If you operate one of Canada’s SMEs, you know all too well how cash flow impacts the business. It’s not just about being able to turn a profit. You need to be able to pay your expenses and invest in growth, too. Thankfully, there are solutions that can help bridge gaps, like invoice factoring. Factoring’s impact on cash flow is like none other. It is not a bank loan, so it helps SMEs in ways that loans can’t. On this page, we’ll go over some ways factoring benefits SMEs to support growth so it’s easier to see if it fits your needs.

Factoring’s Impact on Cash Flow: A Brief Primer

Before we cover how factoring affects your cash flow or how it supports growing SMEs, it’s important to understand how it works. Invoice factoring is unique because factoring accelerates cash flow by providing an advance on your B2B receivables. Instead of waiting weeks or months for your clients to pay, an invoice factoring company purchases your unpaid invoice and provides you with a lump sum worth most of the invoice’s value. You choose how to spend the cash and continue running your business as you usually would. When your client pays, the factoring company sends you the remaining value of the invoice minus a nominal factoring fee.

Because your client is the one paying the invoice, their creditworthiness is weighed more heavily than yours. That means most SMEs qualify, including those that have been turned down for loans. In this respect, factoring’s impact on cash flow is what you make of it. You can factor a single invoice or factor them all. You can also sign up with a factoring company and wait months to factor or factor one invoice right away and then never again. It’s a very versatile solution.

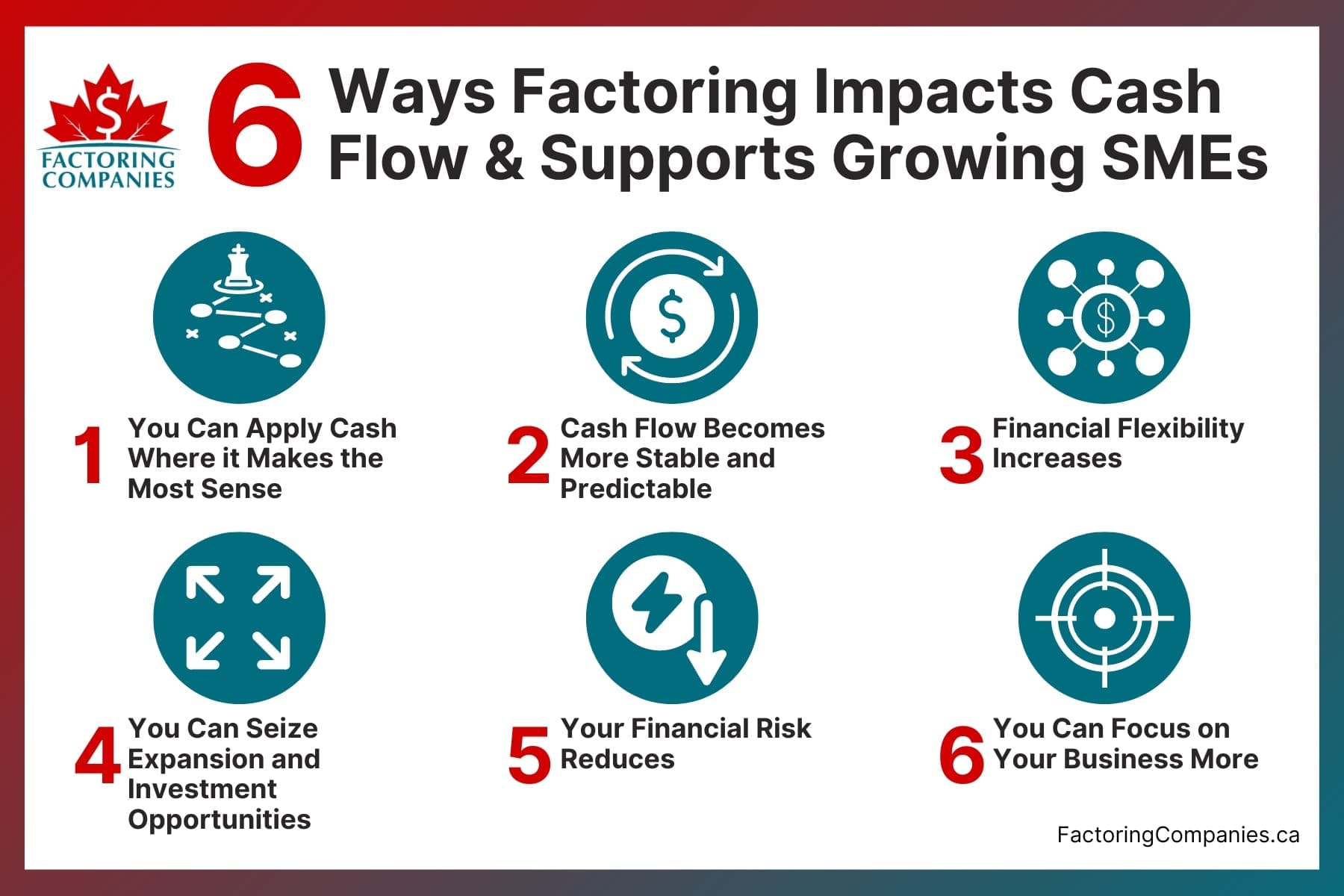

6 Ways Invoice Factoring Supports Growing SMEs

Now that we’ve covered factoring’s impact on cash flow, let’s look at what this means for growing SMEs.

1. You Can Apply Your Factoring Cash Wherever it Makes the Most Sense

Slow-paying clients and rapid growth often leave SMEs with cash flow gaps. In other words, there’s a small window in which the business can’t pay its bills, even though it may be profitable, and the cash will eventually be there to cover things. Unfortunately, without some way to bridge this gap, SMEs typically wind up missing payroll and losing valued employees or racking up late fees. Thanks to the cash flow impact of factoring, you don’t need to face these consequences. You just use the money you’ve already earned but haven’t been paid to cover them.

2. Your Cash Flow Becomes More Stable and Predictable

Cash flow management is complex when you operate an SME. You have very little wiggle room, so even a single delayed payment or modest seasonal shift may make it impossible to keep up with your expenses. This is no doubt why more than 80 percent of small business closures can be traced back to poor cash flow management, NFIB reports.

Suppose you’re struggling with inconsistent cash flow that makes it difficult or impossible to gauge when you can spend money. In that case, invoice factoring can prove invaluable by making it easy for you to determine exactly when your revenue will arrive.

3. You’ll Have Greater Financial Flexibility

If your SME secures a loan, you’re committing to making payments on that loan regardless of what happens for the duration of the term. The same is true of lines of credit, credit cards, and merchant cash advances. Factoring is the only solution in which you have total control over the funding. You choose when you want to factor and for which invoices. When your client pays their invoice, you’re done. There’s no debt to pay off and no requirement to keep making payments.

Another option that offers greater flexibility than traditional loans is asset-based lending, which allows SMEs to unlock working capital using receivables, equipment, or inventory as collateral, without the rigid terms and credit barriers of conventional financing.

For businesses in industries like transportation or staffing, factoring solutions often include additional benefits, such as fuel discount cards or other tailored financial tools, to enhance cash flow efficiency. These added features provide SMEs with even more flexibility to navigate operational expenses and maximize growth opportunities.

4. You Can Seize Expansion and Investment Opportunities

Try telling a bank that you need cash the day you request it or even within a week. You’ll likely be told it’s impossible because specific regulatory requirements necessitate an extended timeline. It takes at least two weeks to be funded through traditional channels, as Shopify reports. On the longer side of things, two months isn’t unheard of. Opportunities like business acquisition and real estate deals can evaporate long before this. If you don’t already have the cash on hand to seize growth opportunities or a way to secure cash fast, your competitor will seal the deal before you do.

In addition to factoring, many SMEs leverage equipment leasing and financing to quickly access the machinery or technology they need without depleting working capital, giving them a competitive edge in high-stakes growth scenarios.

Conversely, a factoring company typically pays you within two business days of submitting an invoice. Some even offer same-day funding. This ensures you can seize every growth opportunity that comes your way instead of fueling the growth of your competitors.

5. Your Financial Risk Reduces

Roughly 1.6 percent of receivables will become bad debt for a typical SME, according to Wolters Kluwer research. Although you may never be able to eradicate the risk of bad debt completely, you can minimize it. One fundamental way factoring companies do this is by running credit checks on your clients for you. That way, it’s easy to tell if a company is likely to pay its balance and how much credit you can extend while keeping your risk of non-payment as low as possible.

6. You Can Focus on Your Business More

Supporting growing SMEs through factoring is not the only way factoring companies help. Many offer value-added services, such as invoice preparation and collections. This allows you to focus on running daily operations and growing your business.

Factoring as a Key Strategy for SME Growth and Stability

Factoring for small businesses is not just a tool for improving cash flow; it’s a strategic asset that fosters business growth and financial stability. By transforming accounts receivable into immediate cash, SMEs gain the working capital needed to navigate cash flow challenges and invest in their future. With the benefits of factoring, including non-recourse factoring options, businesses minimize their financial risk and enhance their liquidity. This flexibility allows SMEs to accelerate their operations, negotiate better payment terms, and maintain robust customer relationships. Ultimately, factoring supports a holistic approach to business finance, enabling small business owners to focus on their core activities while managing cash efficiently and seizing opportunities for accelerated growth.

Experience Factoring’s Impact on Cash Flow Firsthand

Whether you need to bridge cash flow gaps, want to focus more on your business, or are trying to scale, factoring can help. To learn more or get started, request a complimentary rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778