Choosing a business structure is one of the most important decisions a new or growing company makes because it impacts everything from liability to taxes. On this page, we’ll do a deep dive into sole proprietorships, including the top drawbacks and benefits of sole proprietorships and how they stack up to other options.

Types of Business Entities in Canada

Before we dig into the drawbacks and benefits of sole proprietorships, let’s quickly review the four types of business entities you can form in Canada.

Sole Proprietorships

The business and its owner are considered the same entity in a sole proprietorship, often described as an unincorporated business owned by one person. This structure is straightforward, with the owner and the business being legally indistinct, which simplifies many aspects of business operation.

Partnerships

Partnerships work like sole proprietorships but consist of more than one owner. They combine resources and talents but, like sole proprietorships, don’t provide the liability protection that a limited liability company does.

Corporations

A corporation is a legal entity distinct from its owner or operator, offering liability protection that sole proprietorships do not. Businesses may be incorporated at the federal or provincial level and must register with the state, requiring a formal structure including a board of directors and corporate officers.

Cooperatives

Cooperatives can be for-profit or not-for-profit. They work similarly to corporations and may be registered at the federal or provincial level. However, they’re distinct in that they’re organized and controlled by their members, making them unique compared to other business structures like sole proprietorships.

Disadvantages of a Sole Proprietorship

There are advantages and disadvantages associated with each type of entity. Let’s explore some of the disadvantages of sole proprietorship first.

1. You’re Personally Liable for the Business

Because the business and business owner are one and the same in a sole proprietorship, the owner is liable for anything that might happen to the company. That means the owner’s personal assets, such as home and vehicles, may be on the line if the business doesn’t fulfill its obligations. This unlimited personal liability means creditors can go after your personal assets, a major risk if the business faces legal issues or debts.

2. It’s Difficult to Secure Funding and Credit

Many investors and banks will only lend to or invest in incorporated businesses. Even if a sole proprietorship can obtain a loan, it’s usually at a higher rate than a corporation pays. Plus, corporations can raise funds in ways sole proprietorships cannot, such as by selling shares or bonds to investors.

3. Taxes Are Usually Higher

The business’s profit is considered your income when you operate a sole proprietorshipp, which means it’s subject to income tax at the personal rate. This can become expensive as your business grows, especially since sole proprietors are also responsible for self-employment taxes, including contributions to social security and medicare. This often results in a higher tax burden compared to corporations, where income splitting might reduce overall tax liabilities.

4. It’s Harder to Sell the Business

Sole proprietorships are not distinct from their owner. That means there’s no business or shares to sell if you decide to exit. Sole proprietors sell business assets to get around this, but it’s done piecemeal. For instance, you might sell your trademarks, database, or equipment. Business debts don’t necessarily transfer with them. You must negotiate every portion. This makes the process difficult and often messy.

5. Your Business May Cease to Exist When You Pass Away

If something happens to the owner, a sole proprietorship typically ceases to exist. This is a stark contrast to corporations or other structures where the entity continues. Planning for succession is crucial but often overlooked, which can end a business’s legacy abruptly. This highlights the importance of considering how your business structure affects your long-term legacy.

Advantages of a Sole Proprietorship

Despite these negatives, there are some benefits of sole proprietorships that make them one of the most popular legal structures for small businesses.

1. There’s Less Paperwork

One of the greatest advantages of a sole proprietorship is that paperwork is minimized. For instance, if your annual revenue is under $30,000 and you’re doing business under your legal name, you might not need to file at all, as BDC reports.

2. You Keep All the Profit

The business’s earnings before tax (EBT) are considered the owner’s income with a sole proprietorship and don’t need to be shared with anyone. This direct profit ownership is appealing, but it also means that owners must manage their personal tax returns carefully, as business and personal finances are intertwined, affecting personal income tax calculations.

3. You Maintain Control of Your Company

A corporation must have a board of directors with at least one director and officers, including a president and secretary. While it’s technically possible for one person to hold all these roles, a fair amount of reporting is still involved. These rules don’t apply to a sole proprietorship. Sole proprietors enjoy total control over their business decisions. This autonomy means that sole proprietors can react quickly to business challenges without the need for extensive reporting or board approval, maintaining a direct connection between owner decisions and business outcomes.

4. Accounting is Simpler

Corporations have ongoing disclosure requirements, including sharing specific financial statements throughout the year. This aspect can be complex, so most business owners must hire an accountant to manage it all. Sole proprietorships don’t have the same requirements. Those with basic financial literacy and/or good accounting software can typically manage it without external help.

5. There Are Fewer Tax Requirements

For the most part, a business owner with a sole proprietorship will keep filing taxes like they always have. However, a separate section outlines the business’s profit and loss, which must also be completed. Filing taxes as a corporation is entirely different and usually requires the help of a tax professional. The business itself pays taxes, and you pay taxes based on your income separately.

Weighing the Pros and Cons of a Sole Proprietorship

While the advantages of a sole proprietorship often make it an attractive option for small business owners due to its simplicity, fewer tax requirements, and complete control over business decisions, it’s important to consider the disadvantages as well. Unlimited personal liability means that sole proprietors face significant risks, including the potential loss of personal assets if the business incurs debt or legal problems. Additionally, the challenges in raising capital and the complications involved in transferring ownership highlight why some may prefer the protection and flexibility of a limited liability company (LLC). Ultimately, whether a sole proprietorship is right for you depends on your business goals, your willingness to bear personal risk, and your future growth and expansion plans. Careful consideration of these pros and cons will help ensure that you choose the business structure that best suits your needs.

Bottom Line: Should You Open a Sole Proprietorship?

A sole proprietorship is the easiest type of business to start and register in Canada. It’s ideal for those looking to operate their business independently with minimal paperwork and full control. But since a sole proprietorship is an unincorporated structure, there’s no legal separation between the business and personal assets of the owner. This can increase risk, especially if the business takes on debt or faces legal issues.

Many who register as a sole proprietor are freelancers or small service providers. You’ll report business income and expenses on your personal tax return—there’s no separate business tax return. To keep finances organized, it’s essential to open a business bank account under your business name and track all business transactions.

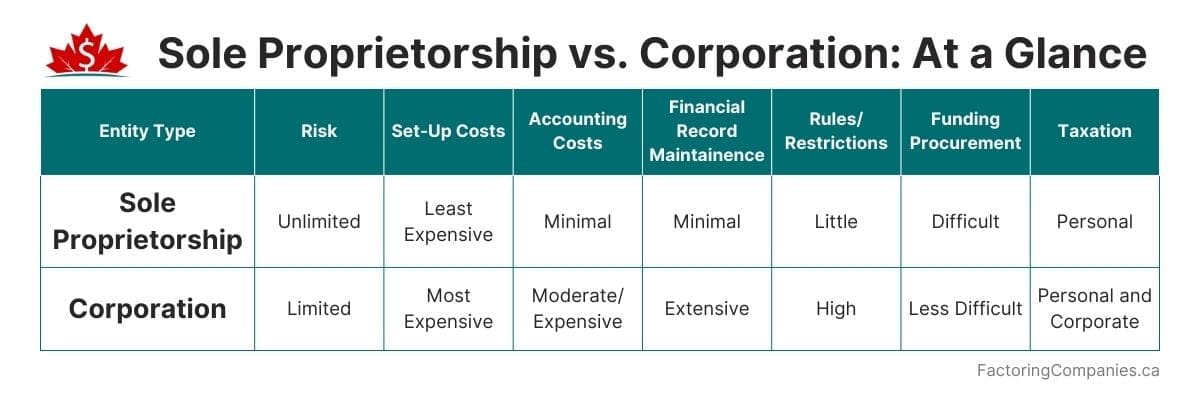

However, if you plan to scale, seek funding, or eventually sell a sole proprietorship, consider whether incorporation offers better tax advantages and liability protection. Choosing between a sole proprietor or corporation depends on your long-term goals, risk tolerance, and funding needs. Weigh the benefits of sole proprietorship carefully before deciding how to operate your business.

Help Your Small Business Get the Funding it Needs to Grow

If your business is experiencing cash flow gaps due to slow-paying clients or it’s expanding, and you need help covering everyday expenses or growth-related initiatives, an invoice factoring company may be able to provide you with advance payment on your B2B invoices. Businesses primarily qualify based on the creditworthiness of their clients because they’re the ones paying the invoices, so it’s easier to get approved. Request a complimentary rate quote to learn more or get started.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778