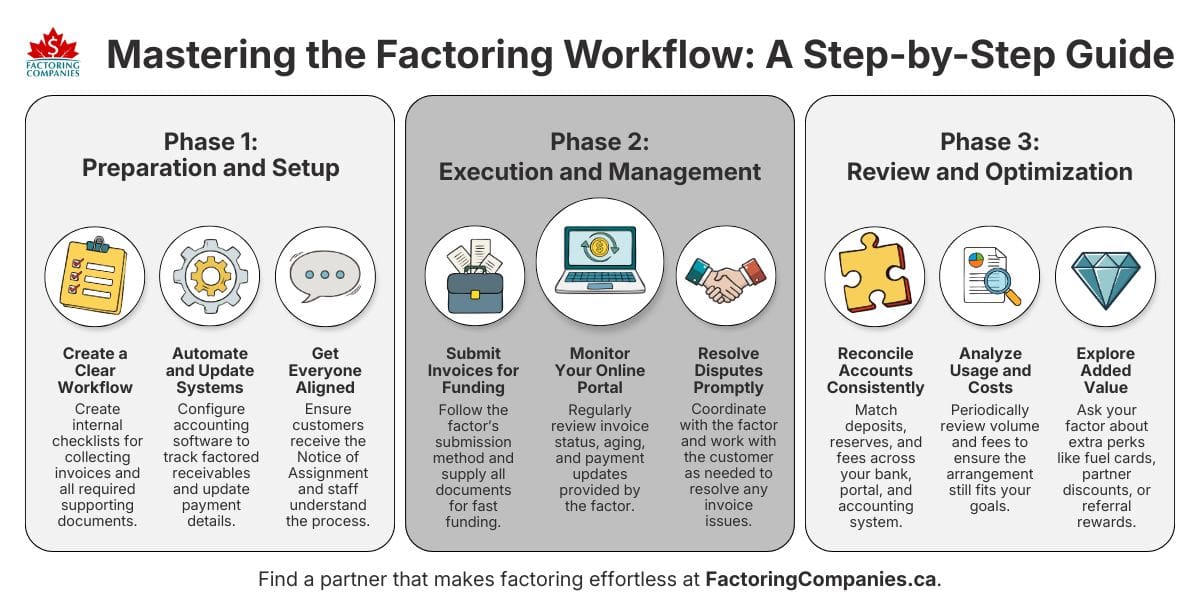

Most businesses don’t need to change much when they start factoring. However, because a third party is being introduced into your workflows and there are some nuances to tracking, it’s helpful to use a factoring process checklist when you’re getting started. We’ll cover the basics on this page, so you have the smoothest start possible.

Note: This invoice factoring checklist assumes you’re ready to start factoring or want to plan your next steps after approval. If you’re not approved yet or don’t know how factoring fits into your plans, start with “Checklist: Getting Your Business Ready for Factoring.”

☐ 1. Revisit Factoring Compliance Standards and the Nuances of Your Factoring Contract

While there are “standard” processes in factoring that most companies follow, each factoring company operates differently, and some tailor how they work to the needs of the businesses they serve. Take another look at your factoring contract and any supporting documentation to ensure you’re aware of any nuances.

https://youtu.be/1L9eabgI3is

☐ Clarify What the Factoring Company Handles

Factoring introduces a shared workflow. Certain responsibilities move to the factoring company, while others stay with you. Knowing where those lines are drawn ensures nothing falls through the cracks.

- Collections and Payment Processing: In a traditional factoring agreement, the factoring company manages customer payments for factored invoices and applies them to your account once received.

- Invoice Creation Responsibilities: In most cases, you’ll continue invoicing your customers as usual, then send a copy of the invoice to your factoring company. However, sometimes factors will create invoices for you. This is more common in certain industries where alternative documentation is accepted in place of an invoice. For instance, if you run a trucking business and you’re working with a freight factoring company, they may accept a signed bill of lading (BOL) and then prep the invoice for you

☐ Identify Which Customers and Receivables Are Eligible

It’s important to remember that each invoice is usually processed on its own merit. Take time to review which invoices will qualify to ensure you’re planning submissions and cash flow accordingly.

- Approved Customer Accounts: In most cases, the factoring company will need to review each customer’s payment history before accepting any invoices the customer is expected to pay, although some that tailor their services by industry may also offer a list of pre-approved customers. Always confirm which customer accounts qualify for factoring and evaluate any limits.

- Eligible Receivable Types: Most factors will need invoices for work you’ve completed or services delivered, though, as mentioned, some factors accept alternate documents such as signed bills of lading, timesheets, or oilfield tickets. Double-check whether there are aging requirements as well, as most factors only accept newer invoices.

- Contractual Requirements: Payment terms, proof of delivery, and customer credit standing often influence what can be submitted.

☐ 2. Develop a Structured Factoring Process and Invoicing and Documentation Workflow

Most businesses don’t have to make any major changes to how they create and store documents. However, drafting internal policies and procedures will help ensure you don’t miss any steps that can delay funding and keep you more organized overall.

☐ Align Supporting Documents with Each Receivable Type

Create a checklist that covers what you need to submit to the factoring company each time.

- Standard Invoice Packages: Find out what a “standard” invoice package is. For instance, you may need to submit an invoice with proof of delivery, service completion, or customer acceptance.

- Customer-Specific Requirements: Certain customers require additional approvals or formats that must be reflected in what you submit. For instance, you may need to send a copy of the purchase order with some invoices if the customer requires it, or include specific details on the invoice.

☐ Define How Documents Are Collected and Stored Internally

Make sure you have a way to store documents so that they’re easy to locate, review, and match together.

- Centralized Document Storage: Keeping invoices and supporting records in a shared location helps you maintain visibility as volume grows.

- Clear Naming Conventions: Consistent file names or references make it easier to match documents to receivables.

- Version Control Awareness: Ensuring the most current document set is submitted supports smoother processing.

☐ Establish an Internal Review Step Before Submission

A brief internal review helps confirm each receivable is complete and ready for submission.

- Accuracy Review: Verify customer details, amounts, and dates align across all documents.

- Eligibility Confirmation: Ensure the receivable meets the agreement’s submission criteria.

- Consistency Check: Confirm supporting documents clearly correspond to the invoice or receivable being submitted.

☐ 3. Update Customer Billing and Internal Visibility Before Submitting Invoices

Before your first invoice is submitted for funding, customer-facing details and internal visibility need to be aligned. This ensures payments are routed correctly and that anyone interacting with customers understands how factored accounts are handled.

☐ Confirm How and When the Notice of Assignment Is Delivered

The Notice of Assignment formally informs your customer that payments for specific receivables are directed to the factoring company. While this notice is typically issued by the factoring company, it plays a role in your internal workflow as well.

- Delivery Responsibility: Most factoring companies send the Notice of Assignment directly to the customer once factoring begins.

- Timing Awareness: Find out when the notice is being sent, so you can plan any invoicing changes or customer communication needs around it.

- Internal Visibility: Ensure staff who interact with customers have seen the notice, so they understand the language being used and can answer questions.

☐ Update Invoice Templates and Remittance Details Where Required

Depending on your agreement, invoices may need updated payment instructions or references to reflect the factoring relationship.

- Consistency Across Systems: Ensure invoice templates match what customers and the factoring company expect for a smoother payment flow.

- Remittance Information Alignment: If you’re responsible for invoicing your clients and factoring all your invoices, update your invoice templates so that the factor’s payment options and billing address are reflected. If you’re leveraging spot factoring, identify the best method for switching out this information in your billing software.

☐ Ensure Internal Staff Can Recognize and Explain Factored Accounts

Anyone who is involved in the management of customer accounts and receivables must be able to understand what’s happening with accounts.

- Account Identification: Factored customers should be clearly identified in your records so there is no confusion at billing time.

- Basic Explanation Readiness: Staff should understand how factoring affects where payments go and who handles collections.

- Escalation Awareness: Designate one person on your team to be the main point of contact for all things related to factoring. Ensure this person is well-versed in the process and is connected with your account manager at the factoring company, so they can escalate questions as needed.

☐ Consider Proactive Outreach to Key Customers

Some businesses choose to speak directly with key customers about factoring in advance, particularly when relationships are long-standing or payment volumes are significant. Although it isn’t always necessary, doing so can help ensure they understand the new process and are comfortable before the new process begins.

☐ 4. Configure Your Accounting System to Track Factored Receivables

If you’re using accounting software, especially if invoicing and customer notifications are automated, you’ll need to make sure you have a way to separate your factored invoices from any invoices you’re managing in-house and track what’s happening with them.

Each software offers different features for this, so it may be helpful to connect with your program’s support team or your accountant on the best setup for your business needs.

☐ Ensure Factoring Payment Tracking is Distinguished from Customer Payments

Your system should make it easy to distinguish between invoices that are part of the factoring program and those that are not.

- Customer-Level Identification: Factored customers should be flagged in your accounting software so receivables are grouped correctly.

- Receivable Classification: Factored invoices should be recorded in a way that keeps them visible until final payment is received.

- Parallel Tracking: Non-factored invoices should continue to follow your existing workflow without disruption.

☐ Align Advances, Fees, and Reserves with Your Chart of Accounts

Factoring introduces new cash flow components that need clear placement in your books.

- Advance Deposits: Funds received at submission should be recorded as proceeds against the related receivable.

- Reserve Balances: Holdbacks should remain identifiable so you can track what is still owed to your business.

- Fee Treatment: Factoring fees should be recorded consistently so reporting remains accurate over time.

☐ Ensure Outstanding Balances Remain Visible Until Final Payment

Even though the factoring company manages collections, unpaid invoices should remain visible in your system.

- Open Invoice Tracking: Factored invoices should stay open until customer payment is applied and the reserve is released.

- Payment Application Awareness: Customer payments should be reflected once received by the factoring company, even if funds pass through a reserve first.

- Aging Visibility: Your reports should show which invoices are current and which require follow-up awareness.

Explore Factoring Automation Solutions

Automation can reduce errors and eliminate tedious manual tasks. Double-check whether any steps in your workflows can be automated.

- Invoice Submission: In integrated systems, you may be able to automatically send invoices to your factor when you send them to your customer.

- Payment Logging: If your system integrates with your factor, you may be able to have payments automatically logged in your system as they are sent.

- Reminders and Alerts: Many tools offer reminders or alerts to complete tasks. These can be used to help ensure you’re sending the right documentation, using the right information, checking on status as needed, and more.

☐ 5. Follow Factoring Best Practices When Submitting Your First Invoices for Funding

With your documentation, billing details, and accounting setup in place, you are ready to submit your first invoices for funding. This step sets the tone for how smoothly factoring fits into your day-to-day operations.

☐ Follow the Agreed Submission Method and Timing

Factoring companies outline how and when invoices should be submitted. Sticking to that process helps funding move on schedule.

- Submission Channel: Invoices and supporting documents are typically submitted through an online portal, secure upload, or email, depending on your agreement.

- Timing Expectations: Some businesses submit invoices as soon as work is completed, while others follow a daily or weekly cadence. If speed is your top concern, verify the factoring company’s daily submission cutoff time and set up a schedule to ensure you have time to get everything together and submit before the submission window closes.

- Completeness Check: Each submission should include all required documents so the invoice can move directly into review.

☐ Confirm Funding Deposits and Reserve Treatment

Once invoices are accepted, funding follows based on the advance rate in your agreement.

- Advance Receipt: The initial deposit should align with the agreed advance percentage and appear in your bank account within the expected timeframe.

- Reserve Recognition: The remaining balance is held in reserve and released once the customer pays.

- Deposit Matching: Each deposit should be traceable back to the invoices submitted, so records stay aligned.

☐ Establish a Repeatable Submission Routine

After the first submission, the goal is consistency rather than constant adjustment.

- Defined Responsibility: One person should be responsible for preparing and submitting invoices to reduce errors.

- Standard Schedule: Submit invoices on a regular schedule so it’s easier to anticipate cash flow.

- Process Review: Submit early so there’s time to confirm that documentation, timing, and deposits align as expected.

☐ 6. Monitor Factored Invoices Through Your Online Portal

Although certain software used by factoring companies can integrate with business accounting software, most businesses will have no integration or only limited functionality. Because of this, you’ll want to check your factoring account regularly.

☐ Review Aging and Payment Status Regularly

Your portal should show where each factored invoice stands in the payment cycle.

- Invoice Status Review: Check which invoices are newly funded, outstanding, or paid.

- Aging Awareness: Pay attention to how long invoices have been outstanding so you understand payment patterns across customers.

- Balance Confirmation: Ensure invoice totals in the portal align with what you see in your accounting system.

☐ Watch for Delays That May Require Customer Outreach

The factoring company handles payment follow-up, though you may still choose to reach out in certain situations.

- Late Payments: If an invoice extends beyond expected payment timing, it may be worth checking in with the customer.

- Relationship-Based Follow-Ups: A brief nudge from you can sometimes prompt faster action, especially with long-standing accounts.

- Coordination with the Factoring Company: Reviewing notes or updates in the portal helps ensure your outreach aligns with ongoing collection activity.

☐ Track Volume Against Any Contractual Commitments

Some factoring agreements include volume expectations. Check your portal to see whether submissions are lining up with those terms.

- Submission Totals: Review how much receivable volume has been submitted over a given period.

- Trend Awareness: Identify seasonal shifts or customer-driven changes that affect volume.

- Early Check-Ins: If volume looks lighter or heavier than expected, it may be time to connect with your factoring partner or adjust plans.

☐ 7. Maintain Awareness of Invoice Disputes and Resolution Steps

Your factoring agreement likely stipulates what happens if an invoice is disputed by a customer. Check the documentation to know what to expect and have a plan in place to follow up with these situations as they arise.

☐ Understand What Triggers a Dispute Hold

A dispute usually begins when a customer questions an invoice or supporting documentation. When that happens, the factoring company pauses activity on that receivable until the issue is addressed.

- Documentation Questions: Missing signatures, incomplete backup, or mismatched amounts often lead to disputes.

- Service or Delivery Concerns: Customers may raise questions about work performed, delivery timing, or scope.

- Customer-Specific Requirements: Some customers require approvals or reference numbers that must appear exactly as expected.

☐ Coordinate with the Factoring Company on Resolution

Once a dispute is flagged, the factoring company will typically notify you and outline what is needed to move forward.

- Information Requests: You may be asked to provide revised documents, confirmations, or clarifications.

- Customer Communication: In many cases, you are best positioned to speak directly with the customer to resolve the issue. Because of this, the factoring company will likely connect with you and ask you to resolve the issue with the customer.

- Status Updates: Let the factoring company know when the dispute is resolved, and keep an eye on your portal to ensure the status of the invoice changes.

☐ Adjust Internal Processes to Reduce Repeat Issues

Disputes often highlight areas where small changes can improve future submissions.

- Documentation Improvements: Update checklists and templates to reduce disputes caused by missing or inconsistent information.

- Customer-Specific Notes: Record unique billing requirements to ensure they are met every time.

- Internal Review Adjustments: Strengthen review steps for certain customers or invoice types to reduce repeat questions.

☐ 8. Set Up Alerts and Checkpoints to Stay Ahead of Issues

As factoring activity increases, small issues can slip by unless you build in reminders and review points. Alerts and checkpoints help you notice changes early and respond while invoices are still easy to address.

☐ Use Accounting Software Alerts Where Available

Most accounting systems offer basic alerts that help you keep an eye on outstanding receivables.

- Aging Notifications: Set alerts for invoices that pass specific aging thresholds so they do not get overlooked.

- Balance Changes: Use notifications tied to receivable balances, so you know when payments or reserve releases occur.

- Customer-Specific Triggers: Set alerts for key accounts to help you monitor higher-volume or time-sensitive customers.

☐ Schedule Regular Portal Reviews as Part of Your Factoring Process Management

The factoring portal shows activity that may not immediately appear in your accounting system. Setting a review schedule keeps that information in front of you.

- Weekly Check-Ins: Set a regular review to help you track payment status, disputes, and aging trends.

- Volume Review Points: Conduct periodic checks to assess how submitted volume compares with expectations.

- Notes and Updates: Review portal notes to ensure you are aware of any actions or follow-ups already underway.

☐ Create Simple Follow-Up Triggers for Aging Invoices

Some situations call for action on your side, even when the factoring company manages collections.

- Customer Outreach Timing: Decide when you will reach out if an invoice remains unpaid beyond expected timing.

- Internal Escalation Points: Define when an issue should be reviewed more closely or discussed internally.

- Factoring Partner Coordination: Knowing when to connect with the factoring company helps keep activity aligned.

☐ 9. Reconcile Factored Receivables on an Ongoing Basis

Reconciliation connects what you see in your bank account, your accounting system, and the factoring portal. Doing this regularly keeps your records accurate and makes reporting straightforward.

☐ Match Funded Invoices to Deposits and Customer Payments

Each funding event and payment should be traceable back to specific invoices.

- Deposit Matching: Link advance deposits to the invoices submitted so funding activity is clearly accounted for.

- Customer Payment Recognition: Record customer payments once they are received by the factoring company, even though funds may pass through a reserve first.

- Timing Alignment: Ensure dates and amounts line up across your bank statements, accounting records, and portal activity.

☐ Reconcile Reserve Releases as Invoices Are Paid

Reserves are released after customers pay, and those funds need to be accounted for clearly.

- Reserve Tracking: Keep a clear record of reserve balances tied to individual invoices.

- Release Application: Apply released reserves against the correct receivables so balances close cleanly.

- Fee Confirmation: Ensure fees deducted at release align with what was outlined in your agreement.

☐ Maintain Clean Records for Month-End and Year-End Reporting

Regular reconciliation simplifies reporting and reduces last-minute cleanup.

- Open Balance Review: Confirm only unpaid invoices remain open at the end of each period.

- Reporting Accuracy: Ensure receivable, cash, and expense reports reflect factoring activity accurately.

- Documentation Retention: Keep portal reports and statements accessible for reference during reviews or audits.

☐ 10. Review Volume, Usage, and Fit as Factoring Becomes Routine

Factoring agreements can and do change over time. If your agreement locks you in for a period of time, such as 12 months, dig into the data a couple of months before it renews. If you’re not on a term contract, run a quarterly analysis. This will help you spot opportunities to minimize costs and maximize the value of your factoring relationship.

☐ Check Volume and Assess Factoring Cost Management

The amount you’re factoring and the way your contract is structured impacts the fees you pay. Once you understand how much you’re factoring, you’re in a better position to negotiate factoring terms that align with your actual usage.

- High Volume with No Minimums: If you don’t have minimums or are spot factoring, but you’re factoring in bulk, it’s worth asking if you can qualify for a discount if you agree to continue factoring at the same scale.

- Exceeding Minimums: If you’re consistently exceeding your minimum volume requirement and are confident this will continue, consider asking the factor if they’ll raise the minimum in exchange for a greater discount.

- Falling Short of Minimums: Factoring contracts that stipulate minimum volume typically have a penalty associated with missing them. If you’ve been missing yours and paying fees for this, add up the total fees paid for the period, including the factoring fees and additional costs for volume. Then, calculate what you would have paid if you were on a spot factoring contract or a contract with no minimums. While the base factoring fee will be higher, you may find that you save money overall. If so, it’s worth asking your factor if you can shift to a contract with no minimums.

☐ Confirm Fit Against Your Long-Term Factoring Strategy

Your funding and business needs will change over time. It’s important to confirm whether you’re still benefiting from factoring and if you’re with the right factor.

- Factoring Goal Check: Before you started factoring, you should have set goals, such as stabilizing cash flow, funding growth initiatives, or managing extended payment terms. Confirm whether the goals you set are still relevant and if factoring is helping you meet them. If not, it’s time to reassess.

- Cash Flow Analysis: Perform a cash flow analysis to gauge what your stability would be like without factoring. If you don’t have cash flow gaps, you may have outgrown factoring. If you do, but they’re irregular and tied to specific situations, you may also want to pivot. For instance, those who only use factoring for emergencies may want to consider moving to a spot factoring solution, while those using factoring for major purchases, such as new equipment, may want to explore using more traditional forms of financing in place of factoring or in addition to factoring.

- Bad Debt: Overall, six percent of Canadian B2B invoices are written off as bad debt, per Atradius. Factored invoices are even less likely to go unpaid because of all the upfront diligence. Check your bad debt levels for the period. If customers are paying as they should and you have a non-recourse contract, you might be able to switch to recourse to save money. If you’re on a recourse contract and find that you’re writing off bad debt, run your actual numbers to see if recourse factoring might pay for itself or provide you with greater security.

☐ Explore Benefits That Add Value

Oftentimes, businesses just starting out with invoice factoring focus exclusively on the benefit of cash flow acceleration. Once you’re settled, it’s worth exploring whether your factoring company offers additional services that can help your business excel.

- Alternative Funding: Sometimes, factoring companies offer asset-based lending, commercial credit cards, equipment financing, and lines of credit. If you’re ready for other forms of funding, it’s often easier to secure them from your factoring company because you have an existing relationship.

- Industry-Specific Perks: Factors that specialize in specific industries often provide additional tools and services for those businesses. For instance, a transportation factoring firm might provide fuel advances, fuel discount cards, load boards, roadside assistance, or tire discount programs.

- Partner Discounts: Occasionally, factoring companies partner with providers of other services and products you’ll need. For instance, a factor that provides insurance premium financing might also partner with insurance brokers who can ensure you have the right level of coverage for your needs. In trucking, factors often partner with dispatchers and compliance specialists. Let your factoring company know what you need and ask if they’re aware of any good providers, especially those that offer discounts for their clients.

- Referral Rewards: If you’re happy with your factoring company, find out if they have a referral program. Many factors will reward you for sending customers their way, giving you discounts or commission to help keep more money in your pocket.

Find a Partner That Makes Factoring Effortless

Although this invoice factoring checklist is lengthy because it’s designed to address many unique situations, the reality is that factoring can be quite effortless, especially when you have the right factoring partner. An experienced factor will walk you through the options and look at your receivables and processes with you, so it’s easier to understand the best ways to structure your agreement and what, if anything, needs to change about your receivables process. To be matched with a vetted factor, request a free rate quote.

Factoring Process Checklist FAQs

How do I submit invoices to a factoring company after approval?

After approval, invoices are submitted using the method outlined in your agreement, often through an online portal. Each submission includes the invoice and required supporting documents. Once reviewed and accepted, the factoring company releases the advance to your bank account based on the agreed advance rate.

What documents are required when submitting factored receivables?

Most factoring companies require an invoice plus proof that work was completed. This may include signed delivery receipts, bills of lading, timesheets, or oilfield tickets, depending on the industry. Customer-specific requirements outlined in contracts should also be included to ensure the receivable is accepted without delay.

Do I still create invoices when using a factoring company?

In many cases, you continue creating invoices as you normally would and submit them for factoring. In some industries, such as trucking, the factoring company may generate invoices using documents you provide. Your agreement specifies which approach applies to your business and customers.

How do I track factored invoices in my accounting software?

Factored invoices should remain visible in your accounting system until customer payment is received. Many businesses flag factored customers or invoices separately, record advance deposits against receivables, and track reserves until they are released. This setup allows you to see outstanding balances without relying solely on the factoring portal.

How do customer payments work when invoices are factored?

Once factoring begins, customers send payment to the factoring company according to updated remittance instructions. The factoring company applies the payment to your account, releases any remaining reserve balance, and updates the invoice status. You continue managing the customer relationship and service delivery as usual.

What happens if a customer disputes a factored invoice?

When a customer raises a dispute, the factoring company places the invoice on hold until the issue is resolved. You may be asked to provide additional documentation or speak directly with the customer. Once the dispute is cleared, the invoice returns to normal processing, and funding continues.

How do I reconcile advances and reserves from invoice factoring?

Reconciliation involves matching advance deposits to submitted invoices and recording customer payments when they are received by the factoring company. Reserve releases are applied once invoices are paid in full. Keeping portal reports and accounting records aligned helps ensure receivable balances close correctly.

How often should I check my factoring portal?

Most businesses review their factoring portal at least once a week. Regular checks help you monitor invoice aging, payment status, disputes, and submitted volume. This habit keeps expectations aligned and helps you notice changes early without needing to log in daily.

What if I am not meeting the minimum volume required by my factoring agreement?

If the submitted volume is consistently below expectations, you may adjust how factoring is used. Options include factoring only selected invoices, switching to spot factoring, or narrowing the scope of customers included. These changes are often discussed directly with the factoring company once patterns are clear.

Can I change how I use factoring after I get started?

Yes. Many businesses adjust their factoring approach over time based on billing patterns, customer mix, or cash flow needs. Changes may include selective submissions, revised terms, or different usage levels. Reviewing actual activity gives you the information needed to decide what structure fits your business best.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778