You’re probably exploring the idea of invoice factoring because you want to improve cash flow. But did you know that your own internal processes still play a major role in the speed and efficiency of payments? Give us a few minutes, and we’ll walk you through why it’s essential to align your billing cycle with factoring and how to make it happen to ensure factoring delivers maximum value for your business.

Benefits of Aligning Your Billing Cycle with Factoring

When you line up your billing practices with your factoring arrangement, you set your business up for greater success.

Faster Access to Cash Flow

If you send invoices at the same rhythm as your factoring company funds, you avoid gaps where you are waiting for both your client and your factor. For example, weekly invoicing paired with weekly funding ensures a steady inflow instead of peaks and valleys.

Lower Administrative Burden

Standardising your billing schedule reduces back-and-forth with your factor. When they know when to expect batches of invoices, they can process them more efficiently, which saves you time and staff resources.

Predictable Working Capital

Aligning cycles creates consistency. Instead of getting a lump sum at unpredictable times, you receive funds at regular intervals. This predictability makes it easier to manage payroll, supplier payments, and taxes.

Stronger Client Relationships

Consistency in billing is a sign of professionalism. When your clients see that invoices arrive on a set schedule, it reinforces reliability, which also benefits your factoring relationship because it lowers the risk of disputes.

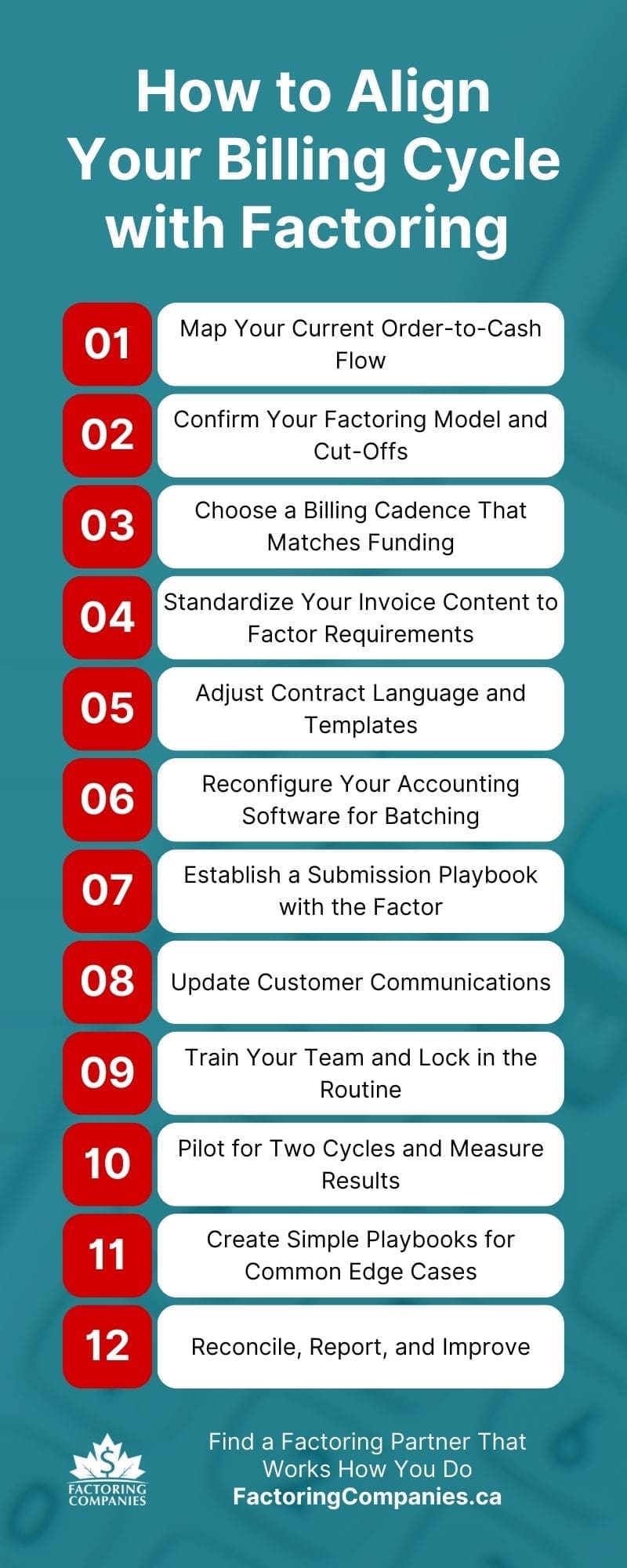

How to Adjust Billing for Factoring: Step-by-Step Instructions

You can align invoicing with your funding cycles in a few deliberate moves. Start simple, then tighten the process over two to three billing cycles.

Step 1: Map Your Current Order-to-Cash Flow

- Document the End-to-End Path: Capture how a sale becomes cash, from purchase order to proof of delivery to invoice to collection.

- Identify Bottlenecks: Note where invoices stall, such as missing purchase order numbers, delayed approvals, or disputed rates, so you can optimize invoices for approval.

- Quantify Baseline: Record average days to invoice, average days sales outstanding, and the number of credit memos per month.

Step 2: Confirm Your Factoring Model and Cut-Offs

- Align in Recourse Terms and Eligibility: Clarify what your factor will purchase, advance timing, reserve releases, and disqualifying issues like missing signatures or unsigned work orders.

- Set Funding Rhythm: Ask for clear cut-off times for same-day, next-day, or twice-weekly funding so your billing cadence matches the funding cadence.

- Establish Submission Channels: Confirm portals, file formats, and naming conventions for invoice batches and supporting documents.

Step 3: Choose a Billing Cadence That Matches Funding

Pick a cadence that the factor can reliably support and your team can execute without errors.

- Weekly Batching: This method may be best when you generate steady volume. For example, batch all approved work from Monday to Friday and submit every Friday by 3 p.m. to fund on Monday or Tuesday.

- Twice-Weekly Batching: This approach is useful for payroll-heavy firms like staffing and field services that want a mid-week and end-of-week factoring payment schedule.

- Daily Invoicing: This works when you have high volume and automation. Keep a strict cut-off to avoid partial or duplicate batches. If your factor offers same-day funding that you’re leveraging and there’s a cut-off time, consider setting your timeline to an hour before the deadline.

Step 4: Standardize Your Invoice Content to Factor Requirements

- Invoice Completeness Checklist: Customer legal name, remit-to, purchase order or work order, service period, unit rates, taxes, freight, and payment terms.

- Proof Packages: Attach proof of delivery, signed timesheets, field tickets, or milestone sign-offs exactly as the customer requires.

- Customer-Specific Rules: Maintain profiles for major customers that specify portal uploads, electronic data interchange (EDI) references, tax rules, and contact emails.

Step 5: Adjust Contract Language and Templates

- Payment Instructions: Ensure the invoice and statement show the factor’s lockbox and electronic remittance details.

- Notice of Assignment: Coordinate a clean notice to customers so remittances flow to the factor without exception.

- Dispute Handling: Define how you and the factor will communicate and resolve short pays or quality issues before the due date.

Step 6: Reconfigure Your Accounting Software for Batching

- Create Batch Codes: Use classes, tags, or projects in QuickBooks, Sage, or NetSuite to group invoices by funding batch and date.

- Automate Cut-Offs: Set scheduled invoice creation at a fixed hour and lock batches after submission to prevent edits that break reconciliation.

- Attachment Discipline: Require proof documents at invoice creation so submissions are complete on the first pass.

Step 7: Establish a Submission Playbook with the Factor

- File Structure and Naming: Include one PDF per invoice with supporting documents in order, or a single batch file if the factor prefers.

- Exception Rules: Decide what to do with invoices that are missing proof or have rate differences so they do not hold the entire batch.

- Acknowledgement and Funding ETA: Get written confirmation that specifies what is funded, what is pending, and why.

Step 8: Update Customer Communications

- Invoice Cover Note: Add a plain-language line that invoices have been assigned and include the factor’s remittance details.

- Accounts Payable Contacts: Verify emails, portals, and approval steps for large customers so submissions reach the correct queue.

- Statement Rhythm: Send statements that match your batch timing to keep receivables clean and easy to reconcile.

Step 9: Train Your Team and Lock in the Routine

- Roles and Hand-Offs: Clarify who collects proof, who creates invoices, who reviews, and who submits to the factor.

- Two-Person Review: Use a brief checklist review before each batch to minimize rejections and delays.

- Close The Loop: After funding, post advances and reserves the same day so your ledger reflects reality.

Step 10: Pilot for Two Cycles and Measure Results

- Target Metrics: Track days to invoice, advance timing, exceptions per batch, and collections by due date.

- Customer Outliers: Identify customers that need different documentation or a separate batch day to keep funding smooth.

- Tighten Cadence: If you started weekly and your factor funds reliably, consider moving to twice weekly for steadier cash flow.

Step 11: Create Simple Playbooks for Common Edge Cases

- Short Pays and Disputes: Route disputes to operations within 24 hours, issue corrected invoices if needed, and keep the factor updated so reserves release quickly.

- Partial Deliveries: Invoice what is accepted and hold the remainder for the next batch to avoid confusion.

- Chargebacks from Portals: Track portal rejections and update your customer profile rules to prevent repeats.

Step 12: Reconcile, Report, and Improve

- Batch-Level Reconciliation: Tie each funded batch to deposits, fees, and reserves so statements match cash.

- Monthly Review: Meet with your factor to review exception trends and explore file-format or portal tweaks that reduce handling time.

- Quarterly Optimisation: Revisit cadence, cut-offs, and customer profiles as your volume, seasonality, and pricing evolve.

Additional Tips for Synchronizing Invoices with Factoring

Following a few additional tips and best practices will make it easier to synchronize your billing with accounts receivable factoring.

1. Audit for Consistency, Not Speed

It is tempting to focus on shaving off hours, but synchronizing works best when your process is consistent week to week. Factors value predictability as much as timeliness.

2. Use Cash Flow Forecasting as a Guide

Build a rolling cash flow forecast and align invoice submissions to when you anticipate pressure points like supplier payments or tax remittances.

3. Segment Customers by Payment Behaviour

Some customers approve quickly, others drag their feet. Time your submissions so the quick-paying accounts keep your funding flow steady while slower ones are layered in.

4. Treat Synchronization as a Team Sport

Operations, sales, and finance all feed into the invoice process. Synchronization breaks down if even one group is late delivering paperwork.

5. Review and Adjust Quarterly

Customer habits, volume, and even your factor’s processes can shift. Revisit your synchronization rhythm every few months rather than treating it as set-and-forget.

6. Follow Best Invoicing Practices for Factoring

Ensure every invoice is complete, accurate, and consistent, with correct customer details, purchase order or work order numbers, taxes, and proof of delivery. Clean invoices reduce disputes and speed up funding.

7. Leverage Automated Invoicing for Factoring

Use accounting software features or integrations that generate and send invoices automatically at set times. Automation reduces errors, keeps your billing cycle consistent, and ensures invoices reach your factor on schedule. Alternatively, you can work with a factoring company that generates invoices for you.

8. Set Invoice Payment Terms for Factoring Requirements

Use clear, standard terms such as Net 30 or Net 45 that match what your factor accepts. Consistent terms make it easier for your factor to project collections, prevent disputes with customers, and keep funding predictable.

9. Consider Factoring Fees and Billing Cycles

Because fees are linked to the length of time invoices stay open, submitting invoices quickly and on a consistent schedule reduces carrying costs, keeps funding more affordable, and helps you maximize efficiency.

Find a Factoring Partner That Works the Way You Do

Whether you’re hoping to batch bill, work more efficiently through automation, or need the convenience of same-day payments, it’s important to find a company that works how you do. However, every factoring company operates a little differently. To get started, request a complimentary rate quote.

FAQs on Billing Cycle/ Factoring Alignment

How does factor billing work?

Factor billing works by submitting your invoices to a factoring company, which advances you a percentage of their value right away. The factor collects payment directly from your customers according to the invoice terms, then releases the remaining balance to you, minus fees, once your customer has paid.

How can I improve cash flow optimization with factoring?

You can improve cash flow optimization with factoring by standardizing your invoicing schedule, keeping invoices accurate and complete, and submitting them quickly after work is done. Using automation and aligning submissions with payroll or major expenses ensures steady funding, lowers administrative stress, and maximizes the benefits of factoring.

What does factoring involve in cash flow management?

Factoring in cash flow management involves turning unpaid invoices into immediate working capital. Instead of waiting thirty to sixty days for customers to pay, you receive an advance right away. This approach stabilizes cash flow, helps you cover regular expenses, and supports growth without taking on additional debt.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778