Very few people start out knowing how to manage business cash flow. In fact, roughly two out of three small business owners say they’ve experienced cash flow issues, according to QuickBooks. This leads to a plethora of issues. For instance, one in three small business owners has been unable to pay themselves, Xero surveys show. Stress, anxiety, difficulty meeting payroll, and other concerns are reported, too. Thankfully, many of these challenges evaporate once you have a strong cash flow management system in place. We’ll walk you through how to do it in the guide below.

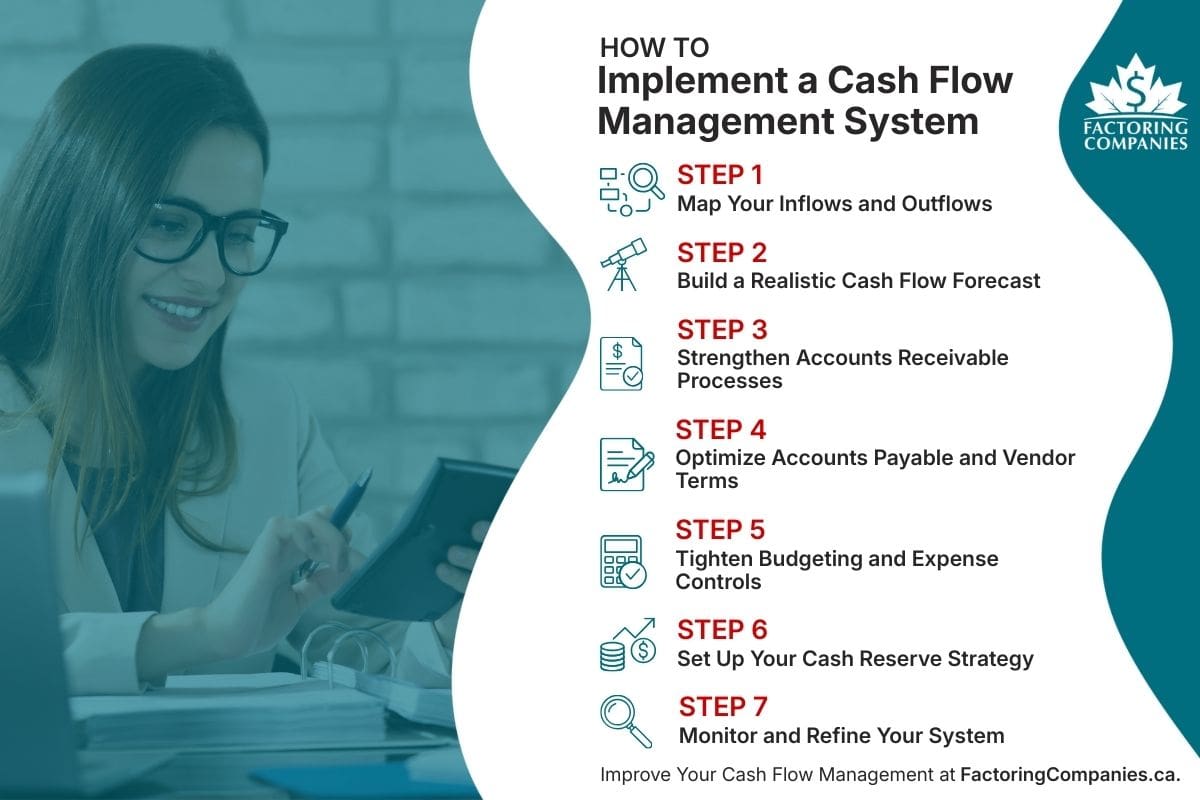

Step 1: Map Your Inflows and Outflows

Before implementing cash flow strategies, you need visibility into where cash enters your business, where it leaves, and when those movements occur.

Identify All Cash Inflows

Start by listing every way cash comes into your business. Focus on real payments received rather than recorded revenue. This distinction is especially important if your customers pay after services are delivered.

- Customer Payments: Include invoices by client, payment terms, and typical payment timing.

- Recurring Revenue: Account for subscriptions, retainers, or contract-based payments.

- Other Income Sources: Include grants, rebates, tax credits, or owner contributions when applicable.

Identify All Cash Outflows

Next, document where cash leaves your business. Be thorough. Small recurring expenses can add up quickly and often get overlooked.

- Operating Expenses: Capture rent, utilities, software subscriptions, insurance, and similar fixed costs.

- Payroll and Contractor Costs: Include wages, benefits, payroll taxes, and seasonal labour expenses.

- Supplier Payments: Record vendor invoices, purchase schedules, and typical payment terms.

- Debt Obligations: Include loan repayments, lines of credit, and credit card balances.

- Tax Remittances: Account for GST or HST, payroll remittances, and corporate tax instalments.

- Owner Withdrawals: Include regular or irregular payments made to yourself or other owners.

Add Timing to the Picture

Once inflows and outflows are listed, timing becomes the focus. This is where many businesses uncover the real cause of cash strain. If customers pay in 45 days but suppliers expect payment in 15, the gap must be managed.

- Payment Timing: Note when cash is actually received or paid, not when it is invoiced or incurred.

- Seasonal Patterns: Identify months where inflows slow or expenses increase.

- One-Time Obligations: Flag large, infrequent payments that can disrupt cash availability.

Step 2: Build a Realistic Cash Flow Forecast

With your inflows and outflows mapped, you can start projecting what your cash position will look like in the weeks and months ahead. A clear forecast helps you plan around gaps, avoid last-minute scrambles, and prepare for growth with confidence.

Forecast Short-Term Cash Flow First

Begin by building a rolling forecast that covers the next four to 12 weeks. A weekly view makes it easier to manage payroll, rent, vendor payments, and other immediate needs. This can be done manually in a spreadsheet to start. Just be sure to update it weekly so it reflects your current realities.

- Incoming Cash: Forecast payments you expect to receive based on invoice due dates and typical client behaviour.

- Outgoing Cash: Include payroll, vendor invoices, loan payments, subscriptions, and taxes by the week they are due.

- Cash Position: Subtract outflows from inflows to see your projected cash balance at the end of each week.

Add a Long-Term View

Once you have a reliable short-term process in place, start layering in a monthly forecast that looks six to 12 months ahead. This helps you plan for larger decisions and spot trends early.

- Sales Estimates: Base monthly projections on prior years, seasonal shifts, or pipeline visibility.

- Lump-Sum Expenses: Include upcoming equipment purchases, annual insurance premiums, or tax instalments.

- Scenario Planning: Model a few different paths, such as taking on a new client, hiring, or losing a major contract.

Use Software to Simplify and Scale

If you are still tracking everything manually, this is a good time to consider software. Many tools can automate your forecast and alert you to changes before they become issues.

- Automate Forecasting: Accounting software like QuickBooks, Xero, and Sage can sync with your bank feeds to keep short-term forecasts current.

- Strengthen Forecasting and Modeling: Apps like Float, Dryrun, or Fathom offer more robust forecasting and scenario modelling features.

- Get Real-Time Data and Alerts: Some platforms let you set thresholds and view projected cash balances, overdue invoices, and risk areas in real time.

Step 3: Strengthen Accounts Receivable Processes

Small business cash flow problems often arise simply because the gap between performing work and getting paid is too long. Strengthening your accounts receivable process helps ensure the money you are owed actually arrives on time and in full.

Set Clear Credit Policies

Before extending credit to a client, make sure you understand their payment habits and set expectations from the start. Set a credit policy that’s easy for your team to apply and for clients to understand.

- Eligibility Criteria: Define what qualifies a customer for payment terms, such as order history, size, or credit checks.

- Payment Terms: Decide how long customers have to pay, and apply those terms consistently across your business.

- Limits and Conditions: Set maximum balances or limits on how much credit you extend to any single client.

Invoice Accurately and Promptly

The speed at which payments arrive hinges on your timing and accuracy. Automation can help across a wide variety of areas if you’re leveraging accounting software.

- Send Invoices Immediately: Issue invoices as soon as goods or services are delivered, not days or weeks later.

- Include All Required Information: Make sure your invoices include the purchase order, due date, payment instructions, and a contact for questions.

- Use a Consistent Format: Stick to a standard template so clients know what to expect, and your team can track payments more easily.

Formalize Your Collections Workflow

Following a structured process for collections makes it easier to manage.

- Set a Reminder Schedule: Create a timeline for reminders, such as three days before the due date, on the due date, and at regular intervals afterward.

- Escalate When Needed: Decide when a missed payment moves from your accounts team to management or collections, and document that threshold.

- Track Collection Outcomes: Keep a record of which strategies work best and which clients require more effort to collect from.

Leverage Invoice Factoring

Even when you follow all the best practices outlined here, some customers may still take longer to pay. Many B2B industries also have long payment windows. For instance, 30-day or longer windows are the norm in trucking, and, in oil and gas, large corporations often push contractors into 90-day payment terms. In the meantime, there’s fuel to purchase, equipment to maintain, and payroll to cover. These challenges can be solved through invoice factoring, sometimes referred to as accounts receivable factoring.

- Faster Payment: With factoring, you sell your invoice to the factoring company and receive most of the invoice’s value right away.

- Collections Services: Once the invoice is accepted by the factoring company, they take over the collections process, saving you time and money.

- Bad Debt Reduction: Factors typically run credit checks on your customers, so you can make informed decisions about who to extend credit to and how much, which reduces the risk of bad debt. Some factors also offer non-recourse factoring, which transfers the risk of non-payment to the factor in certain cases, such as if the customer becomes insolvent.

Step 4: Optimize Accounts Payable and Vendor Terms

Controlling how and when money leaves your business is another major component of cash flow management. By optimizing your accounts payable processes, you can hold onto cash longer without damaging vendor relationships or missing critical payments.

Create a Structured Payment Schedule

Managing payment timing intentionally gives you more control over your cash position. Instead of paying invoices the moment they arrive, group and schedule them based on priority, due date, and available cash.

- Review Due Dates Weekly: Monitor upcoming payments each week and plan accordingly to avoid last-minute decisions.

- Batch Payments: Process payments in weekly or biweekly cycles instead of ad hoc, so you can better forecast outflows and reduce admin time.

- Prioritize Strategically: Pay essential vendors, government obligations, and critical services first. Schedule the rest to align with inflows.

Implement an Internal Approval Workflow

If your team is growing, or if you are delegating finance tasks, set clear controls around who can approve expenses and how payments are processed.

- Define Approval Tiers: Create thresholds for who can approve payments based on amount or department.

- Use Centralized Systems: Rely on accounting software or payment platforms that offer built-in approval chains and audit trails.

- Prevent Duplicate or Unauthorised Payments: Include a simple review step before funds leave your account.

Negotiate Better Vendor Terms

Many vendors are open to adjusting payment terms, especially if you have a solid history or place regular orders. Taking the time to negotiate can free up working capital without borrowing.

- Extend Payment Terms Where Possible: Moving from net 15 to net 30 or net 60 can ease pressure during slow periods.

- Ask About Early Payment Discounts: Some suppliers offer a percentage off if you pay before the due date, which can reduce costs if cash is available.

- Build Relationships: A strong vendor relationship often leads to more flexibility when you need it.

Step 5: Tighten Budgeting and Expense Controls

Make sure your money is being used intentionally and give your business the structure to make smarter decisions as conditions change.

Establish a Regular Review Cadence

Build in regular checkpoints to stay aligned with your goals and adjust for unexpected changes.

- Monthly Budget vs. Actual Reviews: Compare what you planned to spend with what actually happened. Use the results to adjust upcoming budgets or spot trends early.

- Quarterly Planning Sessions: Step back each quarter to assess progress, identify risks, and make broader financial decisions.

- Department or Project-Level Reviews: If your business has multiple teams or cost centres, review those budgets separately to see where adjustments are needed.

Run Scenario Planning Exercises

No business can predict the future, but you can prepare for it. Scenario planning gives you a structured way to explore what might happen and how your cash flow would respond.

- Best-Case and Worst-Case Models: Forecast outcomes if revenue grows faster than expected or slows down sharply.

- Operational Shifts: Model what happens to cash if you hire staff, expand locations, or take on a large contract.

- Stress Tests: Explore how long your business could run if certain inflows were delayed or a major cost increased.

Put Practical Cost Controls in Place

Align spending with your priorities and improve agility.

- Flag Discretionary Spending: Identify categories that can be paused or reduced without disrupting your operations.

- Create Spending Thresholds: Require approval for purchases above a certain dollar amount or outside of budgeted categories.

- Track Small Recurring Costs: Subscriptions and minor tools often go unnoticed but can add up quickly over time.

Step 6: Set Up Your Cash Reserve Strategy

Strong cash flow systems also prepare you for the unexpected. A cash reserve strategy gives your business room to absorb late payments, rising costs, or temporary slowdowns without disrupting operations.

Build a Contingency Plan

A contingency plan outlines how your business will respond to disruptions before they happen. That way, when something unexpected hits, you are not building a plan from scratch under pressure.

- Identify High-Risk Disruptions: List events that would put pressure on your cash flow, such as late customer payments, supply chain issues, or equipment failures.

- Document Your First-Line Responses: Decide which expenses you could pause, which payments could be rescheduled, and what backup options are available.

- Set Clear Activation Triggers: Establish thresholds, such as a projected shortfall or missed invoice, where contingency actions should begin.

Create a Cash Buffer

A cash buffer is money you intentionally set aside to cover shortfalls. Even a small reserve can make a major difference when timing becomes tight.

- Start With a Modest Target: Many businesses aim to build one to two months’ worth of essential expenses. This includes payroll, rent, and supplier payments.

- Use a Separate Account: Keeping your reserve in a different account makes it easier to track and harder to spend accidentally.

- Replenish After Use: If you dip into your reserve, make a plan to rebuild it when conditions stabilize.

Know What Tools Are Available

Cash reserves are the ideal solution, but not every business can set them up right away. In the meantime, make sure you understand what tools are available to help you manage working capital.

- Lines of Credit: A line of credit provides flexible access to funds when needed, but watch for usage fees and repayment terms.

- Invoice Factoring: While factoring is often used to strengthen cash inflows, it can also serve as a source of backup funding when you opt for spot factoring.

- Business Credit Cards: Although commercial credit cards are useful for short-term expenses, they should be used strategically to avoid interest accumulation.

Step 7: Monitor and Refine Your System Over Time

You’ll need to track performance, review it regularly, and make improvements as your business grows or conditions change to ensure your cash flow management system continues to work for you.

Track Key Cash Flow Metrics

Start by choosing a small set of metrics that reflect the health of your cash flow, so you can spot issues early and make decisions faster.

- Cash on Hand: Track how much available cash your business has at the end of each week or month.

- Accounts Receivable Aging: Monitor how long invoices are outstanding so you can follow up before they become overdue.

- Net Cash Flow: Review whether more cash is coming in or going out during a set period, typically monthly or quarterly.

- Operating Cash Flow: Separate from net income, this shows how much cash your core operations are generating.

Build Regular Review Routines

Make reviewing your cash flow part of how you run the business.

- Weekly Operational Reviews: Use your short-term forecast to check for upcoming gaps and make tactical decisions.

- Monthly Financial Reviews: Compare actuals to forecasts and budgets to see how accurate your assumptions are.

- Quarterly Strategic Reviews: Step back to evaluate the bigger picture and adjust your forecasts, tools, or vendor terms if needed.

Commit to Continuous Improvement

As you learn what works and where friction shows up, adjust your system accordingly.

- Update Tools as You Grow: If spreadsheets start to feel limiting, explore accounting or forecasting software with automation features.

- Simplify Where You Can: Remove steps or reports that do not add value so your team stays focused on what matters.

- Document What Changes: Keep a running record of updates to your forecast model, review process, or cash policies so you are not starting from scratch each time.

Strengthen Your Cash Flow Management with Factoring

Although getting started with invoice factoring is fast and easy, getting set up with a provider now will streamline the process when you’re ready to begin accelerating payment on your invoices. To kickstart the process, request a complimentary factoring rate quote.

FAQs on Implementing an Effective Cash Flow Management System

What is the importance of cash flow management?

Cash flow management helps ensure your business has enough money on hand to meet obligations like payroll, rent, and supplier payments. It allows you to make informed decisions, avoid financial stress, and invest in growth. Without strong cash flow management, even profitable businesses can run into serious trouble.

What’s the easiest way to handle cash flow tracking and forecasting?

The easiest way to manage cash flow tracking and forecasting is to use accounting software with built-in tools. These platforms can automatically pull bank transactions, track receivables, and project cash balances. Many businesses start with spreadsheets, but software can save time and improve accuracy as operations grow.

Do I need to purchase cash flow forecasting software?

You do not need to purchase forecasting software to get started. A spreadsheet can work well in the early stages. However, as your business grows or your cash flow becomes more complex, software can save time, reduce errors, and provide clearer visibility into future risks and opportunities.

What are the best cash flow management tools?

Popular cash flow tools include QuickBooks, Xero, and Sage for integrated forecasting and reporting. Standalone apps like Float, Dryrun, and Fathom offer deeper insights and scenario planning. The best tool depends on your business size, complexity, and how much automation you need to support decision-making.

What are the best cash flow solutions for businesses?

Common cash flow solutions include invoice factoring, lines of credit, extended vendor terms, and cash reserve strategies. Many businesses also improve cash flow by tightening receivables processes and budgeting more proactively. The right mix depends on your industry, sales cycle, and how predictable your revenue streams are.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778