If your business works with Québec’s provincial government, knowing when to expect payment is essential for managing cash flow. While government contracts can offer stable, long-term opportunities, payment processes for government contractors vary across Canadian provinces, and Québec follows its own laws and procedures. This guide explains the province’s rules, typical timelines, and what you can do to keep payments moving.

Typical Payment Terms for Government Contractors in Québec

Québec’s public procurement is governed by the Act Respecting Contracting by Public Bodies (C-65.1), which outlines how ministries, agencies, and other public bodies award, manage, and pay for contracts. While the Act defines the contracting framework, payment timelines depend on the type of public body you work with.

- 30-Day Standard for Most Ministries and Agencies: Many provincial ministries and core government bodies issue payment within 30 days of receiving your invoice and confirming acceptance of goods or services.

- 45-Day Standard for Certain Public Sector Organizations: Some broader public sector entities, such as those in health, education, or municipal sectors, follow a 45-day payment cycle from the later of invoice receipt or service acceptance.

- Special Rules for Construction Projects: Under the Act to Facilitate Payment to Contractors, some construction contracts have legislated prompt payment timelines and adjudication options to resolve disputes quickly.

Interest on overdue payments is not automatically applied unless covered by prompt payment legislation. To enforce interest charges, your contract must specify the rate and conditions. Because payment rules vary by organization and contract type, confirming the applicable terms before work begins is essential.

Common Reasons for Québec Government Contract Payment Delays

Even with clear payment timelines, processing can take longer than expected in Québec due to its layered regulations and multiple oversight bodies.

Complex Oversight Requirements

- Multiple Review Stages: Contracts are subject to the Act Respecting Contracting by Public Bodies (C-65.1) and oversight by the Autorité des marchés publics (AMP), which can add extra approval steps before payment is released.

- Integrity Verification: Measures designed to ensure ethical contracting can involve additional checks, slowing payment processing.

Sector-Specific Payment Cycles

- Different Timelines by Public Body: While ministries and core agencies often pay within 30 days, certain broader public sector organizations operate on 45-day cycles, which can delay cash flow.

- Separate Rules for Construction: Contracts covered by the Act to Facilitate Payment to Contractors follow prompt payment timelines but also require specific documentation, which can extend processing if not prepared correctly.

Documentation or Submission Issues

- Mismatched Information: Invoices that do not match purchase orders or service records may need manual review.

- Missing Proof of Completion: Lack of acceptance certificates, delivery confirmations, or approved change orders can hold up payment.

Decentralized Approval Processes

- Multiple Points of Authorization: Payment release may require sign-off from several departments or agencies, especially on large projects.

- Batch Processing Schedules: Some entities process payments only on fixed dates, meaning a missed cycle could add extra weeks.

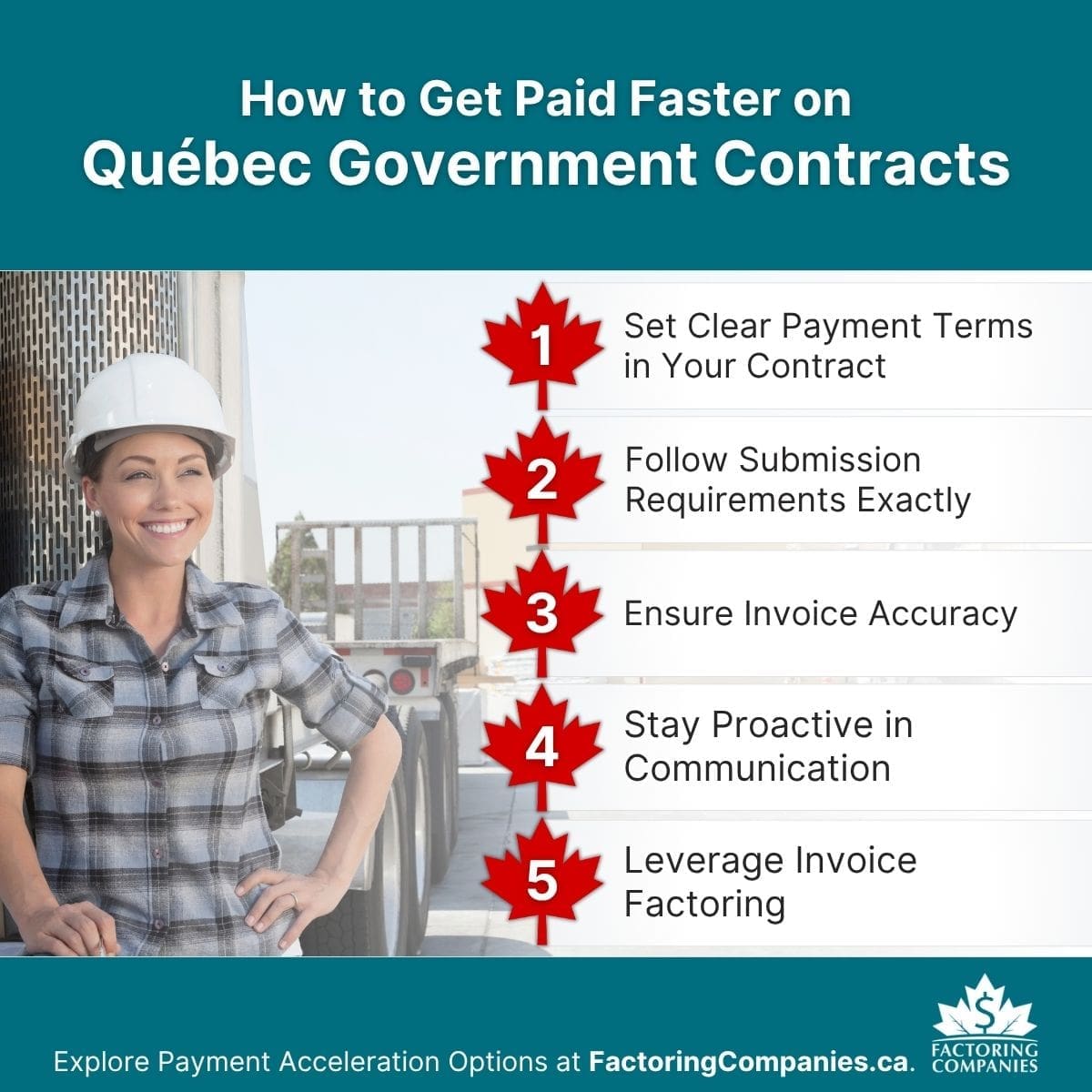

How to Get Paid Faster on Government Contracts in Québec

You cannot control every stage of Québec’s payment process, but you can take steps to help your invoices move through approvals without delays.

Set Clear Payment Terms in Your Contract

- Confirm the Timeline: Verify whether your contract is subject to the thirty-day or forty-five-day standard, or if prompt payment rules for construction apply.

- Include Interest Clauses: If you want the ability to charge interest on overdue payments, clearly define the rate and conditions.

- Clarify the Payment Trigger: Ensure it is clear whether payment terms start from invoice receipt or formal acceptance of goods or services.

Follow Submission Requirements Exactly

- Send to the Right Contact: Confirm the correct department and contact person for invoice submission.

- Use the Correct Method: Some public bodies require invoices through electronic portals, while others use email or paper submissions.

- Know Required Documents: Identify any acceptance certificates, change orders, or proof of delivery needed for payment approval.

Ensure Invoice Accuracy

- Match Contract Details: Ensure all descriptions, quantities, and prices align with the contract or purchase order.

- Attach All Supporting Proof: Include any required sign-off forms or completion certificates.

- Review Before Sending: Errors can reset the approval process and push payment into the next cycle.

Stay Proactive in Communication

- Confirm Receipt of Invoices: Make sure your invoice has been logged into the payment system.

- Follow Up Strategically: If payment is approaching its due date, request a status update.

- Resolve Issues Quickly: Address any discrepancies or missing documents immediately.

Factoring Invoices for Québec Government Contractors

Public bodies in Québec can take 30 to 45 days, or longer if additional approvals are needed, even if every policy is followed. Leveraging specialised factoring for government contractors allows you to turn approved invoices into cash right away, so it’s easier to cover payroll, purchase materials, and take on new contracts without waiting for the government’s payment cycle to finish.

How Factoring Works for Government Contractors in Québec

When you use accounts receivable factoring, you sell your approved invoice to a factoring company. The factor advances most of the value, often within one to two business days, and then collects payment from the public body when it is due. Since the Government of Québec and its agencies are generally considered reliable payers, factoring approvals are usually fast and easy.

Benefits of Factoring for Québec Contractors

- Faster Access to Funds: Receive working capital quickly without taking on debt.

- Straightforward Approval Process: Factors assess the government’s creditworthiness, which can make it easier for newer businesses and those without strong credit to qualify.

- Flexible Funding Options: Factor a single invoice using spot factoring or establish ongoing financing for multiple projects.

- Support for Business Growth: Take on more contracts and keep projects moving without cash flow interruption.

Types of Québec Government Contractors That Leverage Factoring

Many industries can leverage invoice factoring to accelerate payments from their government contracts in Québec. We’ll explore a few below.

- Construction and Infrastructure Firms: Highway repairs, public building projects, and municipal upgrades often lead companies to use tailored factoring for construction companies to maintain steady cash flow during long payment cycles.

- Transportation and Logistics Providers: Delivering goods, equipment, or supplies for government departments can tie up resources. In these cases, factoring for trucking companies is a practical funding solution.

- Healthcare Staffing Agencies and Medical Suppliers: Supplying hospitals, clinics, and long-term care facilities often involves waiting weeks for payment, so healthcare factoring solutions help keep payroll and inventory covered.

- Facilities Management and Janitorial Services: Cleaning, maintenance, and landscaping for public buildings can benefit from factoring for janitorial service companies to bridge the gap between service delivery and payment.

- Security and Protective Services: Guarding provincial offices, courthouses, and public events requires steady payroll funding, which is why tailored factoring for security guard companies is a common choice.

- Technology and IT Service Providers: Supplying software, hardware, or technical support to public agencies can create cash flow gaps that factoring services for technology companies help fill.

- Consulting and Professional Services Firms: Engineers, planners, and project managers engaged on public contracts often turn to factoring programs for consultants to maintain smooth operations while awaiting payment.

Streamline Your Québec Government Contractor Payments with Factoring

If waiting 30 to 45 days or more for payment is slowing your projects or limiting growth, factoring can give you most of your invoice value within days. With quick approvals and flexible terms, it is a straightforward way to keep your operations funded. To get started, request a free rate quote.

Editor’s Note: Please note that every effort has been made to ensure the accuracy of the information provided, and links to policies are included for your reference. However, contract terms are set by individual jurisdictions and are subject to change. Be sure to check with relevant regulatory bodies and your contract as needed.

FAQs on Québec Government Contract Payment Terms

Are late payments from the Québec government subject to interest?

Interest is not applied automatically unless covered by prompt payment rules for construction contracts. Otherwise, your contract must specify the rate and conditions.

How can I avoid payment delays on public contracts in Québec?

Follow the public body’s submission process exactly, ensure your invoice matches contract details, and include all required documentation, such as acceptance certificates.

Can I get paid faster if my Québec contractor invoice is delayed?

Yes. Factoring allows you to receive most of your invoice value within days while the public body completes its payment process.

Does Québec have prompt payment laws for government contractors?

Yes, but only for certain public construction projects under the Act to Facilitate Payment to Contractors, which sets deadlines and dispute resolution procedures.

How long does it take to get paid on a government contract in Québec?

Depending on the public body, payment is typically issued within 30 or 45 days from the later of invoice receipt or service acceptance, but delays can occur.

How can I find a factoring company that serves Québec government contractors?

Factoring Companies Canada can match you with a factoring company that works with Québec government contractors. Tell us a little about your business to get started.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778