It’s no secret that debt has become a significant concern for Canadian businesses. A typical small business now owes $37,000, a 15 percent year-on-year increase per Equifax Canada. Businesses have also pivoted from traditional bank loans to high-interest options. Whereas outstanding loan balances have dropped 2.4 percent, balances on credit lines are up 11 percent, and credit cards are up 15 percent, Financial Post reports.

But it doesn’t have to be this way. Businesses can obtain debt-free funding through invoice factoring instead. We’ll walk you through how it works and some benefits of opting for debt-free business financing on this page.

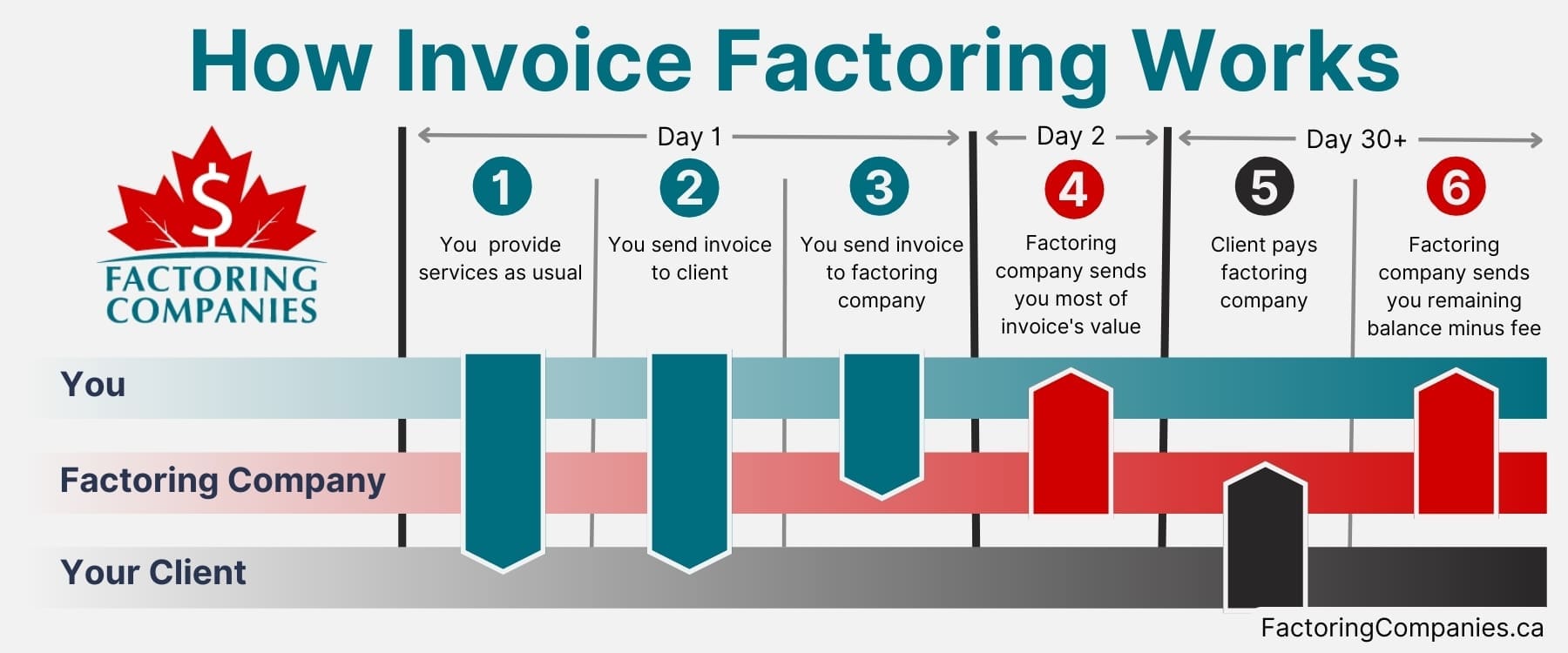

How Invoice Factoring Works

Invoice factoring is not a loan. Instead of borrowing money, you sell your unpaid B2B invoices to a factoring company at a discount. The factoring company sends you up to 95 percent of the invoice’s value right away. When your client pays, the factoring company sends you the remaining sum minus a small factoring fee. There’s nothing for you to pay back.

6 Undeniable Benefits of Debt-Free Funding with Factoring

Now that we’ve covered the basics, let’s take a look at how leveraging debt-free funding benefits your business.

1. You Get Debt-Free Funding without Giving Up Control of Your Business

Aside from factoring and grants, venture capital is the only common funding method that doesn’t create debt for your business. The catch is that you give up equity and some control of your company to secure venture capital. Factoring doesn’t have similar requirements, so you retain total control.

2. You’re Less Likely to Get Caught in a Debt Trap

One of the reasons why it’s concerning that business credit card use is up is that it can quickly become challenging to pay down. Businesses often find themselves making payments that cover little more than interest and fees each month while never really paying down the balance. Invoice factoring doesn’t work the same way. You’re simply accelerating payments your business has already earned.

3. Your Debt Ratio Stays Lower

Debt ratios are an indicator of a business’s financial health and are often used to gauge the risk involved in investing in a business.

Your debt ratio is determined by dividing your total debt by your total assets. A debt ratio greater than 1.0 or 100 percent signifies your business has more debt than assets. A debt ratio under 1.0 or 100 percent signifies your business has more assets than debt.

For instance, if you run a “typical” small business with $37,000 in debts and $100,000 in assets, your debt ratio is 0.37 or 37 percent.

A “good” debt ratio varies by industry, though anything under 0.4 is generally acceptable. A debt ratio over 0.6 is often considered “too risky,” which may make it more difficult for a business to borrow money, as Investopedia reports.

Because factoring doesn’t increase your debt, your debt ratio stays lower. This can make it easier for your business to qualify for traditional loans with lower interest rates if you wish to apply later.

4. Your Ability to Repay Debt Improves

Rather than increasing your debt, factoring accelerates your cash flow. This makes it easier to keep up with payments on existing debts, avoid late fees, and even cash in on early payment discounts if offered.

5. Your Credit May Improve

Two primary considerations in your business credit score are the timeliness of your payments and your credit utilization. For instance, your PAYDEX Score from Dun & Bradstreet ranges from 0 to 100, as Forbes notes. Paying your bills early is the only way to earn above an 80. On-time payments are not enough. Invoice factoring can facilitate this and keep your credit utilization lower.

6. You May Save Money in Other Areas

Many business owners don’t realize this, but just about anyone can check your business credit score. It’s used to determine the risk when lending to you and the risk of doing business with you.

- Lenders: A prospective lender may use your credit score to determine whether you’re approved and what your terms will be.

- Insurance Companies: An insurance company may use your score to determine whether they’ll provide you with coverage and what your premium will be.

- Landlords: Prospective landlords usually run credit checks to determine if you qualify for a lease and what your fees are.

- Suppliers: Your vendors may check your credit before agreeing to issue trade credit and determine how much they’ll extend.

- Customers: Sometimes, customers will check your credit as a way to assess risk before signing up for a long-term engagement with your company.

Having a strong credit score can help you in all these situations and may even save you money. Because factoring can help boost your score, it may also be instrumental in these areas.

The Benefits of Factoring Extend Beyond Debt-Free Funding

The benefits covered above only relate to the debt-free nature of factoring. It benefits your business in lots of other ways, too.

- Easy Approval: Most businesses with B2B invoices are approved, even if they don’t have strong credit or are newer.

- Fast Payouts: Payments are usually deposited via ACH, so they reach your bank account in about two business days. However, some factoring companies can provide same-day payments.

- Flexibility: You choose when to factor and which invoices to factor.

- Scalability: Your funding naturally scales with your business as it grows.

- Back-Office Support: Your factoring company collects on invoices for you, so you’re free from chasing invoices. You may also be able to tap into other services, such as invoice preparation.

- Industry-Specific Perks: If you partner with a factoring company that specializes in your industry, you may also qualify for additional services and benefits. For instance, freight factoring companies often offer fuel discount cards, fuel advances, tire discount programs, and access to load boards.

Request a Complimentary Factoring Rate Quote

If the idea of debt-free business funding appeals to you and your business has unpaid B2B invoices, invoice factoring may be your ideal solution. We’re happy to match you with a factoring company that specializes in your industry and offers competitive rates. Request a complimentary factoring quote to get started.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778