Finding the right operating and overhead cost reduction strategies is everything to small businesses today. As costs continue to climb, it’s not only a matter of profitability but a major determining factor in whether you can continue to operate and grow. Invoice factoring, often seen as a gap-filler or way to cover expenses, can play a crucial role in keeping operating and overhead costs low. We’ll explore the mechanics of this below.

Overhead Costs vs. Operating Expenses

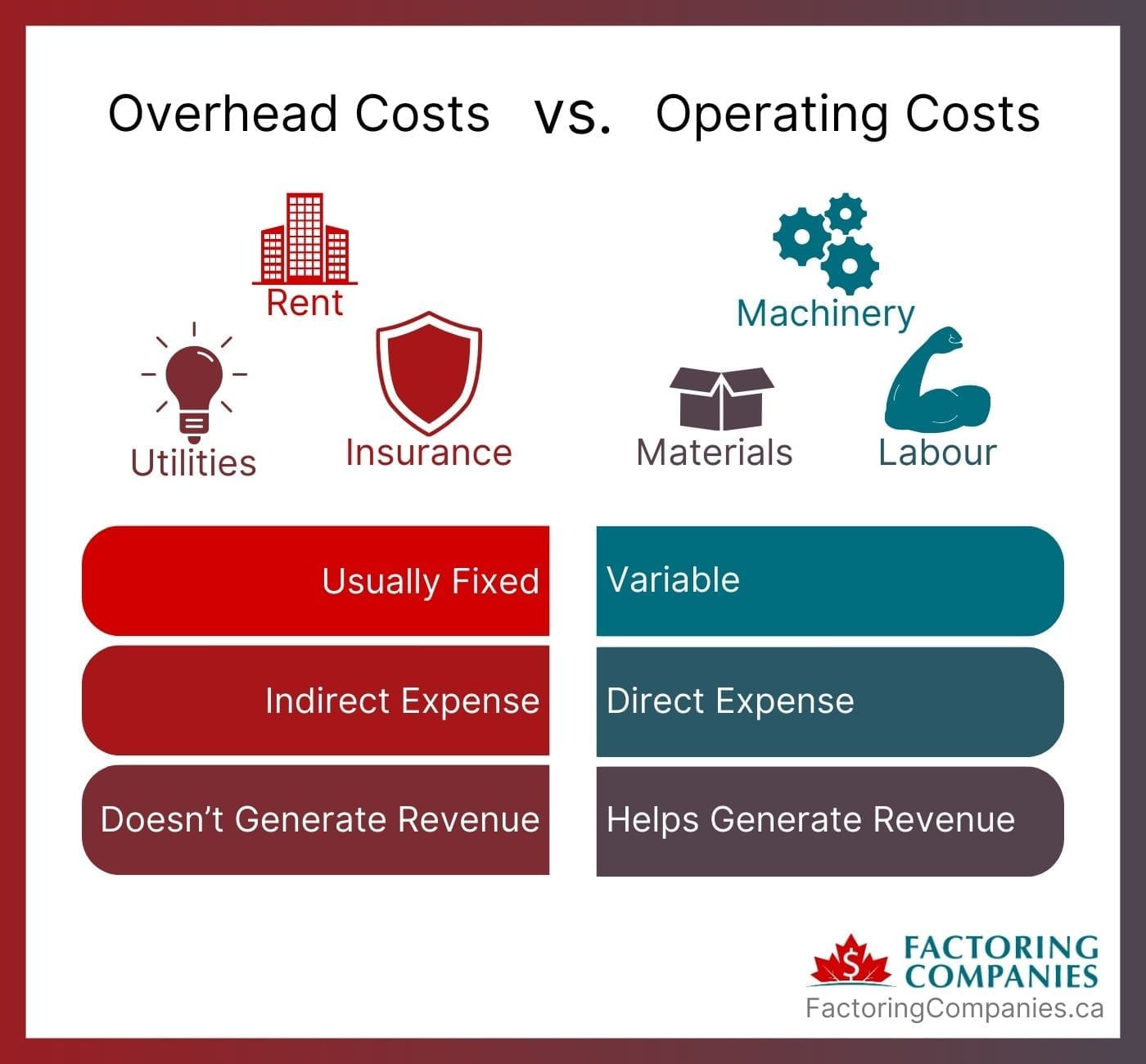

First, let’s take a quick look at overhead and operating costs and how they impact your business’s cash flow and profitability.

Overhead Costs

Overhead costs are expenses your business must pay, even if it doesn’t produce anything at all. Most of these expenses are fixed, meaning they don’t change from one month to the next. Rent, insurance, and depreciation are prime examples. Non-production salaries, such as human resources, also fit into this bracket. Utilities not tied to the production of goods or services are considered overhead costs, too. If your business takes out a loan, any interest or fees fit into overhead costs as well.

Effective overhead management is essential because any reductions your company makes in this area replicate. You’re not merely saving once, but every month regardless of how much your business produces.

Operating Expenses

Operating expenses, also referred to as direct costs, are those that your business incurs while producing, selling, or marketing goods or services. They are variable, meaning they may go up or down depending on production. Materials and labour are two of the biggest operating expenses for most businesses. Costs associated with equipment used to produce goods or services also fit into this bracket.

Managing operating expenses effectively also adds up, as your savings often multiply as your production increases.

5 Ways Invoice Factoring Reduces Operating & Overhead Costs

Invoice factoring can play a crucial role in optimizing business finances by helping you reduce operating and overhead expenses.

1. It Creates Predictability

Three in five small business owners say managing cash flow is a major challenge, Equifax Canada surveys show. This is because cash inflows like invoices are often slow, while overhead and operating costs are high, leaving little room for issues or additional delays. Invoice factoring takes the guesswork out of determining when your business will get paid because you’re paid as soon as you submit your invoice.

Cash Flow Forecasting is Easier

Sound financial management for SMEs is dependent on accurate cash flow forecasting. Because factoring makes it easy to predict your inflows, it’s easier to budget and spend with confidence.

You Can Commit to Longer Leases or Buy

A major component of SME financial planning is ensuring your business has a cost-effective workspace. Factoring stabilizes cash flow, so it’s easier to see how much you can afford. You may also be able to commit to a longer lease to save cash or even afford to buy space.

You’re Less Likely to Have Expensive Knee-Jerk Reactions

Businesses that unexpectedly run short of cash often turn to expensive forms of emergency funding. Because factoring makes cash flow more predictable, you’ll likely catch a potential shortfall before it becomes problematic. That way, you can factor additional invoices as needed or explore other funding sources when you’re unrushed and can make an informed decision.

2. You May Pay Less to Vendors

Half of all Canadian small business owners say their greatest concern is the cost of raw goods, Equifax surveys show. Factoring can help you keep these expenses in check.

You Can Place Bulk Orders

Factoring provides you with a lump sum of cash that you can put toward supplies. This can help you score bulk discounts due to order volume.

You Have Negotiating Power

Vendors are dealing with many of the same issues you are. The idea of having cash in hand now is a huge negotiation point. Ask your vendors about other discounts, such as early or pre-payment discounts, or see if you can negotiate better rates.

3. Employee Expenses Reduce

Around a third of Canadian small businesses say staffing costs are their primary concern. Factoring can help you keep these costs low, too.

Back-Office Support is Included

Because your client pays the factoring company, factoring services for businesses include collections services by default, potentially freeing up hundreds of hours per year for your business. Invoice management solutions are sometimes included, too. For instance, many factoring companies offer invoice preparation services.

4. You Can Avoid Penalties and Late Fees

By enhancing business liquidity, factoring puts you in a better position to keep up with your own payments. That means you’re less likely to experience penalties and late fees from taxes and vendors.

5. Your Business Credit May Improve

Maintaining strong business credit is essential for a variety of reasons.

- Lenders check your credit to determine approval and terms.

- Insurance companies leverage your score to assess risk and set rates.

- Landlords check your credit when deciding whether to rent to you and set your rates.

- Customers may use your score to gauge the risk of business failure, especially when committing to your business in a long-term contract.

- Suppliers check credit when deciding whether to invoice you after delivery and to determine order limits.

Your credit score is largely influenced by how you handle payments and debt. Invoice factoring addresses both areas, so it can help protect a good business credit score and help you improve yours if it’s lacking.

Factoring Does Not Create Debt

Factoring is one of the few business cash flow improvement tools that doesn’t create debt your business has to pay off. The balance is cleared when your customer pays the invoice. That means your debt ratio stays lower, and your score will be higher.

Your Ability to Pay Existing Debts May Improve

Recent economic conditions have caused small business debt to climb almost 15 percent year-over-year, according to Equifax. A typical small business now owes around $40,000. Factoring may make it easier to keep up with these payments and get balances paid off quicker, which keeps more money in your pocket and boosts your business credit.

Your Ability to Make Timely Vendor Payments May Improve

D&B PAYDEX scores range from zero to 100. The only way to score over 80 is to make early payments, as Forbes reports. Business cash flow improvement through factoring may make this easier, so your credit score climbs.

Maximize The Benefits with Cost-Effective Factoring Methods

You can improve your savings even more by applying a few best practices while factoring.

Consider Spot Factoring

You don’t have to factor all your invoices. If you only need to factor occasionally, consider spot factoring to minimize your expenses.

Explore Volume Discounts

If you think you’ll factor many invoices or have a lot of cash tied up in your invoices, ask your factoring company if you qualify for volume discounts.

Work with a Factoring Company That Offers Competitive Rates

Pricing varies from one factoring company to the next. While it’s generally not ideal to go with the least expensive option, as it can impact the quality of your service and how customers are treated during the collections process, ensuring you’re receiving a competitive rate is worthwhile.

Get Started with These Invoice Factoring Overhead Management Strategies

If you’d like to take advantage of these cost-saving strategies, we’re happy to match you with a factoring company specializing in your industry and offering competitive rates. To learn more or get started, request a complimentary rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778