Did you know the Canada Revenue Agency (CRA) typically performs more than 20,000 small and medium-sized business audits annually, per CBC News? Most take around six months, but the average climbs to about a year when staffing levels are low. Knowing how taxes and factoring work is crucial to avoiding CRA issues and keeping your tax bill as low as possible. In fact, taxes and factoring are interlinked in lots of ways. In this guide, you’ll learn how factoring can minimize tax liability and help you avoid CRA problems, plus get strategies to help your business breeze through Canadian business tax concerns.

The Basics of Invoice Factoring and its Tax Impact

Invoice factoring, often just called factoring, is a type of debtor finance. In this arrangement, a business sells its invoices to a third party, called a factor or factoring company, at a discount. This provides the business with cash flow immediately, which is crucial for maintaining operations, especially for companies that experience long invoice payment cycles. This is quite common in industries like trucking, manufacturing, wholesale, and B2B services.

Factoring can be a powerful tool for managing cash flow, but it’s essential to understand that it’s not the same as a loan. Instead of creating a debt you need to repay, factoring involves selling an asset (the invoice).

Tax Documentation Requested by Factoring Companies

Often, factoring companies ask for tax documents during their due diligence process before finalizing a factoring agreement. This is primarily done to verify income, but it also allows them to confirm your business’s financial health and whether you’re compliant with laws and tax guidelines.

The specifics can vary between different factoring companies and may depend on the nature of the business relationship, the amount of funding being sought, and the perceived risk associated with the factoring arrangement. Be prepared to provide:

- Annual Business Tax Returns: These are often the primary documents requested as they provide a comprehensive overview of your business’s financial activities over the past year.

- Quarterly Tax Filings: For businesses that file taxes quarterly, such as GST/HST filings in Canada, these documents can provide more recent data on your company’s financial health and sales activities.

- Notice of Assessment: The Notice of Assessment (NOA) from the CRA for the most recent tax year can also be requested. It confirms that the tax return was processed and highlights any discrepancies that the CRA may have found.

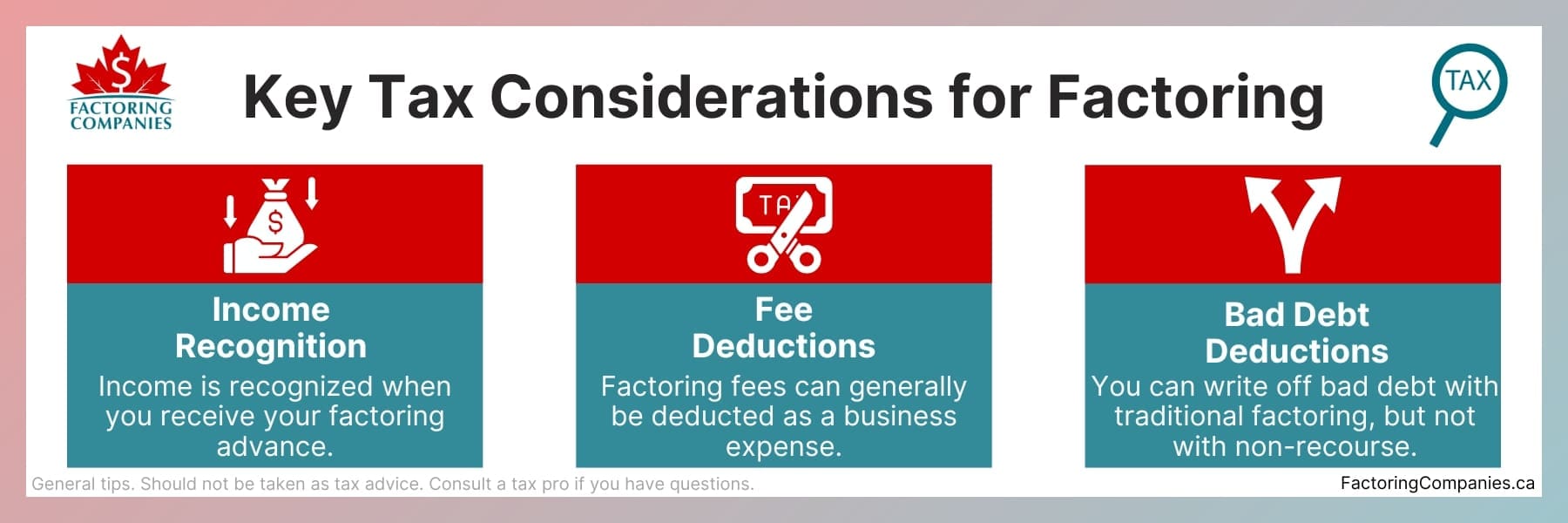

Key Tax Considerations for Factoring Receivables

Factoring impacts three main aspects of business taxes: income recognition, deductions, and bad debt recovery. Let’s take a quick look at what these areas entail.

Income Recognition

Income must be reported in the fiscal period in which you receive it. Your income may shift depending on if and when you factor.

Fee Deductions

Some or all the expenses you accrue through factoring may be considered normal business expenses, which can be deducted from your income to reduce your tax liability.

Bad Debt

Businesses can typically write off uncollectable client debts at tax time. The type of factoring you choose determines whether you can continue to do this or not.

Factoring Receivables and Tax Liability: Understanding the Basics

Now that we’ve covered the background, let’s take a deeper look at how factoring impacts your tax liability.

How Factoring Funds Are Treated for Tax Purposes

When a business factors its receivables, the funds received are treated as immediate income for tax purposes. This is because your company has essentially converted an asset (the invoice) into cash. The conversion triggers the need to recognize the income at the time of the factoring transaction rather than when the invoice would have been paid.

Sales Tax and Invoice Factoring: What Businesses Need to Know

The Goods and Services Tax (GST) or Harmonized Sales Tax (HST), depending on the province, is a critical consideration. When invoices are factored, the responsibility for remitting the sales tax to the CRA does not change. The original business that issued the invoice is still responsible for collecting and remitting the appropriate amount of GST/HST, even if the payment is received through a factor.

This means you need to be diligent in your sales tax handling, ensuring you’re still meeting your tax obligations correctly. It’s essential to keep accurate records of all transactions, including those involving factored invoices, to ensure compliance with tax laws and avoid penalties.

The Significance of the Factoring Company’s Location

The location of the factoring company can have implications, especially when dealing with international factoring transactions. Working with a domestic factoring company typically simplifies the tax implications, as both parties are subject to Canadian tax laws.

However, when the factoring company is located outside Canada, it’s essential to understand the tax treaties and international tax obligations that may apply. For instance, if withholding taxes are involved in the transaction, you need to know how these affect your income recognition and tax liabilities. International transactions may also impact GST/HST obligations, depending on the nature of the goods or services involved and the jurisdictions in question.

International factoring arrangements might also introduce currency exchange risk and additional compliance requirements, further complicating the tax implications. Consult with a tax professional with experience in international business transactions to navigate these complexities effectively, or select a factoring company experienced in Canadian regulations if you aren’t working with a domestic partner.

Navigating Deductions: Factoring Fees and Your Taxes

Navigating deductions related to factoring fees is critical to effectively managing your tax liabilities. Understanding how these fees can be deducted and the best practices for reporting them on your tax filings can lead to significant tax advantages and ensure compliance with CRA regulations.

Can You Deduct Factoring Fees? A Detailed Examination

The short answer is yes. Factoring fees can generally be deducted for tax purposes. “If you incur standby charges, guarantee fees, service fees, or any other similar fees, you may be able to deduct them in full in the year you incur them,” the government notes.

When a business engages in invoice factoring, the fees charged by the factoring company for its services are considered a business expense. These fees typically include a discount rate, which is the percentage of the invoice amount that the factoring company keeps as their fee, and additional charges that may apply for the service provided.

From a tax perspective, these expenses are viewed as the cost of obtaining financing or, more accurately, the cost of accelerating cash flow. Since these costs are directly related to generating business income, they are usually fully tax deductible in the fiscal period in which they are incurred. This deduction can offset the income generated from the factored invoices, thereby reducing the business’ overall tax liability.

Reporting Factoring Fees: Best Practices for Tax Filings

Maintaining accurate and detailed records of factoring transactions is crucial. Here are some best practices for reporting factoring fees on tax filings.

Maintain Detailed Records

Keep detailed records of all factoring transactions, including the original invoices, the agreement with the factoring company, and all fees charged. This documentation will be important for tax reporting and audits if the CRA becomes involved.

Separate Factoring Fees from Other Expenses

On your financial statements and tax filings, it’s a good practice to separate factoring fees from other types of business expenses. This separation provides clarity and facilitates the tax filing process, ensuring that these expenses are properly categorized and deducted.

Use the Correct Tax Forms

Ensure that factoring fees are reported on the correct lines of your tax returns. For most businesses, this will mean including them as part of the business expenses in the T2125 (Statement of Business or Professional Activities) form or the corporate tax return form T2, depending on your business structure.

Consult with a Professional

Tax laws and regulations can be complex and are subject to change. It’s helpful to consult with a tax professional or accountant familiar with business financing and factoring. They can provide guidance specific to your situation, ensuring you maximize your deductions and remain compliant with CRA requirements.

Understand the Timing

Recognize that the timing of deductions may affect your tax liability for a specific year. Since factoring fees are deducted in the fiscal period they are incurred, planning and timing your factoring activities can have tax advantages, especially if you anticipate variations in income from year to year.

Recourse vs. Non-recourse Factoring: Tax Implications Explored

Understanding the tax implications of recourse versus non-recourse factoring is crucial for businesses engaging in these transactions, as the distinction can significantly impact how these transactions are treated for tax purposes.

Tax Differences Between Recourse and Non-recourse Factoring

As mentioned earlier, the type of factoring you choose determines what happens when a client doesn’t pay their invoice and how you’ll handle bad debt at tax time. There are two main types: recourse and non-recourse. We’ll explore how each works below.

Recourse Factoring

In a traditional factoring agreement, also known as recourse factoring, your business retains the risk of non-payment by your client. If your client fails to pay the invoice, the factoring company can demand repayment from you.

For tax purposes, the income recognized from selling receivables under a recourse factoring agreement is treated similarly to other types of income. The primary distinction is that your business may need to account for a liability or reserve for potential chargebacks if there is a significant risk of non-payment that could lead to the factor invoking the recourse clause.

From a tax planning perspective, consider the potential for bad debt deductions if you must repurchase the invoices from the factor due to non-payment. However, because your business maintains the risk of non-payment, the initial transaction (selling the invoice) typically doesn’t involve complex tax considerations beyond recognizing the income and deducting the factoring fees.

Non-Recourse Factoring

In non-recourse factoring, the factoring company assumes the risk of your client’s non-payment. This transfer of risk can have implications for the transaction’s tax treatment. The income received from selling the invoices is still recognized as business income. However, your business does not need to account for potential chargebacks related to those invoices for tax purposes.

The tax advantage of non-recourse factoring comes from the clarity of the transaction. Since the factor cannot seek repayment from the business if the client fails to pay, the company can more definitively recognize the income from the sale of the receivables, minus the factoring fees, without needing to set aside reserves for potential liabilities related to those invoices.

Ensuring Compliance: Reporting and Documentation for Factoring

Ensuring compliance in the context of invoice factoring involves meticulous reporting and documentation practices. This is vital not only for adhering to tax laws but also for maintaining transparent financial records.

Comprehensive Documentation

Factoring companies can often provide you with much, if not all, of the required documentation. It’s often shared via an online portal that your business can access 24/7.

Factoring Agreements

Maintain copies of all factoring agreements, which outline the terms and conditions of your factoring relationship, including fees, recourse provisions, and the handling of uncollectible accounts. This documentation is crucial for understanding the tax implications of each factoring transaction.

Invoice Records

Keep detailed records of all invoices factored, including the date, amount, and client identity. This is important for tracking the income recognized through factoring and reconciling any discrepancies that may arise.

Payment Records

Document the payments received from the factoring company and any fees or charges deducted. These records are essential for accurately reporting income and claiming allowable deductions for factoring fees and other related expenses.

Correspondence

Save any relevant correspondence with the factoring company, especially communications regarding disputed invoices, adjustments, or the exercise of recourse options. This can provide a clear trail of evidence in the event of a tax audit.

Reporting Requirements

It’s also important to be aware of business and tax reporting requirements.

Income Recognition

The proceeds from factoring must be included in business income for the year they are received. Accurately reporting this income on the appropriate tax returns ensures compliance with CRA requirements.

Expense Deductions

Factoring fees and any related charges are generally deductible as business expenses. Your business should report these deductions accurately, categorizing them appropriately in your financial statements and tax filings.

GST/HST Considerations

Ensure that the GST/HST implications of factored invoices are properly managed. Businesses remain responsible for collecting and remitting the GST/HST on sales, even when the receivables are factored. Proper documentation must be maintained to support all GST/HST filings.

Best Practices for Reporting and Documentation

Lastly, let’s quickly review some best practices for taxes and factoring.

Consult with Professionals

Engaging a tax professional or accountant familiar with factoring can help ensure that your reporting and documentation practices comply with CRA regulations and are optimized for your tax situation.

Regular Reviews

Periodically review your factoring documentation and reporting practices to ensure they remain accurate and compliant. This can help identify any issues or discrepancies early on, making it easier to address them proactively.

Leverage Technology

Consider using accounting software that can track and manage factoring transactions effectively. This can streamline the documentation and reporting process, reducing the risk of errors.

Businesses with Tax Problems: Addressing the Challenges

Businesses facing tax problems can find themselves in a precarious position, impacting their cash flow, credibility with lenders, and overall operational stability. Tax issues can stem from unpaid taxes, filing late returns, or inaccuracies in reported income and expenses. When such problems arise, invoice factoring can play a significant role, both in terms of how existing tax issues affect a business’s ability to engage in factoring and how factoring can be leveraged as a tool to mitigate tax-related financial constraints.

Impact of Tax Problems on Factoring

First, let’s dig into how an existing tax problem may impact your ability to factor invoices and terms.

Creditworthiness and Approval

Factoring companies assess the creditworthiness of the invoices being factored, not just the business itself. However, serious tax problems can raise red flags during the vetting process, potentially affecting a business’s ability to secure factoring services. Demonstrated financial instability or ongoing disputes with the CRA can lead factors to perceive a higher risk, possibly resulting in higher fees or outright denial of service.

Lien Positions

Tax authorities, such as the CRA, can place a lien on a business’s assets for unpaid taxes. If the government has a claim on a company’s receivables, this can complicate the factoring agreement, as factoring companies typically require a first-position lien on the invoices they purchase. Businesses will need to address any tax liens to engage in factoring effectively.

How Factoring Can Help Businesses with Tax Problems

Factoring can sometimes help you avoid these types of tax problems and may make it easier for your business to address them if you’re already in a tough spot. There are several ways it does this.

Immediate Cash Flow

Factoring provides immediate cash flow by turning outstanding invoices into liquid assets. This influx of cash can be crucial for businesses struggling to settle tax debts or catch up on late tax filings. By securing funds through factoring, your business can pay off tax liabilities and avoid further penalties and interest accruing on your debt.

Avoiding Additional Debt

Unlike traditional loans, factoring does not add to your company’s debt load. This is particularly beneficial for businesses with tax problems, as taking on additional debt could exacerbate financial strain and negatively impact credit scores. Factoring offers a way to secure funding without the drawbacks associated with new loans.

Budgeting for Future Tax Obligations

By improving cash flow through factoring, your business can budget better for future tax obligations to reduce the risk of recurring tax issues. This proactive financial management can help ensure that taxes are paid on time so you avoid penalties and interest.

Strategic Financial Planning

The cash injection from factoring can provide the breathing room needed for strategic financial planning. To avoid future tax problems, you can use this opportunity to reassess your financial practices and seek advice from tax professionals or financial advisors.

Best Practices for Businesses with Tax Problems Considering Factoring

If you’re already dealing with tax problems, following a few best practices will help improve your odds of getting approved for factoring and make the process smoother.

Transparency

Be upfront with factoring companies about any tax issues. Transparency can help find a factor willing to work with your business despite its financial challenges.

Address Liens

Work with the CRA or other tax authorities to resolve any liens on your receivables before engaging in factoring. This may involve setting up a payment plan or paying off the debt in full.

Professional Advice

Consult with a tax professional to address current tax problems and develop strategies to prevent future issues. They can also advise on how best to use the funds obtained through factoring to settle tax debts.

Use Funds Wisely

Prioritize the use of factoring proceeds to address immediate tax liabilities and invest in strategies that will generate sustainable, long-term financial health for the business.

Get Matched with the Right Funding and Factor for Your Needs

While businesses usually look into factoring to accelerate cash flow, finding the right match becomes much more critical when you plan to use factoring strategically to minimize your tax liabilities. Concerns like the speed of funding, being able to factor as needed, and documentation come into play. We’re happy to match you with a factoring company that excels in these areas, understands your industry, and offers competitive rates. Request a complimentary rate quote to get started.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778