“What are your daily funding cutoff times?”

Knowing when you need to submit invoices to receive same-day funding can help you avoid cash flow gaps.

“How do you handle exceptions or delays in verification?”

This shows how much human oversight and flexibility you can expect if something goes wrong.

“Do you offer funding outside of standard business hours?”

Some industries, especially transportation, may need evening or weekend funding or perks like fuel advances.

Service and Accessibility

Once your factoring relationship is in place, you’ll likely need help with invoice submissions, payment tracking, client disputes, and occasional exceptions. That’s where service and accessibility come in.

The best factoring companies make it easy to get answers, solve problems quickly, and keep your cash flow smooth. But the level of service you receive can vary significantly depending on the size and structure of the company.

What Level of Support to Expect from a Smaller Factor

Many small factoring companies pride themselves on their service, and it shows in the way they interact with clients.

- You Know Who to Call: You’re usually working with the same person or small team day to day. That means fewer handoffs and no need to re-explain your business every time you reach out.

- Customer Service in Small Factoring Companies Feels Personal: Support often extends beyond just troubleshooting. Your rep might proactively flag issues, follow up on outstanding invoices, or give you a heads-up if one of your customers is starting to slip.

- Flexible Support Channels: Small firms are more likely to accommodate how you want to communicate, whether that’s by phone, email, or even text.

- Faster Problem-Solving: The decision-maker is usually a desk away if something needs approval. That can make a big difference when timing matters.

How Accessible Larger Factoring Firms Tend to Be

Larger companies have more structure, which can be good or bad depending on what kind of support you need.

- Customer Service in Large Factoring Companies Can Be Consistent But Formal: You’ll likely have a dedicated account manager, but you may also need to route some requests through general service lines. That can create delays if you’re dealing with something time-sensitive.

- Clear Processes, Less Flexibility: Larger firms often follow strict workflows for resolving issues. This helps with consistency but leaves less room for workarounds or custom handling.

- Support Teams May Rotate: If your account manager is unavailable, another team member will step in, but they may not know your history. That can slow things down if the issue is nuanced or involves previous approvals.

Questions to Ask About Service Before Signing On

To get a feel for how a factoring company handles support, consider asking some of the questions below.

“Who will I be working with day to day?”

A single point of contact is ideal, especially for time-sensitive requests.

“How quickly do you respond to client issues?”

This gives you a sense of their internal culture and how much they prioritize client communication.

“What’s the best way to reach you if something urgent comes up?”

Understanding how accessible your team will be can help you avoid frustration later.

“How do you handle exceptions or disputes?”

This reveals whether the team is empowered to think critically or bound to policy at every turn.

Scalability and Support

If you plan to grow by increasing your receivables, taking on larger clients, or expanding into new markets, your factoring company needs to grow with you. The scalability in factoring companies often correlates with their size.

Growth Support Capabilities in Small Factoring Companies

Small factoring companies can often support growing businesses, but their ability to scale depends on how they’re structured behind the scenes.

- Limited Capital Reserves: Smaller firms may have a ceiling on how much they can fund, especially if your customer concentration is high or you’re issuing very large invoices.

- Capital Constraints Can Create Roadblocks: Some small factoring companies may lack access to outside capital or strong banking relationships. These growth limitations of small factoring companies can make it difficult to support rapid increases in volume or unusually large receivables.

- Flexible and Relationship-Based: Many small factors are willing to expand facilities gradually, especially when they have a strong working relationship with the client.

- Manual Processes and Slower Adaptation: If your needs become more complex, like consolidated reporting or multi-currency funding, a small firm may struggle to implement changes quickly.

Growth Support Capabilities in Large Factoring Companies

This is one of the key advantages of larger factoring companies. They are generally built to handle bigger volumes, more complex clients, and faster scaling timelines.

- Higher Funding Capacity: Large firms typically have greater access to capital, which makes it easier to increase your credit limits as your receivables grow.

- Well-Established Credit Teams: Their in-house analysts can handle larger accounts and higher customer concentrations without delays or added friction.

- Operational Support for Scaling: Many offer client portals, credit-check tools, and the ability to manage multiple entities or locations under one umbrella.

- Less Flexibility on Edge Cases: Larger firms are often more policy-driven. If your growth path involves unusual terms or customer setups, you may have fewer options to adjust how things are handled.

- Additional Funding Solutions: Factoring isn’t right for every situation, especially as a business grows. Larger factoring companies are more likely to offer complementary solutions like asset-based lending, equipment financing, commercial credit cards, and lines of credit.

Questions to Ask About Growth Support Before You Choose a Factor

“What funding capacity do you have available as my volume grows?”

This helps you understand how far they can go before hitting their internal limits.

“Do you have experience supporting clients as they scale rapidly?”

A seasoned factor should be able to describe how they’ve helped others grow.

“Can your systems support multi-location or complex structures?”

This reveals how prepared they are for businesses with evolving operational needs.

“What happens if I outgrow your current facility?”

Some firms have partnerships or upgrade paths in place, while others may not.

Risk Tolerance

One of the most important but overlooked aspects of choosing a factoring company is understanding how they handle risk. This includes how they evaluate your customers, what happens if an invoice goes unpaid, and how much flexibility they offer when something doesn’t fit neatly into their model.

Risk Management Approach in Small Factoring Companies

Smaller factoring companies often take a more hands-on approach to risk. While their policies vary, they tend to evaluate situations case by case.

- More Willing to Review Exceptions: If one of your customers has a weak credit score but a solid payment history, a small factor may be more inclined to take that into account.

- Direct Conversations About Risk: Instead of an automatic decline, you’re more likely to get a phone call to talk through the situation, especially if you’ve built trust with the team.

- Personal Knowledge of Your Customers: Smaller firms working in niche industries may already know your clients and their payment behaviours, which allows them to make quicker and more informed decisions.

- Stronger Reliance on Your Judgment: A small factor may give you more leeway to decide which customers to factor, particularly if your track record with them is solid.

Risk Management Approach in Large Factoring Companies

Larger firms tend to have formal risk policies and credit standards in place, often driven by internal scoring systems or third-party data.

- Defined Credit Thresholds: Large factors usually have set limits for customer credit scores, aging thresholds, or industry types they’re willing to work with.

- Heavier Emphasis on Verification: Payment verification and credit reviews may be more structured, with less room for exceptions or workarounds.

- More Resources for Monitoring: Larger companies often have credit departments that continuously monitor your customers’ financial health, offering automated alerts or recommendations.

- Predictable, But Less Flexible: While their approach is consistent, it can also feel rigid. If a customer falls outside their parameters, it may be a hard no, regardless of your history or context.

Questions to Ask About Risk Policies Before You Sign

Before entering a factoring relationship, it’s worth understanding how the company will respond when customer payments are late, disputed, or outside the norm.

“How do you evaluate my customers’ creditworthiness?”

This tells you how they determine who is eligible for funding.

“What happens if one of my customers pays late or defaults?”

Understand whether you’re responsible for repayment and how disputes are handled.

“Do you offer non-recourse options or credit insurance?”

Even if you don’t need them now, it’s helpful to know what tools are available to reduce your exposure.

Technology and Ease of Use

Today’s factoring companies are expected to make the process fast, easy, and reliable. Technology plays a major role in that, especially when it comes to submitting invoices, tracking payments, checking customer credit, and managing your account.

While both small and large factoring companies use digital tools, their approach can feel very different depending on how each company is set up behind the scenes.

Technology Use in Small Factoring Companies

Smaller factoring companies have come a long way in recent years. Many now use software that makes it easy to manage their funding, even if their systems aren’t custom-built.

- Reliable Third-Party Platforms: Most small firms use well-known factoring software that includes online portals for invoice submission, funding status, and customer management.

- Fast Setup and Straightforward Tools: You’ll often get access to your portal right after signing, and the interface is typically user-friendly, even for those new to factoring.

- Room for Human Oversight: If something doesn’t go through correctly, a real person is usually watching and can help correct the issue quickly.

- Limited Integration Capabilities: While the tools are solid, they may not integrate directly with your accounting system or ERP platform, which can mean more manual steps.

Technology Use in Large Factoring Companies

Larger factoring companies often invest more in proprietary platforms and automation, especially when serving high-volume clients.

- Advanced Client Portals: Large firms typically offer portals with robust features, including invoice uploads, real-time payment tracking, customer credit reports, and document storage with 24/7 access.

- Integrations with Accounting Software: Many have built-in integrations with platforms like QuickBooks or Sage, which can reduce duplicate data entry and improve accuracy.

- Automated Workflows: Some larger firms provide auto-verification, bulk uploads, or alerts tied to customer credit activity, tools that help reduce friction and improve funding consistency.

- Less Personalized Tech Support: While the tools are powerful, troubleshooting may take longer or require multiple steps if you’re routed through a support desk.

Questions to Ask About Tech and Ease of Use Before You Commit

Both small and large factoring companies can offer tech to streamline processes. Ask the questions outlined below to get to the heart of what’s being offered.

“What kind of portal or dashboard will I have access to?”

Make sure it covers all the functions you need, including submitting invoices, checking payment status, and reviewing reports.

“Can your system integrate with my accounting software?”

This is especially important if you have a high volume of invoices or want to reduce manual work.

“What happens if a submission fails or gets flagged?”

Knowing how issues are resolved helps set expectations around support and turnaround time.

“Do you offer mobile access or app-based tools?”

If you’re on the go or manage funding while offsite, this can make a big difference in convenience.

Small vs. Large Factoring Companies: Find the One That’s Right for You

If you’re comparing small and large factoring companies, the smaller ones will almost always stand out in terms of service and flexibility, while the larger ones tend to be better equipped to handle factoring at scale. Even still, there are no absolutes. You may find that a smaller factoring company can still take on a $500,000 invoice or that a large one has systems in place to make it feel personalised, even if it’s very structured.

Because of this, it’s more important to know what you want to achieve through invoice factoring and seek out potential partners that can meet those needs. To help streamline the process, we can match you with factoring companies that are uniquely poised to support your business and your goals. To get started, request a complimentary rate quote.

FAQs on Small vs. Large Factoring Companies

Can I still get personal service from a large factoring company?

Some large factoring companies do offer personalized service, especially through assigned account managers or dedicated support teams. However, the experience may be more structured or ticket-based. If personal contact is important to you, ask how communication works before signing an agreement.

Is it easier to get approved with a small or large factoring company?

Small factoring companies may be more flexible with approvals, especially for newer businesses or clients in niche industries. Large companies often follow stricter guidelines but can move quickly when the paperwork checks out. Approval depends on your customer quality, invoice history, and overall risk profile.

Who charges more: small or large factoring companies?

Costs vary more by contract terms than by company size. Small factoring companies may offer flexible pricing or waive certain fees, while large firms may include more services in their standard rates. Comparing quotes side by side is the best way to understand what you're actually paying for.

Who funds faster: a small or large factoring company?

Both small and large factoring companies can fund invoices within 24 hours. Speed depends more on how clean your paperwork is and how the company processes approvals. Some small firms may push things through manually, while large firms often use automated systems for faster batch processing.

Is a small or large factoring company more likely to work with a new or small business?

Smaller factoring companies are often more willing to work with startups or smaller operations, especially if they specialize in your industry. Larger firms may have minimum volume requirements or prefer established businesses with steady receivables. Either way, it’s worth asking during your initial conversation.

How do I go about choosing the right factoring company size?

Start by identifying what you need from the relationship, such as speed, flexibility, support, or scale. Smaller companies tend to offer more personalized service, while larger ones often have more resources. The right fit depends on your goals, not just the size of the factoring company.

What are the pros and cons of small factoring companies vs. large factoring companies?

- Small Factoring Companies Pros and Cons: More flexible and relationship-driven, but may have funding limits or fewer advanced tools.

- Large Factoring Companies Pros and Cons: Offer more capacity and tech infrastructure, though service can feel less personal or rigid at times.

How do factoring costs compare: small vs. large companies?

Costs are often similar, but how they’re structured can vary. Small factoring companies may offer more flexibility or waive certain fees, while large firms tend to use fixed pricing with additional services built in. The total cost depends on how you use the facility.

How do small and large factoring companies compare in service and support?

- Service Comparison: Small and large factoring companies can offer similar levels of service, but smaller firms are typically more hands-on and easier to reach, while larger ones rely on structured processes and support teams.

- Support Availability: Smaller teams may respond more quickly and adapt to your workflow, while large firms often use ticketing systems or centralized account management.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778