Small business cash flow management can seem incredibly complicated at times. On the one hand, you’re probably coping with thin margins, and slow-paying customers add another layer of complexity. You no doubt have operational costs, like payroll, equipment, and supplies. And, if you want to expand or are already growing, you’ll have large capital outlays too. This isn’t one “problem,” and because of that, it can’t always be solved with a single solution either. Thankfully, you can use invoice factoring and business financing tools together. We’ll walk you through common pairings, how they work, and how to build a custom liquidity strategy for your business in this guide.

Invoice Factoring Strengthens Your Cash Flow Strategy

Factoring gives your business reliable access to working capital at the exact moment you need it. You send in approved invoices and receive funds quickly, which helps you move through slow payments, rising expenses, or tight margins without losing momentum. Instead of dealing with one cash-flow issue at a time, you can manage day-to-day operations and longer-term plans with more control.

Immediate Liquidity

Factoring speeds up access to cash so you can handle expenses as they come.

- Fast Access to Working Capital: You turn approved invoices into usable cash, which helps you cover payroll, suppliers, repairs, or other needs that cannot wait.

- Better Control Over Timing: You can respond to costs on your schedule rather than your customers’ payment schedules.

More Predictable Cash Flow

Nearly 90 percent of Canadian small business owners say managing cash flow is a top priority, according to Xero surveys. However, 44 percent of B2B invoices are paid late, according to Atradius. With factoring, you know when funds will arrive, which makes planning far easier.

- Consistent Schedules for Core Costs: You can map out payroll, purchases, and maintenance with more confidence.

- Stronger Weekly and Monthly Planning: A regular funding rhythm gives you room to prepare for larger expenses or seasonal shifts.

Operational Support from Your Factoring Partner

Your factoring partner also helps manage parts of your accounts receivable.

- Customer Credit Monitoring: Your partner reviews customer credit profiles so you have more clarity before extending terms.

- Collections Follow-Up: Your partner handles payment reminders and follow-up, which reduces the workload on your staff and keeps receivables healthier.

No New Debt on Your Balance Sheet

Factoring gives you working capital without adding long-term repayment obligations.

- Healthier Ratios for Future Financing: Your financial position stays stronger for other financing needs.

- More Flexibility for Growth: You can reserve traditional financing tools for equipment, expansion, or long-term investments.

Flexible Access to Capital That Grows with You

Factoring expands naturally as your business invoices more.

- Funding That Scales with Sales Volume: Higher invoicing leads to increased access to working capital.

- Support for Larger Contracts: You can take on bigger customers or higher workloads with confidence because your ability to access capital grows alongside your activity.

Many Financing Strategies for Growing Businesses Pair Well with Factoring

Factoring gives your business steady access to working capital, but it does not have to stand alone. Other financing tools can support different parts of your cash-flow picture. Some help you manage timing. Others help you invest in equipment or prepare for larger opportunities. When you combine the right tools, you create a more complete system that supports both immediate needs and long-term goals.

Business Lines of Credit

A business line of credit gives you flexible access to funds you can draw from when needed. Combining factoring and credit lines is often ideal because each tool covers a different type of cash-flow gap.

- Support for Short-Term Dips: A line of credit can help you cover expenses that fall between your factoring batches, especially when timing gets tight.

- Coverage for Costs Factoring Does Not Reach: It can help with payroll timing, small equipment needs, or purchases that are not tied to receivables.

Equipment Financing

Equipment financing helps you acquire assets without draining your working capital. When used alongside factoring, equipment financing creates room for growth while keeping your cash flow balanced.

- Long-Term Support for Expansion: You can invest in equipment, vehicles, or technology without large upfront payments.

- Preserved Working Capital: Factoring continues to support day-to-day operations while your loan handles longer-term asset costs.

Commercial Credit Cards

A business credit card is a straightforward tool for everyday expenses. It works well with factoring because credit cards offer short-term flexibility while factoring provides consistent inflows.

- Convenient for Small Purchases: You can cover fuel, office supplies, repairs, or other incidental costs easily.

- Smoother Weekly and Monthly Spending: Factoring’s steady funding schedule helps you pay off balances without stress.

Supply Chain or Vendor Financing

Supply chain financing helps you extend payables or secure better terms from suppliers. It can reduce pressure during busier periods and works well alongside factoring’s speed.

- Extended Timelines for Payables: You gain extra time to pay your suppliers without disrupting your cash flow.

- Support During Busy Seasons: You can handle larger orders or increased volume with fewer timing issues.

Payroll Funding

Payroll funding can be useful for businesses that have consistent workforce needs or growing labour requirements. It complements factoring when payroll timing is one of your biggest demands.

- Support for Labour-Heavy Operations: You can keep payroll running smoothly even when customer payments lag.

- Better Alignment with Factoring: Steady factoring inflows help you cover payroll costs on time while payroll financing fills any remaining gaps.

Asset-Based Lending

Asset-based lending can support businesses that have equipment, inventory, or other collateral to work with. It fits into a factoring strategy when invoices are not the primary asset being leveraged.

- A Broader Funding Base: By pairing factoring with asset-based lending, you can access capital through equipment, inventory, or other assets while still factoring your receivables.

- More Room for Growth: It allows you to pursue larger opportunities that require a mix of available capital sources

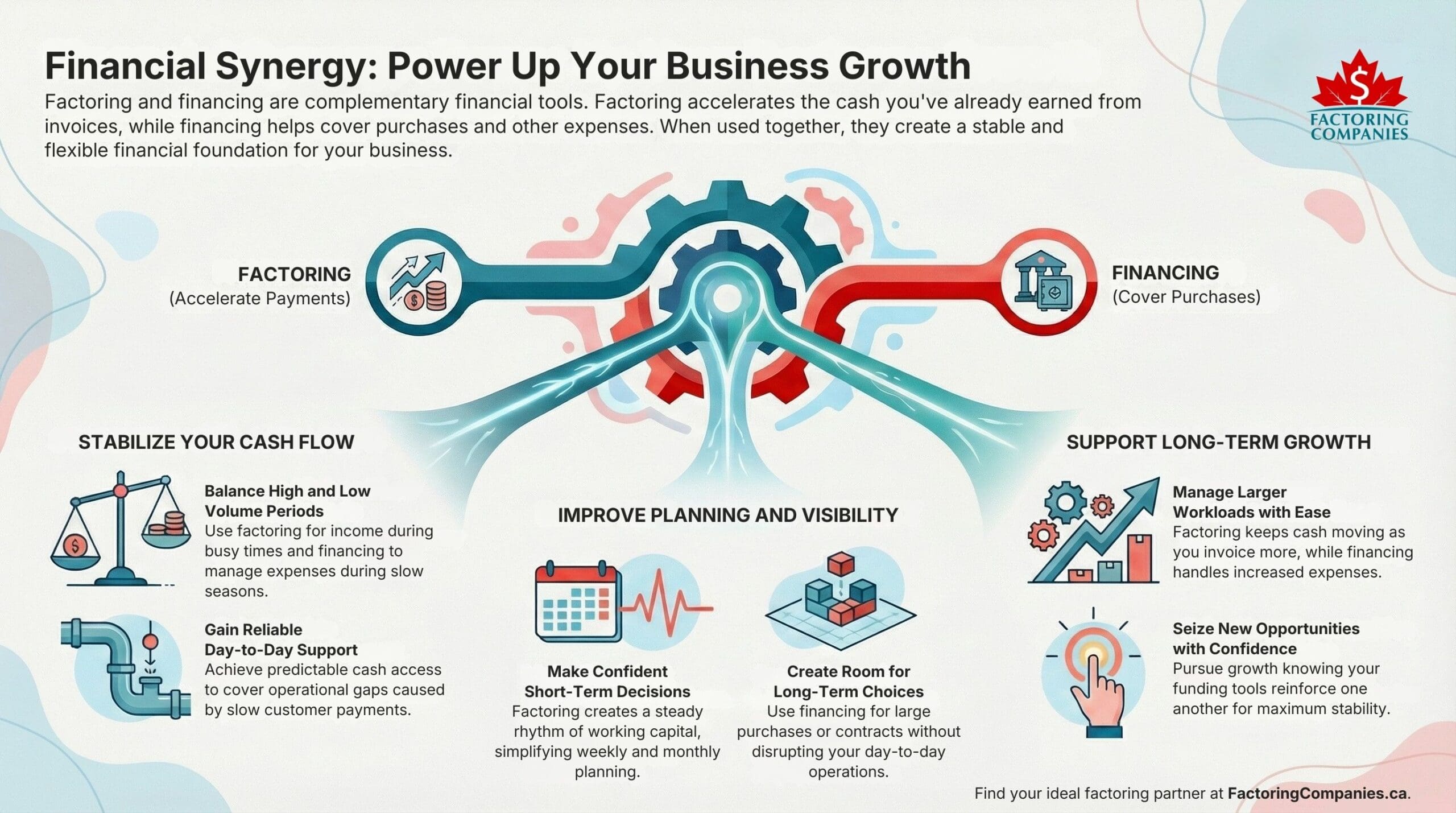

Factoring and Financing Tools Reinforce Each Other

Factoring and financing tools each solve different parts of your cash-flow picture, but their real strength shows up when you use them together. Factoring speeds up the money your business has already earned. Financing tools help you handle purchases, timing gaps, or long-term plans. When these tools support each other, your cash flow becomes steadier, your decisions become clearer, and your business gains more room to move.

Cash Flow Stabilizes Across Cycles

Your needs shift throughout the year. Some weeks bring steady inflows, while others bring delays or unexpected costs. Factoring and financing tools can work in combination to smooth these cycles.

- Better Balance During High and Low Volume: Factoring accelerates the money coming in, while financing tools help you manage expenses during slower periods or seasonal fluctuations.

- Reliable Support for Day-to-Day Operations: You gain predictable access to cash and flexible options for covering timing gaps when customer payments lag.

Planning and Financial Visibility Improve

When your funding tools work together, you gain clearer visibility into your cash flow. This helps you plan ahead rather than reacting to each challenge as it appears.

- More Confident Short-Term Decisions: Factoring gives you a steady rhythm of working capital, which supports weekly and monthly planning.

- More Room for Long-Term Choices: Financing tools help you prepare for larger purchases or upcoming contracts without disrupting your operational flow.

Long-Term Growth is Supported

Growth often brings added costs, whether you are taking on new customers, adding equipment, or entering new markets. Factoring and financing tools create a combined structure that helps you manage those shifts without losing stability.

- Support for Larger Workloads: Factoring keeps cash moving as you invoice more, and financing tools help you handle the expenses that come with higher volume.

- More Flexibility for New Opportunities: You can pursue growth with greater confidence because your funding tools reinforce one another instead of competing for attention.

Hybrid Financing Strategies Can Help Your Business Stay Financially Steady

Your business has specific cash-flow pressures, and the right mix of funding tools will match those real needs. Factoring gives you consistent access to working capital, while financing tools help you cover occasional expenses or long-term plans. When you choose tools based on how your cash flow behaves, you create a structure that supports your operations with fewer surprises.

Identify Your Most Common Cash-Flow Gaps

Your first step is to understand where the pressure shows up most often. Some businesses struggle with slow-paying customers. Others feel squeezed when payroll and supplier payments land at the same time. Knowing where your gaps appear helps you select tools that strengthen those areas.

- Clarity on Recurring Pressure Points: You can choose the right mix when you know which parts of your cash flow cause the most strain.

- Better Alignment Between Needs and Tools: Factoring supports receivables timing, while other tools help with expenses that fall outside that cycle.

Separate Daily Needs from Occasional Expenses

Your daily operations require steady cash. Larger purchases, repairs, or growth-related costs often appear less frequently but still demand attention. A funding mix works best when each tool supports the demands it is suited for.

- Steady Support for Routine Costs: Factoring keeps working capital consistent so you can handle core expenses on time.

- Targeted Support for Bigger Needs: Financing tools help you manage occasional or long-term costs without interrupting your cash flow.

Using Factoring as the Foundation of Your Strategy

Factoring sets the rhythm for your incoming cash. Once that stability is in place, you can layer in additional tools that match the rest of your financial picture.

- A Reliable Base for Cash-Flow Planning: Factoring gives you predictable access to funds, which supports weekly and monthly decisions.

- A Flexible Structure for Growth: You can add financing tools that complement factoring when your business takes on new opportunities or needs more capacity.

Shifts in Growth or Demand Signal the Need for a New Cash-Flow Plan

As your business enters new stages, the pressure on your cash flow changes. These shifts are often signs that your company is moving in the right direction, but they also mean your funding tools need to keep pace. When you understand what is changing and why, you can adjust your cash-flow strategy to support your next level of growth with more confidence.

Consistent Growth in Sales Volume

Higher sales are a positive sign, but more activity increases your need for working capital. Factoring and financing tools can help you maintain your momentum without feeling stretched.

- More Movement Through Your Operations: Increased sales often require more supplies, labour, and transportation, which raises your short-term funding needs.

- A Stronger Case for Layered Funding Tools: Steady growth gives you room to combine factoring with other options that support larger or more frequent orders.

Customers with Longer Payment Terms

As you work with bigger customers, you may see payment timelines extend. Longer terms often support stronger opportunities, but they create more timing pressure.

- Higher Demands on Your Working Capital: You still need to cover payroll, suppliers, and fuel while you wait for payments to arrive.

- More Value from Factoring and Financing Together: This combination helps you stay steady while building relationships with larger customers.

Expansion into New Markets

Entering a new market often brings fresh opportunities, new operational demands, and higher upfront costs. Your cash-flow strategy should reflect that shift.

- Additional Operational Requirements: New regions or industries may require more equipment, staff, or inventory.

- More Flexibility for Growth Costs: A layered approach helps you support expansion without interrupting your existing operations.

Increased Equipment or Technology Needs

Growth often requires better tools, improved systems, or additional equipment. These investments are important, but they can create pressure if you rely on one funding source.

- More Capital Required for Upgrades: New equipment or technology can improve efficiency, but they raise your immediate funding needs.

- A Clear Reason to Combine Funding Tools: Factoring can support your daily operations while financing tools help you manage larger purchases.

Upcoming Contracts or Seasonal Spikes

Preparing for higher demand, new contracts, or busy seasons can stretch your cash flow. These moments call for a plan that fits your upcoming workload.

- Higher Costs Before Revenue Arrives: You may need to hire staff, purchase supplies, or increase capacity before invoices start flowing in.

- Better Preparedness Through a Layered Strategy: Factoring helps you stay consistent, and financing tools support additional needs during peak activity.

Connect with the Best Factoring Companies for Businesses

A stronger cash-flow strategy starts with the right mix of tools and the right guidance to help you choose them. Factoring can serve as a steady foundation while additional financing options support your long-term stability and growth. If you want clarity on which combinations make the most sense for your business, speak with a funding specialist.

FAQs on Using Invoice Factoring and Business Financing Tools Together

What is the difference between factoring and other financing options?

Factoring converts approved invoices into working capital, which improves timing without adding debt. Other financing tools often focus on larger purchases, long-term plans, or expenses that do not follow your receivables cycle. Using both can support different parts of your cash flow and create a more balanced financial structure.

Is combining factoring and credit lines a good idea?

Pairing factoring with a credit line works well for many businesses. Factoring keeps cash flowing through your receivables, while a credit line helps cover short-term timing gaps or expenses that fall outside the invoice cycle. Together, they create a flexible structure that supports routine costs and unexpected needs.

Should I use asset-based lending for cash flow?

Asset-based lending can support cash flow when your business has equipment, inventory, or other assets to leverage. It can fit well alongside factoring as long as invoices are not used as collateral. This combination gives you more room to manage short-term needs while pursuing larger opportunities.

Are cash flow optimization techniques still important when I factor?

Yes. Factoring stabilizes your working capital, but cash flow improves further when you manage expenses, plan ahead, and monitor payment habits. Techniques like forecasting, managing suppliers, and preparing for seasonal changes help you get more value from your factoring relationship and strengthen your financial position.

What should I look for in my factoring contract if I plan to secure other funding?

If you expect to seek additional financing, review how your factoring contract handles liens, customer eligibility, and transaction structure. Clear terms about receivables ownership and contract flexibility help you coordinate factoring with credit lines, equipment financing, or other tools without unnecessary delays.

Can I get a bank loan while factoring?

Yes, in many cases you can still get a bank loan while factoring. Banks usually want clarity on who holds the claim to your receivables, so your factoring partner may need to adjust or confirm the details of their filing. When structured correctly, your business can factor invoices and still qualify for a loan supported by other types of collateral.

What is the key to successfully managing multiple funding sources?

Success comes from choosing tools that support different parts of your cash flow and ensuring they work together. Factoring strengthens your daily operations, while financing tools handle larger or less frequent needs. Good planning, clear contract terms, and strong communication with your partners help you maintain balance.

Can I use factoring and financing at the same time?

Yes. Factoring provides quick access to working capital, and financing tools help you cover expenses or investments that fall outside your receivables cycle. Many businesses use both to create a cash-flow structure that supports growth, seasonal shifts, and operational demands more effectively.

Does factoring make it harder to get a loan or line of credit?

It can create extra steps, but it does not usually prevent financing. Lenders want to know who holds the claim to your receivables, so your factoring partner may need to coordinate with them. When structured properly, factoring can support your cash flow while you secure loans backed by other assets.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778