Have you ever stopped and asked for directions and been told something like, “Turn left at the old Tim Hortons, then go straight until you see where the barn used to be?” It’s a bit funny—until you’re the one trying to find your way. Now, imagine managing your business finances with similar vague guidance. Without financial visibility, you’re essentially navigating based on landmarks that might no longer exist—or that only make sense to those who’ve been around forever. Who knows where you’ll end up? This is, in a nutshell, why financial visibility in factoring is essential, too. Give us a few minutes, and we’ll walk you through why factoring companies insist on this visibility, how your business benefits, and how to make sure you have the clarity you need.

What is Financial Visibility?

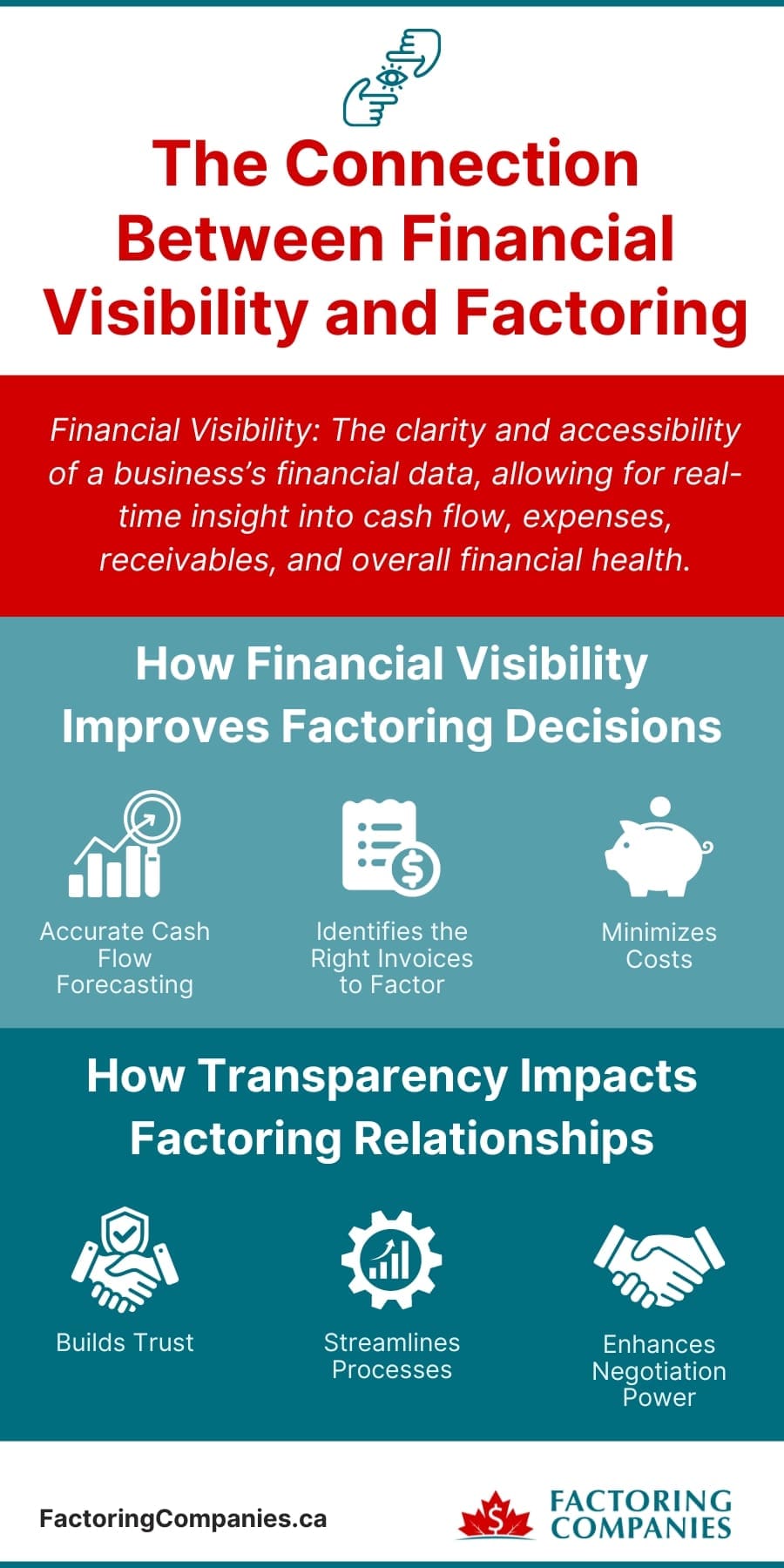

Financial visibility refers to the clarity and accessibility of a company’s financial data. It’s about having a clear, real-time view of all financial aspects of your business, including cash flow, expenses, receivables, payables, and overall financial health. This visibility is crucial because it allows business owners and managers to make informed decisions quickly and accurately.

In simpler terms, financial visibility is like having a bird’s-eye view of your company’s financial landscape. You can see where money is coming from, where it’s going, and how much is left—all in real-time. This insight is vital for steering your business in the right direction, ensuring that you’re not flying blind when it comes to your financial decisions.

The Role of Financial Visibility in Effective Management

Financial visibility plays a critical role in effective business management, particularly in areas like budgeting, forecasting, and strategic planning. Let’s take a quick look at why it’s so important.

Informed Decision-Making

When you have a clear view of your finances, you can make decisions that are based on real data rather than guesswork. For example, if you know your cash flow trends, you can time your expenditures or investments better, avoiding periods of tight liquidity.

Risk Management

Financial visibility helps identify potential risks before they become problems. For instance, if you notice that receivables are taking longer to collect than usual, you can take steps to improve your collections process or explore alternative funding options like invoice factoring to maintain steady cash flow.

Efficient Operations

Understanding where your money is tied up allows you to streamline operations. For example, if you see that a large portion of your working capital is stuck in unpaid invoices, you can take steps to free up that capital, perhaps by selling those invoices to a factoring company.

Strategic Business Growth

With complete financial visibility, you can better plan for growth. You can identify which areas of your business are the most profitable and allocate resources accordingly. This is especially important for small and medium-sized enterprises (SMEs) in Canada, where cash flow is often a major concern.

The Basics of Business Factoring

Business factoring, often simply referred to as invoice factoring or factoring, is a financial transaction in which a business sells its accounts receivable (invoices) to a factoring company at a discount. This provides the business with immediate cash, which can be used to cover expenses, invest in growth, or manage day-to-day operations.

How Business Factoring Works

Factoring is quick and easy. Here’s how the process typically works.

Issuing Invoices

After providing goods or services, a business issues invoices to its customers, who are usually given a set period to pay, such as 30, 60, or 90 days.

Selling Invoices to a Factoring Company

Instead of waiting for the customer to pay, the business can sell these invoices to a factoring company. The factoring company typically pays the business a large percentage of the invoice value upfront—often around 60 to 95 percent.

Customer Payment

The factoring company then takes over the responsibility of collecting payment from the customer. Once the customer pays, the factoring company remits the remaining balance to the business minus a fee for the service.

Fee Structure

The fee charged by the factoring company is typically a small percentage of the invoice value. This fee varies depending on factors like the creditworthiness of the customers, the length of the payment terms, and the industry. It’s usually between one and five percent of the invoice’s value.

The Benefits of Factoring for Cash Flow Management

Factoring offers several key benefits, particularly for managing cash flow, which is often a challenge for Canadian businesses of all sizes.

Improved Cash Flow

One of the biggest advantages of factoring is the immediate boost to cash flow. Instead of waiting weeks or months for customers to pay, businesses can get most of their money right away. This is particularly beneficial for SMEs and startups, where cash flow can be tight. For example, a construction company in Alberta that takes on large projects with long payment cycles can use factoring to ensure they have the cash on hand to pay for materials, labour, and other expenses without waiting for client payments.

Flexibility

Factoring is a flexible financing option because it’s not a loan. Businesses don’t take on debt; instead, they’re simply accessing funds that are already owed to them. This can be a significant advantage for businesses that want to avoid the debt and interest associated with traditional loans.

Credit Management

Factoring companies often take over the responsibility of managing and collecting receivables. This can free up time and resources for the business, allowing them to focus on core activities like sales and growth. Additionally, factoring companies usually conduct credit checks on customers before purchasing invoices, which can help businesses avoid taking on clients that pose a credit risk.

Growth Opportunities

With steady cash flow, businesses can take on new opportunities without worrying about how they’ll finance them. For example, a manufacturing firm in Quebec might use factoring to secure the funds needed to fulfill a large order, knowing they’ll have the cash to cover the upfront costs.

Better Supplier Relationships

By maintaining consistent cash flow through factoring, businesses can pay their suppliers on time or even early. This can lead to stronger relationships and possibly even discounts for early payments, further improving the company’s financial position.

The Connection Between Financial Visibility and Factoring

Financial visibility and factoring are closely intertwined. At its core, financial visibility provides a clear, accurate view of a company’s financial health, which is essential for making informed decisions about whether or not to engage in factoring. When a business has strong financial visibility, it can approach factoring with confidence, knowing it has a solid understanding of its cash flow, receivables, and overall financial position.

This visibility isn’t just beneficial for the business itself; it also builds trust with the factoring company. When a factoring company sees that a business has its financials in order, it can offer more favorable terms, knowing that the business is well-managed and poses less risk. In this way, financial visibility directly impacts the success of factoring arrangements.

How Financial Visibility Improves Factoring Decisions

Financial visibility plays a critical role in improving factoring decisions in several ways.

Accurate Cash Flow Forecasting

With a clear view of all incoming and outgoing funds, a business can accurately forecast its cash flow needs. This is crucial when deciding whether to engage in factoring. For example, if a business knows it will face a cash shortfall due to delayed customer payments, it can preemptively factor its invoices to ensure smooth operations.

To illustrate this point, picture a wholesale distributor in Montreal. It might use financial visibility tools to forecast a seasonal dip in cash flow. By factoring its invoices before this dip, the business ensures it has the cash needed to maintain inventory levels and meet demand during the slower season.

Identifying the Right Invoices to Factor

Not all invoices are created equal. Some may have longer payment terms, while others might be from customers with a history of late payments. With strong financial visibility, a business can identify which invoices are best suited for factoring, focusing on those that will maximize cash flow without incurring unnecessary fees.

For instance, a tech startup in Vancouver might have several clients with extended payment terms. By using financial visibility tools, the startup can pinpoint which invoices to factor to cover its payroll and operational expenses without overextending its factoring arrangements.

Minimizing Costs

Factoring comes with fees, and the better a business understands its financials, the more effectively it can minimize these costs. Financial visibility allows businesses to determine the optimal timing for factoring, ensuring they only factor when it’s absolutely necessary, thereby reducing the overall cost of factoring.

The Impact of Transparency on Factoring Relationships

Transparency is a cornerstone of any successful factoring relationship. When a business is transparent about its financial situation, it builds trust with the factoring company, leading to better terms and a smoother overall process. For Canadian companies, this transparency is crucial for navigating the landscape of canadian invoice factoring regulations and securing favorable terms with factoring providers. Here’s how transparency impacts these relationships.

Building Trust

Factoring companies appreciate clients who provide clear, accurate, and timely financial information. This transparency reassures the factoring company that the business is reliable, reducing the perceived risk and often resulting in better factoring rates and conditions.

Streamlining Processes

Transparency in financial reporting can streamline the factoring process. When a business is open about its receivables, payment terms, and customer relationships, the factoring company can quickly assess the risk and process the transaction without delays. This ensures that the business receives its cash as quickly as possible.

Enhancing Negotiation Power

A business with strong financial visibility and a commitment to transparency is in a better position to negotiate terms with its factoring company. This can include negotiating lower fees, higher advance rates, or more flexible terms, all of which can improve the overall financial health of the business.

Tools for Improving Financial Visibility

In today’s fast-paced business environment, having a clear and up-to-date understanding of your company’s financial health is crucial. Achieving this level of financial visibility often requires the use of specialized tools and technologies designed to provide comprehensive insights into various financial metrics. These tools not only help businesses track their financial performance but also enable them to make informed decisions that can drive growth and stability.

Financial Software Solutions for Businesses

One of the most effective ways to improve financial visibility is by implementing financial software solutions. These tools are designed to automate, streamline, and enhance the management of financial data, making it easier for businesses to maintain accurate and timely financial records. Below, we’ll cover some popular types of financial software solutions that businesses can benefit from.

Accounting Software

This is the cornerstone of financial visibility for many businesses. Accounting software like QuickBooks, Sage 50, and Xero are widely used by Canadian businesses to manage invoicing, payroll, expenses, and financial reporting. These platforms provide a central hub for all financial transactions, ensuring that businesses have a clear and organized view of their finances.

Enterprise Resource Planning (ERP) Systems

For larger businesses, ERP systems like SAP or Oracle offer a more integrated approach, combining financial management with other business processes such as inventory, human resources, and supply chain management. This integration ensures that all financial data is interconnected, providing a holistic view of the company’s operations.

Cash Flow Management Tools

Tools like Float and Pulse are specifically designed to help businesses monitor and manage their cash flow. These tools provide real-time cash flow forecasts, allowing businesses to anticipate and address cash shortages before they become problematic.

Financial Analytics and Reporting Tools

Advanced tools like Tableau or Power BI allow businesses to create custom financial reports and dashboards, providing deeper insights into financial performance. These tools can analyze large datasets, identify trends, and present information in a visually appealing way, making it easier for business owners and managers to understand and act on financial data.

The Importance of Real-Time Financial Reporting

Real-time financial reporting is essential for businesses that want to improve their financial visibility. Unlike traditional reporting methods, which often rely on periodic updates, such as monthly or quarterly, real-time reporting provides continuous access to the latest financial data. Let’s take a look at why it’s so important.

Immediate Insights

With real-time financial reporting, businesses can instantly access their most up-to-date financial information. This immediacy allows for quicker decision-making, enabling businesses to respond to opportunities or challenges as they arise.

For instance, an office supply store in Toronto using real-time reporting can immediately see the impact of a sales promotion on their cash flow, allowing them to adjust their marketing strategy or inventory levels in real-time.

Improved Accuracy

Real-time reporting reduces the risk of errors that can occur with delayed data entry or manual reconciliation. By having immediate access to financial data, businesses can ensure that their records are accurate and reflect the current financial situation.

Enhanced Forecasting

Real-time financial data allows businesses to create more accurate and dynamic forecasts. This is particularly important for cash flow management, where understanding the timing of inflows and outflows can help businesses avoid shortfalls and optimize their financial strategies.

For example, a manufacturing company in Alberta might use real-time reporting to track raw material costs and sales revenue, allowing them to adjust production schedules and pricing in response to changing market conditions.

Better Stakeholder Communication

Real-time financial reporting also improves communication with stakeholders, such as investors, lenders, and board members. By providing up-to-date financial information, businesses can build trust and demonstrate their financial health more effectively.

Compliance and Audit Readiness

For businesses that need to comply with regulatory requirements or undergo audits, real-time reporting ensures that financial records are always up-to-date and ready for review. This can save time and reduce stress during audits or when submitting financial reports to regulatory bodies.

Get Tailored Factoring Solutions to Fuel Your Business Growth

When it comes to optimizing your cash flow, financial visibility is just the beginning. The right factoring partner can turn that visibility into action, providing the funds you need to seize opportunities and grow. For businesses in Alberta, Alberta factoring companies can offer tailored solutions that meet the unique challenges of the region’s industries, from energy to construction. We’re here to connect you with top-tier factoring companies that understand your business goals. To get started, request your complimentary rate quote.

FAQs on Financial Visibility in Factoring

How does financial visibility impact cash flow management?

Financial visibility allows businesses to monitor their cash flow in real time, identify potential shortfalls, and make timely decisions to maintain liquidity. By understanding where money is coming from and where it’s going, businesses can better plan for expenses, avoid cash crunches, and ensure smooth operations.

How does real-time financial reporting benefit businesses?

Real-time financial reporting provides immediate access to up-to-date financial data, enabling quicker decision-making, improved accuracy, and enhanced forecasting. It helps businesses respond to opportunities and challenges in real time, maintain accurate records, and build trust with stakeholders.

How does financial visibility enhance decision-making in factoring?

Financial visibility enables businesses to make informed factoring decisions by providing a clear view of cash flow needs, identifying the best invoices to factor, and minimizing factoring costs. It ensures that businesses factor only when necessary, optimizing cash flow without incurring unnecessary fees.

How can financial transparency improve relationships with factoring companies?

Financial transparency builds trust with factoring companies and helps reduce risks in factoring, leading to better terms and a smoother process. By providing accurate and timely financial information, businesses can secure more favorable rates, streamline the factoring process, and strengthen their relationship with the factoring company.

Why is financial visibility important for businesses considering factoring?

Financial visibility is crucial for businesses considering factoring because it provides a clear understanding of cash flow needs, helps identify the right invoices to factor, and ensures that factoring is used strategically. It minimizes costs and optimizes the benefits of factoring.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778