Selecting accounting software for a small business can be challenging. You need something that fits your needs today, will grow with your business, and fits your budget. But how can you know which options check off all the boxes before you sign up?

On this page, we’ll provide some background, go over what to look for in accounting software, and cover a few popular options to kickstart your search.

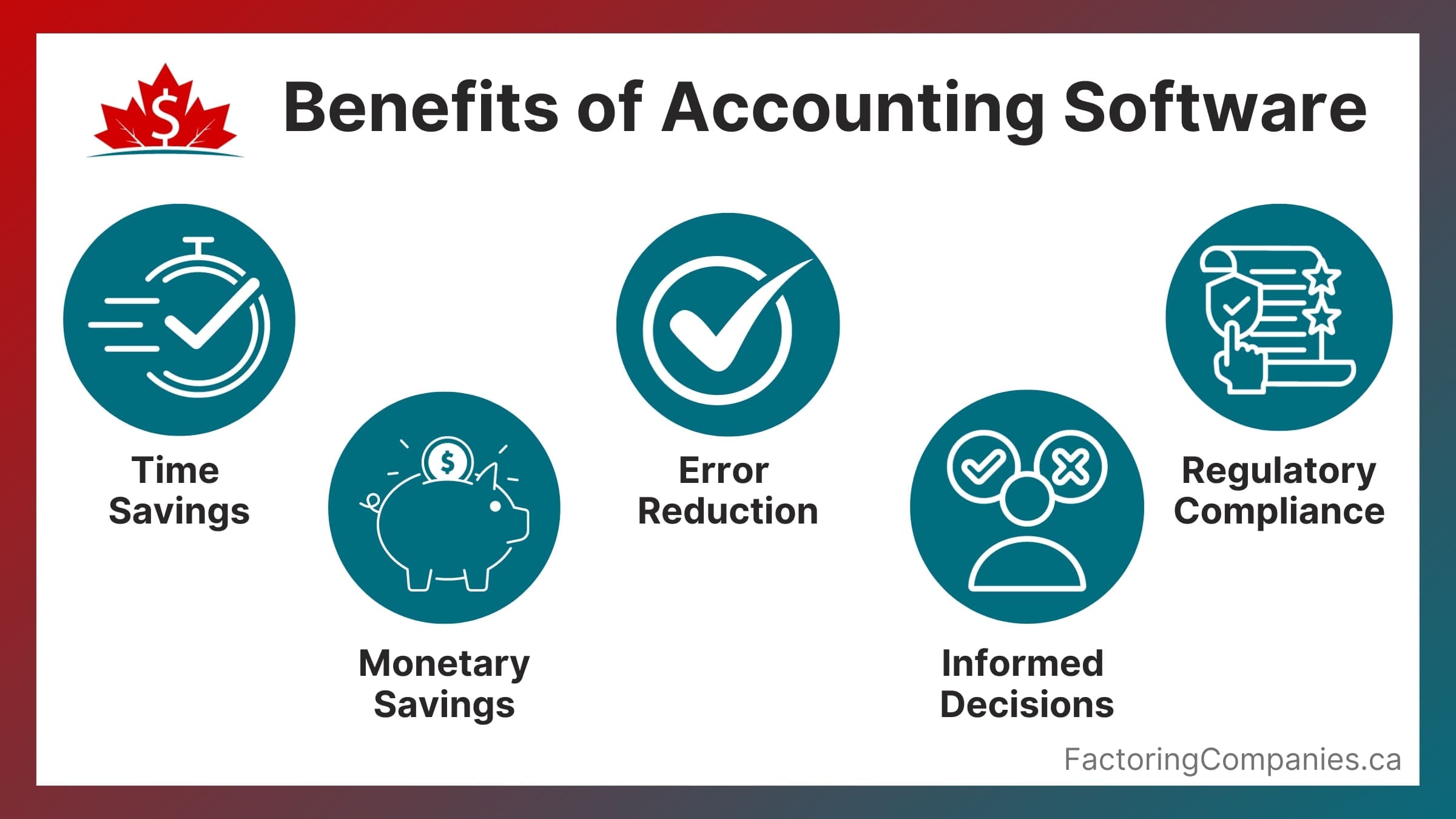

Benefits of Accounting Software Packages for Small Business

Canadians pace our neighbours to the south for technology adoption, per BDC. That means just shy of half of all small businesses aren’t using accounting software yet, based on Chamber of Commerce research. If you’re among them, leveraging accounting software can benefit your business in many ways.

- Time Savings: Most small businesses can save 20 hours a month or more by eliminating tedious or repetitive tasks that accounting software will take care of.

- Error Reduction: Your software will take care of the calculations for you. Some also offer reconciliation and will read the documents you scan to reduce errors and save time.

- Regulatory Compliance: It can be challenging to keep track of all the rules you’re supposed to follow as a small business owner, but accounting software is designed with the laws in mind, so you stay in compliance almost effortlessly.

- Monetary Savings: Small businesses can easily save thousands of dollars each year based on labour savings alone.

- Informed Decision-Making Anytime: Most modern accounting software for small businesses stores your data in the cloud, so you can check your numbers anytime and make data-driven decisions anywhere, anytime.

What to Look for in Accounting Software

As you select your accounting software, look for the following traits to help ensure the one you go with meets your needs now and continues to work for you as your business grows.

1. Accounts Receivable and Accounts Payable

Most accounting software platforms allow you to track accounts receivable (money coming into your business) and accounts payable (money flowing out of your business). However, they differ in the features they offer in this respect.

Accounts Receivable

- Invoice preparation

- Payment reminders

- Payment recording

- Receivables reports that show you things like which customers owe you money, how much money is outstanding, and the average age of invoices

Accounts Payable

- Vendor bills

- Operating expenses

- Reminders to pay

- Payables reports that show you what’s outstanding and when you need to pay

2. Payment Gateways

Well-made accounting software handles everything related to payments, including providing payment gateways. That way, you can send bills digitally, your customers can pay right from the link, and payments are automatically logged in your software. Some include payment gateways as part of the core features but charge a fee for each payment received, while others have a payment gateway as an add-on and then charge fees on each transaction. It’s essential to keep this in mind as you explore your options and price things out.

3. Capacity for Both Cash-Based and Accrual-Based Accounting

Most small businesses use the cash-based accounting method. That means you record receivables when the money arrives and record payables when you send the bill. It’s the more accurate form of accounting but is only manageable when you don’t have a high volume of receivables and payables.

As businesses grow, they often switch to accrual-based accounting. That means they record transactions and expenses as they occur before any money actually changes hands. This is naturally less accurate because invoices aren’t always paid when you expect them to be. However, it’s more manageable for businesses with lots of receivables and payables and businesses that use this method often have a large enough cash surplus that it’s not an issue.

If you’re presently using the cash-based accounting method, odds are that you’ll switch to accrual-based at some point in the future. If you don’t want to have to change software at that point, make sure the platform you choose now can help you pivot later.

4. Tax Readiness

Your accounting software should work with multiple tax rates, allow you to calculate your tax liability, and produce reports that allow you to comply with all tax regulations. While most large software companies include this aspect, not all are designed for Canada or have the latest provincial and local tax rates.

5. Automation

Automation is one of the most important features that ensures you receive ROI from your accounting software investment. The ability to scan receipts and invoices and automatically record payments are common features. Auto charges, reminders, and reports can also save you considerable time and allow you to focus on the core areas of your business more.

Popular Accounting Apps

Some of the most popular options for accounting software for small businesses are covered below. Each one offers a free trial or a free version, so you can test it out to see if it fits your needs.

- QuickBooks (free 30-day trial)

- Xero (free 30-day free trial)

- FreshBooks (free 30-day free trial)

- Wave (free, earns money through add-ons)

- Zoho Books (free tier + 14-day free trial)

Get Help Streamlining Your Cash Flow

Accounting software can help your small business better understand its cash flow and working capital needs. It can often help you predict potential cash flow shortfalls, too. However, your business will likely continue to struggle to maintain a healthy cash flow if your clients take too long to pay or your cash flow is inconsistent. This is where invoice factoring comes in. It provides you with instant payment on your outstanding receivables, so you don’t have to wait 30 or more days for payment. You can get up to 95 percent of an invoice’s value right away. To learn more or to start streamlining your cash flow with factoring, request a complimentary rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778