If your business supplies goods or services to the provincial government in New Brunswick, knowing when you will be paid is key to planning your cash flow. While public sector work can be steady, government contractor payment timelines across Canada vary, and New Brunswick follows its own approach. This guide outlines what to expect in the province and how to access your funds sooner if payment takes longer than planned.

Typical Payment Terms for Government Contractors in New Brunswick

New Brunswick’s Purchase Order Terms and Conditions commit the provincial government to pay approved invoices within 30 calendar days of the invoice date, provided the goods or services have been accepted and all contract requirements are met. This is standard policy rather than law. However, the Construction Prompt Payment and Adjudication Act covers construction projects separately and mandates that payments be made within 28 days.

Once the SNB Accounts Payable Services team receives your invoice, it is checked for completeness, entered into the invoice management system, and sent to the identified departmental Spending Authority for authorization. Payment is only made after this authorization is applied.

Interest on late payments is not automatic. To claim it, your contract must include a clause specifying the interest rate and conditions.

Common Reasons for New Brunswick Government Contract Payment Delays

Even with net 30 terms outlined in New Brunswick’s Purchase Order Terms and Conditions, payments can sometimes take longer. Below are frequent causes of delay.

Invoicing and Approval Delays

- Multiple Authorization Steps: Invoices must be reviewed by the identified Spending Authority before payment can be issued.

- Incorrect Submission: Sending invoices to the wrong contact or omitting the correct Spending Authority can hold up processing.

- Missing References: Without the required purchase order number or coding, invoices may be returned for correction.

Errors, Disputes, or Documentation Gaps

- Incomplete Information: Missing quantities, descriptions, or other required details can cause the invoice to be flagged for follow-up.

- Mismatched Details: Discrepancies between the invoice, purchase order, or delivery records can trigger a manual review.

- Unresolved Questions: If the scope of work changed or delivery acceptance is unclear, payment authorization may be delayed.

Formatting and Submission Issues

- Handwritten Invoices: The province’s invoice management system cannot reliably read handwritten text, which can slow down processing. Typewritten invoices are strongly encouraged.

- Unsupported Formats: Using a non-approved file type or sending documents in a format the system cannot process may result in delays.

Internal Processing Cycles

- Batch Payments: Departments may release payments in set cycles rather than on a rolling basis, so missing a cut-off can add time.

- Staffing Limitations: Absences or high workloads within Accounts Payable or the Spending Authority’s office can create bottlenecks.

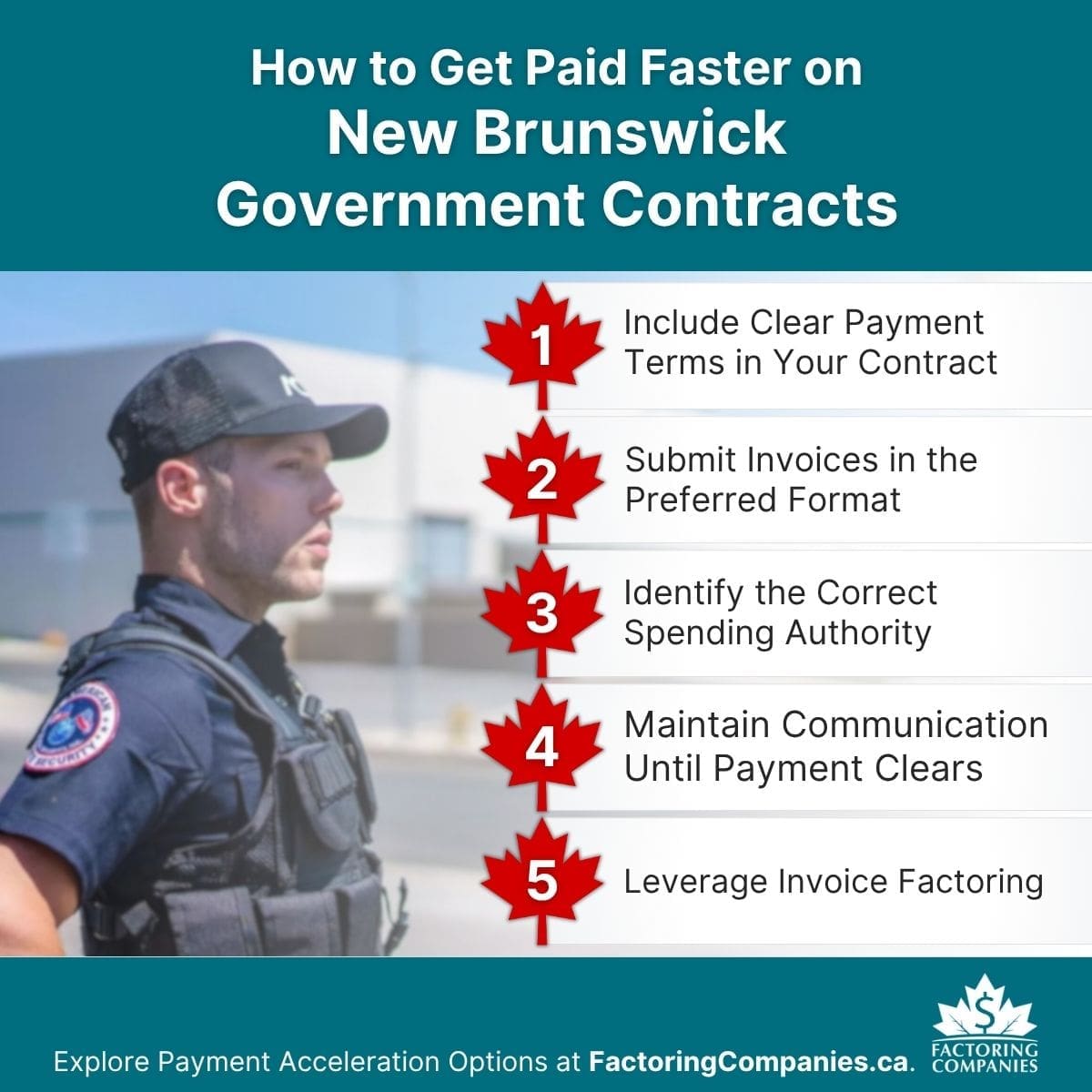

How to Get Paid Faster on Government Contracts in New Brunswick

You can’t change the province’s internal approval steps, but you can position your business to move through the process without unnecessary delays.

Include Clear Payment Terms in Your Contract

- Define the Timeline: Specify the number of days the province has to pay after receiving your invoice and confirming acceptance of goods or services.

- Include Interest Terms: If you want to claim interest on late payments, state the rate and conditions in the contract.

- Confirm the Trigger: Make sure it’s clear when the payment period starts, such as the invoice date or acceptance date.

Submit Invoices in the Preferred Format

- Use a Typewritten or Computer-Generated Invoice: The province’s system does not reliably read handwritten invoices, which can slow processing.

- Follow the Invoice Guide: Include every required field, from purchase order numbers to accurate supplier details.

- Check File Compatibility: If sending electronically, ensure the format is supported by the province’s processing system.

Identify the Correct Spending Authority from the Start

- Confirm the Contact: Before submitting your first invoice, verify the department and person responsible for approval.

- Match Contract References: Make sure all numbers, names, and codes align with your purchase order and agreement.

- Send to the Right Place: Routing errors can add days or even weeks to the payment timeline.

Maintain Communication Until Payment Clears

- Confirm Receipt: Follow up to ensure your invoice has been received and entered into the system.

- Ask About Status: If payment is approaching or past the due date, request an update from the Spending Authority.

- Provide Clarifications Promptly: Respond quickly to any questions to avoid repeated back-and-forth.

Factoring Invoices for New Brunswick Government Contractors

Even when invoices are complete and properly submitted, New Brunswick’s payment process can still stretch beyond the 30-day target. By using factoring for government contractors, you can access most of your invoice value right away, so it’s easier to manage payroll, materials, and operating costs while the province works through approvals.

How Factoring Works for Government Contractors in New Brunswick

With accounts receivable factoring, you sell an approved invoice to a third-party factoring company. The company advances most of the invoice amount within 24 to 48 hours and collects payment directly from the province when it’s due. Because the provincial government is viewed as a reliable payer, factors often offer competitive rates and flexible terms.

Benefits of Factoring for New Brunswick Contractors

- Improves Cash Flow without Adding Debt: Factoring turns receivables into working capital, with no loan repayments or interest schedules.

- Reduces Payment-Related Strain: You can keep your projects funded even when approvals take longer than expected.

- Offers Competitive Rates: Provincial government invoices are low-risk for factors, which can result in better terms.

- Allows Flexible Use: Choose spot factoring for a single invoice or factor regularly for steady cash flow.

- Supports Steady Operations During Growth: Maintain payroll, materials, and service delivery as you take on more government contracts.

Types of New Brunswick Government Contractors That Leverage Factoring

Many sectors benefit from government contractor factoring to bridge payment cycles on provincial work. A few industries are covered below.

- Construction and Infrastructure Projects: Road repairs, public building maintenance, and utility work often require upfront spending. Tailored factoring solutions for construction can keep these projects moving.

- Transportation and Logistics Providers: Vendors handling goods and equipment for government departments often use trucking or motor carrier factoring to manage expenses such as fuel and payroll.

- Healthcare Service Providers: Agencies supplying staff, medical equipment, or services to health authorities leverage healthcare factoring to cover things like payroll and inventory.

- Facility Maintenance and Service Companies: Contracts for janitorial, HVAC, or building repairs can be supported with factoring for janitorial service companies or tailored solutions for maintenance companies.

- Security and Staffing Firms: Providers of security personnel, event staff, or administrative support may use factoring for security guard companies or temporary staffing to keep payroll steady.

- Technology and Professional Services: IT firms, consultants, and other service providers working on provincial projects may choose factoring for technology companies or consultants to smooth out cash flow.

Streamline Your New Brunswick Government Contractor Payments with Factoring

Getting approved for factoring is easy for most government contractors in New Brunswick because the province is considered a reliable payer, and a client’s creditworthiness is the main factor. Even small or newer businesses can qualify. To learn more, speak with a factoring specialist.

Editor’s Note: Please note that every effort has been made to ensure the accuracy of the information provided, and links to policies are included for your reference. However, contract terms are set by individual jurisdictions and are subject to change. Be sure to check with relevant regulatory bodies and your contract as needed.

FAQs on New Brunswick Government Contract Payment Terms

Are late payments from the New Brunswick government subject to interest?

Interest is not applied automatically. To claim it, your contract must include a clause specifying the interest rate and conditions. Without this, there is no obligation for the province to pay interest, even if the payment extends beyond the 30-day target.

How can I avoid payment delays on public contracts in New Brunswick?

Use a computer-generated or typewritten invoice, include all required details, and confirm the correct Spending Authority and submission method before you send it. Ensure contract and purchase order details match exactly. Following up on receipt and approval can also help keep your payment on track.

Can I get paid faster if my invoice is delayed?

Yes. New Brunswick contractors can use factoring to access most of their invoice value in one to two business days. A factoring company advances the funds while the province completes its approval process, helping you maintain cash flow during delays.

Does New Brunswick have prompt payment laws for government contractors?

No. The province does not have legislation that requires prompt payment on all public contracts. Payment timelines are guided by contract terms and the Purchase Order Terms and Conditions, which outline a 30-day target. However, construction projects are subject to different guidelines, and a 28-day payment schedule is required.

How long does it take to get paid on a government contract in New Brunswick?

Most invoices are paid within 30 days of the invoice date if complete and approved on time. However, multi-step approvals, missing information, or routing errors can extend the payment period. Delays sometimes push payment beyond 30 days.

How can I find a factoring company that serves New Brunswick government contractors?

Factoring Companies Canada can match you with a factoring company that works with New Brunswick government contractors. Tell us a little about your business to get started.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778