Most businesses enter into contracts with the expectation that everything will proceed as planned. As a result, disputes and discrepancies are among the least discussed challenges in factoring… until they arise. Even with clear terms and strong relationships, factoring involves three parties: your business, your customer, and your factor. At some point, a misunderstanding or issue is likely. In this guide, we’ll walk you through some background, tips for reducing factoring disputes and discrepancies, and how concerns like factoring errors or invoice disputes are handled if they happen.

Common Causes of Factoring Disputes

Factoring disputes can arise at any stage in the process, from invoice creation to collection. Most of the time, they trace back to gaps in communication, documentation, or approval.

Unapproved Customers

Your factor needs to approve each customer before you submit invoices tied to them. If you invoice an unapproved customer, your factor may reject the invoice or decline to advance funds.

Invoice Discrepancies and Errors

Errors in invoices impacting factoring often include incorrect amounts, missing purchase order numbers, or vague descriptions, all of which can trigger disputes. Your customer may delay payment or raise concerns that prevent your factor from collecting.

Lack of Supporting Documentation

Missing proof of delivery, timesheets, or other documents can lead your customer or your factor to question the validity of the invoice.

Duplicate Submissions

Accidentally submitting the same invoice more than once can cause confusion or trigger audit flags with your factor. This usually stems from a lack of internal tracking.

Unclear Terms and Conditions

If your payment terms differ from what your customer expects, or if the invoice doesn’t reflect what was agreed upon, disputes are more likely. This can include misunderstandings around early payment discounts or penalties. Factoring transparency is also a concern. If your customer doesn’t understand where to send payments or why, it can create conflict.

Customer Disputes Over Service or Product Quality

If your customer believes the service was incomplete or the goods were damaged, they may refuse to pay.

Changes to the Original Agreement

If you renegotiate terms with your customer after an invoice is submitted or add additional charges, without proper documentation, your factor may decline to fund or collect.

How Factoring Disputes and Discrepancies Impact Your Business

When a dispute arises in the factoring process, the impact goes beyond a single delayed payment. These issues can ripple across operations, slow down cash flow, damage relationships, and increase administrative strain.

Delayed Access to Funds

Factoring is designed to speed up business cash flow, but if an invoice is under dispute, funding may be withheld until it’s resolved. That can affect your ability to cover payroll, purchase supplies, or take on new work. In addition to slowing cash flow, disputes can halt customer payments, which may cut into your profit if you’ve already received an advance and your factoring contract leverages a variable time-based fee structure.

Strained Customer Relationships

Some disputes originate with your customer. For instance, if they believe the invoice amount is incorrect or the work was incomplete. Involving a third party (your factor) can make the situation feel more formal or adversarial, especially if the customer was unaware the invoice would be factored.

Administrative Backlogs

Resolving a dispute often requires multiple touchpoints, including confirming terms, pulling documentation, and contacting both the customer and the factor. That means more time is spent on paperwork and fewer resources are focused on growth.

Higher Factoring Costs

Disputes that take longer to resolve may incur additional fees. Over time, a history of discrepancies could lead to reduced advance rates, increased reserves, or stricter contract terms.

Credibility and Risk Rating with the Factor

If your business submits frequent corrections, duplicate invoices, or deals with a high number of customer disputes, your factor may begin to view you as higher risk. That can affect future approvals, particularly if you want to grow your factoring line.

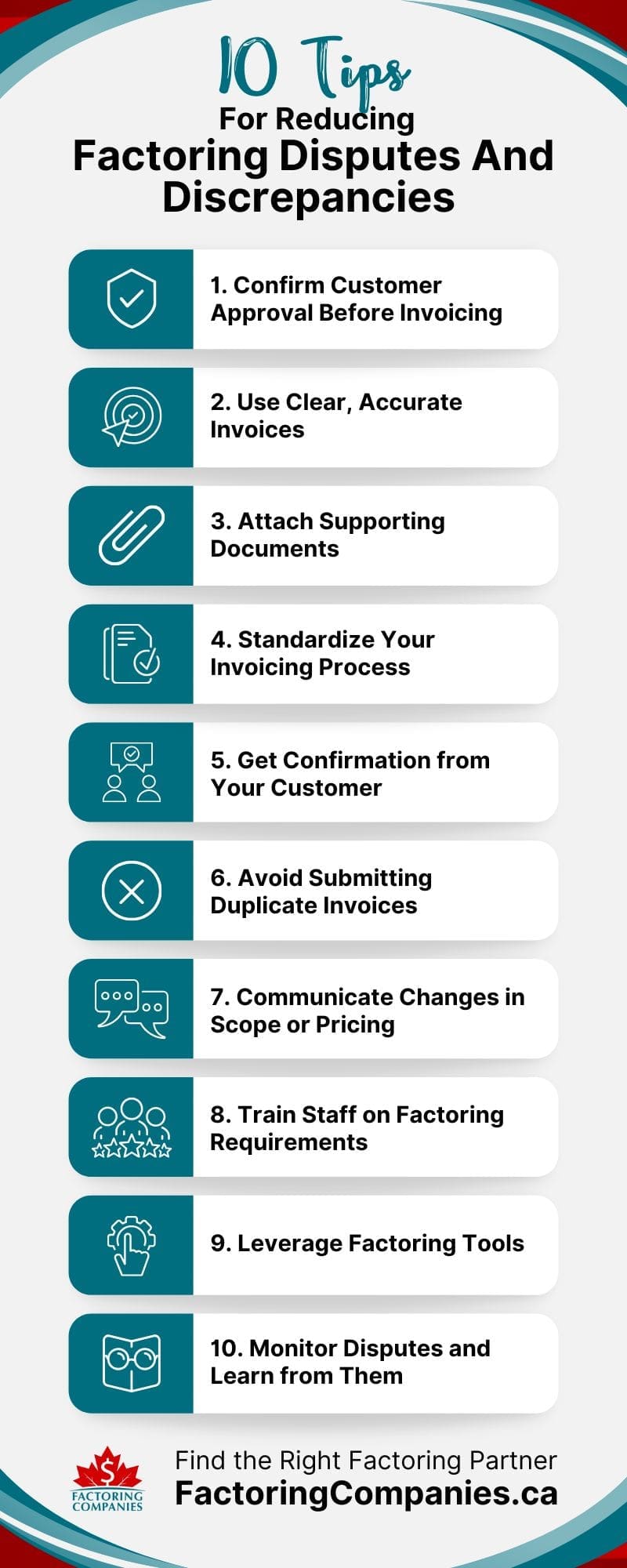

10 Tips for Reducing Factoring Disputes and Discrepancies

Minimizing disputes in factoring is a necessary task, but it does not mean you have to overhaul all of your processes. A few small tweaks can go a long way toward dispute prevention.

1. Confirm Customer Approval Before Invoicing

Your factor will only fund invoices tied to approved customers. Before providing goods or services, confirm that the customer has been reviewed and approved by your factor. If you skip this step, the invoice may be declined entirely.

2. Use Clear, Accurate Invoices

- Use the Customer’s Preferred Format: Some clients have strict internal processes. Matching their format can help prevent rejections or delays.

- Include Specific Service Dates and Line Items: Always itemize what was delivered, when, and at what price.

- Double-Check for Errors: To ensure invoice accuracy, watch for typos, incorrect rates, and outdated terms before submitting the invoice.

3. Attach Supporting Documents

- Signed Delivery Receipts: Provide confirmation that goods or services were received.

- Work Orders or Timecards: Ensure the scope and timeline of services performed can be verified.

- Purchase Orders: Demonstrate that the client formally requested the work or goods.

- Written Approvals or Confirmations: Share emails or other correspondence that support pricing or changes to the original agreement.

- Client Agreements: Clear payment terms in factoring are essential. Include documents that indicate the customer understands the payment timeline and any other important details.

4. Standardize Your Invoicing Process

- Use Templates That Align with Your Factor’s Requirements: Reduce variation and keep invoices compliant.

- Automate Where Possible: Use automated platforms to prevent discrepancies, avoid duplicate entries, and flag missing data. Accounting software, such as Zoho Books, Xero, and FreshBooks, can help here.

- Establish Internal Checks: Add a quick review step before submission to catch issues early.

5. Get Confirmation from Your Customer

- Confirm Invoice Receipt: Try to get a quick note from the client acknowledging the invoice to prevent future delays.

- Verify Accuracy Before Submission: If your customer sees the invoice before the factor does, you reduce the chance of disputes.

6. Avoid Submitting Duplicate Invoices

- Keep Detailed Internal Records: Track what was sent, when, and for how much.

- Limit Access to Invoicing Tools: Fewer hands in the system reduce the risk of overlap.

- Label Correctly When Reissuing: If an invoice needs to be corrected, clearly mark it as a revision to avoid confusion.

7. Communicate Changes in Scope or Pricing

- Get it in Writing: Any change should be documented and acknowledged by the customer.

- Attach Documentation to the Invoice: This helps your factor understand the reason for the update.

- Avoid Verbal Adjustments: Without a paper trail, disputes are harder to resolve.

8. Train Staff on Factoring Requirements

- Educate Teams Involved in Billing or Operations: Make sure everyone understands what the factor expects.

- Hold Regular Refresher Sessions: Check in regularly and immediately after if your factor updates their policies.

- Create a Quick Reference Guide: Make it easy for staff to double-check requirements.

9. Leverage Factoring Tools

- Use Digital Systems to Reduce Human Error: Many platforms now support automated factoring to help your team submit invoices efficiently while reducing mistakes that could trigger disputes.

- Implement Real-Time Tracking Across Teams: Real-time tracking for factoring accuracy allows you to catch issues early, monitor funding progress, and coordinate better between billing and operations.

- Set Up Internal Processes for Invoice Tracking: Knowing the status of each invoice, from submission to payment, helps prevent delays, missed follow-ups, and duplicate entries. Consistent invoice tracking makes your workflow more reliable.

- Prioritize Maintaining Accurate Factoring Records: Detailed, up-to-date records help you respond quickly if a dispute arises. By maintaining accurate factoring records, your team can back up every invoice with the right data, which builds trust with both your customer and your factor.

10. Monitor Disputes and Learn from Them

- Track the Source of Each Issue: Look at which customer, department, or step caused the dispute.

- Identify Repeat Offenders: Some clients may require more clarity or structure.

- Adjust Internal Processes Accordingly: Use past data to reduce future risk.

Steps Involved in Factoring Dispute Resolution

Factoring disputes can feel disruptive, especially when they affect your cash flow. But the process to resolve them is usually straightforward, provided everyone stays responsive and transparent. While each factor may follow slightly different procedures, most resolution processes follow the same general path. Let’s take a quick look at what’s involved in resolving factoring disputes efficiently.

1. Notification of the Dispute

In many cases, the factor discovers the problem during invoice validation, either because the customer pushes back or key documents are missing. They will notify you and may place the invoice on hold.

2. Internal Review of the Invoice

You’ll need to review the invoice, check supporting documentation, and confirm whether the information submitted was accurate and complete.

3. Communication with the Customer

Depending on your factoring agreement, either your team or the factor will reach out to the customer to clarify the concern. This may involve providing missing documents, correcting details, or resolving misunderstandings around the scope of work.

4. Submission of Corrected or Supporting Information

If the dispute stems from missing or unclear documentation, you’ll submit signed delivery receipts, revised invoices, purchase orders, or written approvals to help verify the transaction.

5. Decision From the Factor

After reviewing the situation, the factor will either reinstate the invoice for collection, request further clarification, or return the invoice to you. If you’ve already received an advance on the invoice, you’ll generally submit a new invoice in its place, though each factor may have its own process for this.

6. Ongoing Monitoring

If multiple disputes occur over time, your factor may begin flagging similar submissions for extra review. This does not necessarily affect your factor-client relationship, but should prompt a review of your internal processes.

Reduce Disputes by Starting with the Right Factoring Company

When you work with the right factoring company, discrepancies and disputes are typically just a blip on your radar. You learn about them, address them, collaborate as needed, and move on. We can help you find this type of partnership by matching you with an experienced factoring company. To take the first step, request a free quote.

FAQs on Preventing Factoring Discrepancies and Disputes

What is the financial impact of factoring disputes?

Factoring disputes can delay funding, reduce cash flow reliability, and lead to increased administrative costs. If disputes become frequent, your factor may lower advance rates, increase reserve holds, or adjust your terms. Over time, this can affect budgeting, payroll, and the ability to reinvest in business operations.

What are some mediation strategies for factoring disputes?

Factoring mediation often begins with gathering supporting documentation, reviewing communications, and clarifying the terms of the transaction. Open dialogue between your business, the customer, and the factor can help prevent escalation. Clear records and a cooperative approach are key strategies for successful resolution through factoring mediation.

What are my contractual obligations regarding disputes in factoring?

Factoring agreements typically require your business to submit accurate invoices, notify the factor of any potential issues, and support dispute resolution efforts. Contract clarity is essential, including knowing what you’re responsible for and under what conditions, ensures smoother communication and limits delays when disputes arise.

What happens if my customer disputes an invoice with a factoring company?

If a customer disputes a factored invoice, the factor will place the invoice on hold and notify your business. You may be asked to provide documentation or work directly with the customer to resolve the issue. Funding may be delayed or reversed until the matter is resolved.

Who is responsible if a customer doesn’t pay the factoring company?

Responsibility depends on the type of factoring agreement. With recourse factoring, your business must repay the factor if the customer fails to pay. With non-recourse factoring, the factor absorbs the risk unless the dispute involves service quality, fraud, or a contract violation.

How do I avoid disputes when using invoice factoring?

To avoid disputes, ensure invoices are accurate, approved by the customer, and supported with clear documentation. Use standardized billing processes and real-time tools to catch errors early. Strong communication with both your customer and your factor also helps reduce confusion and delays.

What documentation do I need to prevent factoring disputes?

Key documents include signed delivery receipts, work orders, timecards, purchase orders, and written confirmations of scope or pricing. These records verify that goods or services were delivered as agreed and can quickly resolve questions from your customer or factor if a dispute arises.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778