The past year has challenged small business owners in ways we never could have imagined but has also brought many rewards. Reflecting on the lessons learned as we move into the new year can help us prepare for the changing landscape ahead and grow stronger, more resilient businesses. Below, we’ll quickly review some of the most important lessons we can take away from 2023.

1. Businesses Must Be Prepared for Economic Shifts

Up to seven in ten small businesses were impacted by inflation, Statistics Canada reports. Specific industries, such as wholesale trade, construction, and food and accommodations, were hit the hardest. Buyer behaviour naturally shifted, though individual businesses were impacted differently. Businesses can be better prepared for economic shifts in the future by:

- Following the lessons learned on this page.

- Keeping a pulse on changes and responding promptly.

- Diversifying revenue streams to minimize adverse effects.

2. Minimizing Debt is Essential

Over 40 percent of businesses say rising interest rates and debt costs are among their biggest obstacles, according to Statistics Canada. This figure climbed to nearly 62 percent in certain industries. One in three businesses believe they cannot repay their Canada Emergency Business Account (CEBA) loan by the new December 31, 2026 deadline, the agency reports.

Businesses in this situation can follow tips in our guide “What to Do if You Can’t Pay Back Your CEBA Loan,” such as:

- Cutting costs to make more capital available for debt payments.

- Avoiding taking on new debt.

- Increasing and accelerating receivables to ensure payments are made on time and avoid penalties.

- Exploring refinancing options.

3. Cash Flow Management Must Be a Priority

Nearly two-thirds of small businesses struggle with cash flow issues, Intuit reports. Insufficient and slow cash flow can make it difficult to cover everyday expenses. Two in five Canadian businesses have also lost $10,000 or more by forgoing a project due to insufficient cash flow.

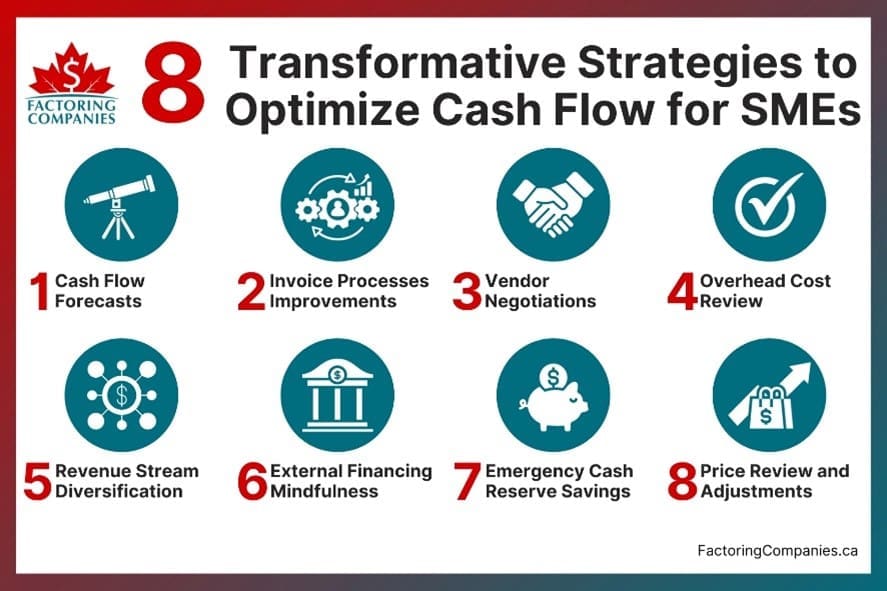

Those seeking to optimize business cash flow in the coming year can do so by:

- Forecasting cash flow to identify potential shortfalls before they become an issue.

- Improving invoice processes to accelerate cash flow.

- Negotiating with vendors to reduce costs and extend payment windows.

- Identifying ways to reduce overhead costs to reduce outflows.

- Diversifying revenue streams to boost cash flow.

- Building a cash reserve to help with emergencies.

- Reviewing pricing and adjusting as appropriate to increase cash flow.

4. Businesses Embracing Digital Transformation Are More Resilient

While we’ve touched on how different industries were impacted by economic shifts in unique ways, it’s important to note that businesses within those industries were not uniformly affected. Some are bouncing back faster and outperforming their peers by a wide margin.

Technology is a crucial difference between the two, Strategic Entrepreneurship Journal research shows. Businesses improve their adaptation speed, flexibility, and collaboration by embracing five digital capabilities:

- Virtual access.

- Virtual collaboration.

- Data-driven decision-making.

- Algorithmic re-programmability.

- Assisted decision-making.

5. Businesses Investing in Employee Well-being Thrive

Most of us intrinsically know that taking care of employees is the right thing to do, but the past couple of years have shown us that there’s a business case for it, too. Companies with higher levels of employee well-being also garner a greater return on assets, generate higher profit, and command higher valuations, according to Oxford research.

They’ve found several potential causes for the link. For instance, employees who feel good are more productive. They have better relationships with colleagues and improved communication, too. Plus, they tend to be more creative. Talented individuals also seek out companies that will boost their overall happiness, so companies with better well-being do better in recruiting and retaining the best people.

As an employer, you may already think your employee well-being is reasonably high. However, businesses are notoriously bad at gauging employee well-being, MetLife surveys show. For instance, 86 percent of employers say their employees are socially healthy, while just 67 percent of employees agree. Similar results were found when rating physical and mental health. The most remarkable difference emerged with finances, with 83 percent of businesses saying their employees are financially healthy and just 55 percent of employees agreeing.

Businesses that want to prioritize employee well-being going forward can conduct surveys to identify which areas of well-being can benefit from further reinforcement. Areas of concern include:

- Satisfaction and a sense of purpose at work.

- A social and supportive workplace culture.

- Workplace flexibility and work/life balance.

- Opportunities for professional growth and training.

- Competitive pay and compensation.

- Wellness programs and benefits.

6. Community Partnerships Keep Businesses Strong

A business’s success can often be traced back to the relationships it develops. For instance, strong vendor relationships help businesses keep costs low, and help companies avoid supply chain issues. Businesses also tend to easily navigate challenges when they have a network of experts in key areas like finance and law. Those with connections throughout the business community also feel more supported and receive more referrals.

Those hoping to improve in this area going forward may wish to:

- Schedule time to speak with suppliers regularly.

- Attend more networking events and connect with other business owners.

- Develop relationships with professionals who can help as needed, including lawyers, accountants, and funding specialists.

Be Ready for the Future with Invoice Factoring

Invoice factoring allows you to turn your unpaid B2B invoices into instant cash so you can streamline cash flow, cover expenses, or adapt to economic changes and customer demand as needed. Plus, your business doesn’t accrue debt because your clients clear the balance when they pay their invoices. It’s also flexible. You choose which invoices to factor and when to factor them.

If it sounds like invoice factoring can help you build a stronger business, we’re happy to connect you with a factoring company that aligns with your needs and offers competitive rates. To learn more or get started, request a complimentary factoring quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778