If you’re comparing bridge financing with invoice factoring and other bridge funding alternatives, there’s no shortage of choices. However, each one works differently, and the right fit depends on your needs. In this guide, we’ll review common bridge financing options for small businesses and explore factoring in depth, so it’s easy to select the best choice for your business.

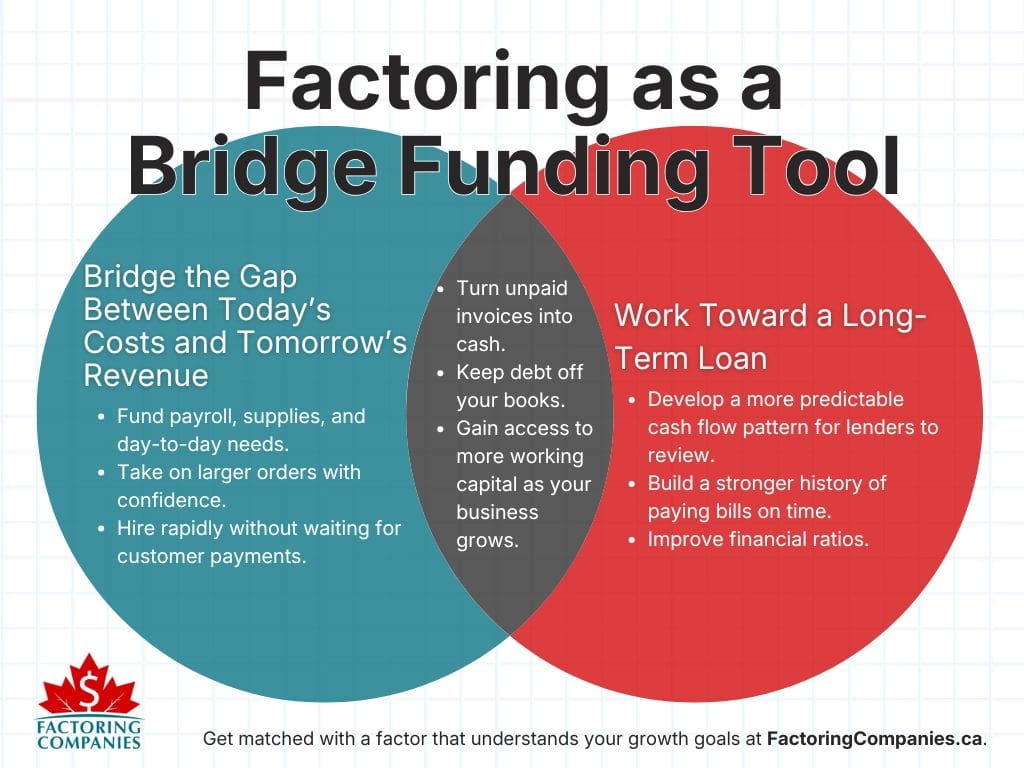

Bridge Funding Serves Two Core Purposes When Your Business is Growing

When your business enters a growth phase, the timing of cash flow often becomes more challenging than the expansion itself. Bridge funding helps you move through that stage without slowing down your plans, delaying projects, or turning away new opportunities.

Cover the Gap Between Today’s Costs and Tomorrow’s Revenue

Growth usually requires you to spend money before you earn it. You may need to bring on more staff, purchase materials, invest in equipment, or take on larger orders. Those costs start immediately, but the revenue from those efforts may not arrive for 30 to 90 days. Bridge funding gives you a way to keep everything moving during that period. It lets you manage your obligations and take on work.

Hold Steady While Working Toward a Long-Term Loan

Many owners plan to secure a term loan or line of credit once the expansion begins to generate steady revenue. Banks and credit unions typically want to see consistent cash flow, strong payment patterns, and predictable receivables before they approve that type of financing. Bridge funding supports you during the months leading up to that point. Keeping your working capital stable and your vendor payments on time helps you build the financial foundation lenders look for.

There Are Many Bridge Financing Tools and Bridge Financing Alternatives

Before we get into securing bridge financing with invoice factoring, let’s take a look at the broader bridge funding landscape, so it’s easier to see where factoring fits in and make the right choice for your business.

Short-Term Loans

Lenders sometimes offer short-term loans that cover a specific need until a longer-term loan is finalized. These loans usually have higher rates because of the short timeline and the speed of approval.

Operating Lines of Credit

An operating line gives you access to revolving credit that you can draw from and pay back as needed. When used during business expansion, it covers short-term gaps until the business reaches a point where the line can be refinanced or expanded.

Merchant Cash Advances

A merchant cash advance (MCA) gives you a lump sum upfront and pulls repayment from your daily or weekly sales. It is fast, but the cost is usually high, so owners use it only when they are confident the need is temporary.

Private Lender Bridge Loans

Private lenders may offer short-term loans for businesses that need funding before a larger loan or investment arrives. These products are flexible but generally come with higher costs.

Equity-Based Bridge Rounds

Some businesses raise a small amount of equity from investors to cover expenses until a larger funding round closes. This is common in early-stage or rapidly scaling environments.

Purchase Order Financing

This covers the cost of fulfilling a large order when you do not have the working capital on hand. It bridges the time between receiving the order and receiving payment.

Inventory Financing

When growth requires stocking more inventory, a lender may provide short-term funding secured by that inventory until it sells.

Contract Financing

If you secure a large new contract but payment is delayed, contract financing helps cover the early costs tied to that contract until the revenue starts flowing.

Invoice Factoring Can Serve as Short-Term Bridge Financing for Businesses, Too

Invoice factoring, sometimes referred to as accounts receivable factoring, is different than any of the solutions we’ve covered so far because it’s not a loan and it does not require you to give up any equity in your company, either.

Turn Your Unpaid B2B Invoices into Cash Right Away

As we’ve touched on, slow customer payments are one of the main reasons rapid growth is difficult for businesses. Net-30 payment terms are standard in most industries, but others operate on net-60 or net-90 terms. This is simply too long as it is, but adding to the challenge, nearly half of all B2B invoices are paid late, according to Atradius. Invoice factoring lets you eliminate these waits by selling your invoice to a third party, known as a factoring company or factor, at a slight discount.

In short, once you’re set up with a factor, you simply bill your clients like you normally would, then submit a copy of that invoice to your factor. They’ll then advance you most of the invoice’s value and manage the collections process for that invoice. When your customer pays the factoring company, you receive the remaining sum, minus a small factoring fee.

Your customers stay happy because you can still offer them breathing room on payments, and your business has the capital it requires to operate and grow.

This unique setup also means that factoring is much easier to qualify for than other funding solutions. Factoring companies care more about the payment histories of your customers than yours. That means you can get approved even if your business hasn’t been in operation long or you don’t have strong credit yet.

Keep Debt Off Your Books

Factoring accelerates payment on money you’ve already earned. The balance is cleared once your customer pays. This means there’s no debt added to your balance sheet, and no interest charges to pay off.

Gain Access to More Working Capital as Your Business Expands

Sometimes businesses grow so rapidly that owners find themselves reapplying soon after receiving funding. Not only is it challenging to get approved in these situations, but it can leave you weighed down with debt for years. With factoring, however, your access to capital is directly tied to your invoices. As your volume or invoice value grows, your funding naturally scales with it—no need to reapply.

Factoring May Help You Qualify for a Term Loan Down the Road

If your long-term financial plan includes securing a term loan or line of credit, factoring can support that goal. It strengthens the financial signals lenders look for and helps you build a more stable foundation during the early stages of growth.

Develop a More Predictable Cash Flow Pattern for Lenders to Review

Term lenders place significant weight on consistency. They want to see that your business can maintain healthy cash flow from month to month. Factoring helps by smoothing out the timing of your revenue. Even if your customers take weeks or months to pay, your cash inflows remain steady. This creates a clear track record that lenders can evaluate when deciding how to support your business.

Build a Stronger History of Paying Bills on Time

On-time payments are one of the main indicators lenders review when assessing risk. When your business has access to faster, more reliable cash through factoring, it becomes easier to keep vendor accounts current and avoid the backlogs that often occur during expansion. Over time, that pattern demonstrates that your business handles its obligations responsibly, which can strengthen your credit score and position when you apply for a term loan.

Improve Financial Ratios

Because factoring does not add debt to your balance sheet, it helps preserve financial ratios that lenders commonly evaluate. Measures related to working capital, liabilities, and liquidity remain easier to manage when you are not taking on new debt to cover short-term needs. This gives lenders a clearer view of your underlying performance and may help you qualify for more favourable terms once your expansion stabilizes.

Keep Pace with Expansion Before Revenue Catches Up

Expanding your business often means operating at a faster pace than your incoming revenue allows. You may have strong sales, new contracts, or rising demand, but the cash tied to those invoices has not arrived yet. Factoring gives you access to that revenue sooner, so you can maintain momentum during this stage of growth.

Fund Payroll, Supplies, and Day-to-Day Needs

Expansion usually increases day-to-day expenses immediately. You might need additional team members, higher inventory levels, or more frequent supply orders to keep up with demand. Factoring helps by giving you steady access to working capital based on the invoices you have already issued. This allows you to cover essential costs without slowing production or delaying services.

Take on Larger Orders or Contracts with Confidence

A new contract or major client often requires upfront spending. You may need to purchase materials, ramp up staffing, or commit to delivery timelines that begin before you receive any payments. Factoring bridges this timing gap by converting your receivables into cash right away. This makes it easier to accept new opportunities without straining your resources.

Hire Rapidly without Waiting for Customer Payments

Staffing needs can grow quickly during expansion. Payroll is one of the most time-sensitive obligations, and even a short delay in incoming payments can create pressure. By accelerating access to your receivables, factoring ensures you have the funds required to maintain your team and continue onboarding new employees as demand increases.

Key Signs Factoring Makes Sense as Your Bridge Tool

Factoring is useful during expansion, but it is not the right fit for every situation. If any of the following apply to you, it’s worth exploring the fit more.

You Expect Revenue Soon, But Need Cash Now

Factoring works best when the work is already completed and payment is on the way, but delayed. If your customers consistently take 30 to 90 days to pay, and you often feel the strain during those waiting periods, factoring can fill that timing gap. It gives you access to that incoming revenue at the moment you need it most.

You Want to Strengthen Your Position Before Applying for a Loan

As mentioned earlier, factoring supports the financial signals lenders evaluate. If your goal is to apply for a term loan or expand an operating line once your growth stabilizes, factoring can help you get there. It gives you steady cash flow, keeps accounts current, and preserves clean financial ratios while you work toward meeting lender requirements.

You Prefer a Flexible Option without Adding Debt

Some owners prefer to avoid taking on debt during expansion, especially when they are unsure how quickly new revenue will stabilize. Because factoring accelerates the payment of earned revenue, it does not add liabilities or interest charges. If you want short-term support without increasing your debt load, factoring aligns well with that preference.

What to Look for When Choosing the Right Factoring Company for Bridge Financing

It’s essential to choose the right factoring partner, especially when your business is in a growth phase. You will rely on this relationship for working capital, customer experience, and overall financial stability. A good partner should support your expansion, keep funding predictable, and provide clear terms so you always understand what to expect.

Clear Pricing and Straightforward Terms

Transparency is essential. You should be able to see exactly what the service will cost, how fees are calculated, and when they are applied. Many owners prefer a simple structure that outlines the advance rate, the factoring fee, and any additional charges. During expansion, that clarity helps you manage cash flow and avoid surprises.

A Contract That Works with Your Growth Plans

Flexibility matters during high-growth periods. Some factors offer month-to-month agreements or low-volume commitments, which can be useful if your invoice volume changes as you expand. The goal is to choose a partner whose contract does not force you into long-term obligations that do not match the pace or direction of your growth.

Funding That Arrives Quickly and Consistently

When you are growing, timing is everything. A strong factoring partner should fund advances quickly and maintain a predictable process so you can plan around your cash flow. Delays can slow your ability to take on new work or meet obligations. Reliability is just as important as speed.

Customer Service That Reflects Well on Your Business

Because your factor interacts with your customers during the invoice payment process, the partner you choose becomes an extension of your business. Professional, courteous communication helps maintain healthy customer relationships. This becomes even more important during expansion, when you may be onboarding new clients or handling larger contracts.

How to Qualify for Bridge Financing with Factoring

Qualifying for factoring is usually more straightforward than qualifying for other forms of bridge financing. Because factoring is based on the strength of your receivables rather than your credit history or time in business, the approval process focuses on the quality of your customers and the reliability of their payment patterns. This makes factoring accessible during early expansion stages, when traditional lenders may still be waiting for more established financial data.

Your Business Must Issue B2B Invoices for Completed Work

Factoring is built around invoices for delivered goods or services. If your customers are other businesses and you regularly issue invoices with payment terms, you already meet the core requirement. The work must be completed, since factors advance funds against revenue that has already been earned.

Your Customers Should Have a Strong Payment History

Factoring companies pay close attention to the creditworthiness and payment habits of your customers. If your customers have a track record of paying on time and have stable operations, approval is generally easier. This is helpful during expansion, as your eligibility is tied to the customers you serve rather than your own credit profile.

Your Invoices Must Be Clear, Verifiable, and Free from Disputes

A factoring company needs to confirm that the invoice is legitimate, that the work has been completed, and that there are no unresolved issues that might delay payment. Clean documentation and straightforward terms help the process move quickly.

Your Business Should Have Simple, Consistent Billing Practices

Factors look for clear processes around invoicing and payment. If your billing is accurate, consistent, and supported by basic documentation such as purchase orders or delivery confirmations, approval is faster. This is especially important when your invoice volume increases during expansion.

Kickstart Your Bridge Funding Approval

If it sounds like factoring is the ideal solution for your bridge funding needs, we can help accelerate your funding timeline by matching you with reputable factors that offer fast payments and competitive rates. To get started, request a free factoring quote.

FAQs on Bridge Financing with Invoice Factoring

What is the downside of a bridge loan?

Bridge loans offer fast access to capital, but the cost is usually higher than traditional financing. They also add debt to your balance sheet. This can affect cash flow, financial ratios, and your ability to qualify for longer-term funding. Owners use them when the need is temporary and timing matters more than cost. However, there are alternatives, such as invoice factoring.

How does bridge financing work?

Bridge financing provides short-term funds to cover immediate needs while you wait for revenue, refinancing, or long-term financing. The structure varies by product. Some rely on collateral or repayment through future financing, while others fund against invoices, inventory, or sales. The goal is to keep operations moving during a transitional period.

What qualifies you for a bridge loan?

Approval usually depends on your ability to repay once longer-term financing arrives. Lenders review cash flow, collateral, business performance, and financial history. They also want to see a clear plan for how the bridge loan will be repaid. Strong financial statements and predictable revenue improve your likelihood of qualifying. However, alternatives to bridge loans, such as invoice factoring, do not have the same rigid requirements.

What’s the difference between bridge financing vs. business loans?

Bridge financing is designed for short-term needs and helps you cover expenses until revenue or long-term financing becomes available. Business loans are long-term tools with lower costs, structured repayment schedules, and broader uses. Bridge products focus on immediacy and flexibility, while business loans focus on stability and long-term planning.

Can factoring help me while I wait to qualify for a loan?

Yes. Factoring gives you faster access to the revenue tied to your invoices, which strengthens cash flow and supports on-time payments. These patterns help you present a more stable financial picture to lenders later. Many owners use factoring as a temporary bridge while working toward a term loan.

Can factoring get me through the expansion period until my revenue stabilizes?

Yes. Factoring converts your receivables into working capital, which helps you manage higher expenses during expansion. It keeps payroll, supplies, and operating costs on track while you wait for customer payments. This support makes it easier to accept new contracts and maintain momentum until your revenue levels out.

Are there any debt-free bridge financing solutions?

Yes. Factoring is a debt-free option because it accelerates payment on completed work rather than adding new liabilities. Purchase order financing and certain inventory advances may also function without adding traditional debt, depending on the structure. These tools help you bridge short-term gaps without affecting your balance sheet.

What are the top bridge financing options for small businesses?

Common bridge options include short-term loans, operating lines of credit, merchant cash advances, private lender bridge loans, purchase order financing, inventory financing, contract financing, and invoice factoring. The right choice depends on your cash flow needs, customer payment patterns, available collateral, and how quickly you expect revenue to arrive.

Can I use bridge financing for cash flow management?

Yes. Many businesses use bridge financing to manage timing gaps between expenses and incoming payments. It helps stabilize operations when revenue is delayed due to long payment terms, seasonal cycles, or expansion-related costs. The goal is to provide short-term support so you can operate smoothly while waiting for cash flow to catch up.

Where can I get alternative bridge financing for business expansion?

Alternative bridge financing is available from factoring companies, private lenders, fintech platforms, and some non-bank financing providers. These sources often have faster approvals and more flexible criteria than traditional lenders. They can be useful when your business is growing quickly and needs short-term support before revenue stabilizes.

What are the best industries for bridge financing with factoring?

Factoring works well in industries with steady invoicing and longer payment cycles. Businesses in industries such as transportation, staffing, construction, manufacturing, distribution, and professional services often rely on it. These industries experience rising expenses before payments arrive, making factoring a practical tool for managing growth and maintaining stability during expansion.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778